Three small cap pocket rockets

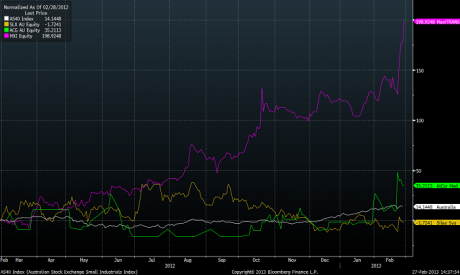

| Summary: The latest earnings season has brought mixed results from the small caps sector, and many have underperformed the broader market. Silex Systems, AtCor Medical and MaxiTRANS are three stocks that have easily outperformed. |

| Key take-out: The Small Industrials Index has only managed a 3.4% gain since the start of the month, while the largest industrial stocks have surged ahead by 5.2%. |

| Key beneficiaries: General investors. Category: Growth. |

No one knows how to throw a surprise like a small cap stock, and that’s why it really pays to pay attention as you never know what little gems you might uncover.

The February reporting season is no exception, with nearly a third of companies in the ASX Small Industrials Index posting profits that were at least 10% off what analysts were expecting.

The differences between expectations and actual results swing to extremes. The variance for small industrial stocks is 78 times that of their larger counterparts in the S&P/ASX 100 Index.

No surprises here. Large industrial stocks have an average of eight brokers covering them, while small industrials average around one.

This lack of scrutiny means that the juniors can easily sink or surge on their profit announcement, and looking at the “announcement effect”, most emerging industrials have disappointed the market.

The “announcement effect” measures a company’s share price performance relative to the broader market three days after its results are published.

If the results were better than expected, the stock will run substantially ahead of the index. The opposite is true for those who disappoint.

There are more stocks in the latter category, with 36 names in the ASX Small Industrials Index lagging the All Ordinaries by 1% or more in the three days since their results, compared with 28 that outperformed.

The numbers are likely to change as there are still a number of small companies that have yet to report, but the downbeat tone to the reporting season has prompted analysts to shave their 2013-14 earnings forecast for the sector by an average of 8% so far.

In contrast, consensus expectations for industrials in the top 100 index have only been lowered by 0.4%.

This explains why the Small Industrials Index has only managed a 3.4% gain since the start of the month, while the largest industrial stocks have surged ahead by 5.2%.

Best & Worst performers in the ASX Small Industrials Index from the reporting season | ||||||

| Company Name | Announcement effect* (%) | Result date | Period | Reported net profit ($m) | Difference to expectations (%) | Comments |

| Best Performers | ||||||

| Bradken | 21.89 | 12/02/2013 | Half year | 46.7 | -10.90 | Stronger than expected outlook more than overshadowed a miss in profit expectations. |

| Southern Cross Media Group | 15.76 | 19/02/2013 | Half year | 45.1 | 2.40 | Indicated that advertising is turning around. |

| Silex Systems | 15.76 | 22/02/2013 | Half year | -8.4 | 44.00 | Narrowing net loss and value-adding milestones in year ahead. |

| Worst Performers | ||||||

| Boart Longyear | -15.3 | 18/02/2013 | Full year | 114.2 | -4.40 | Earnings miss and uncertain outlook. |

| SAI Global | -19.89 | 14/02/2013 | Half year | 18.4 | -1.10 | Expensive defensive that is sensitive to any negative news. |

| Breville Group | -22.62 | 20/02/2013 | Half year | 31.7 | -3.65 | Weak profit growth guidance on top of earnings miss. |

| * Relative share price performance to All Ordinaries over a three-day period from the day the company announces its results. | ||||||

| Source: Bloomberg, Eureka Report | ||||||

But it’s not all bad news. There are a number of small stocks that have performed exceptionally well, but remain unfamiliar to retail investors.

Silex Systems (SLX)

You won’t be alone if you missed that fact that Silex Systems is one of the best performers from the reporting season.

If anything, most investors won’t even know what the $540 million market cap company does, let alone notice that the laser technology developer recorded the third-best “announcement effect” performance of stocks in the ASX Small Industrials Index.

The company outpaced the All Ordinaries by a whopping 15.8% in the three days since February 22 when it reported an interim net loss of $8.4 million, which is half the loss it made in the six months to December back in 2011.

The loss was narrower than what the market was expecting, but that wasn’t what sparked the rally.

Management said the next year will be a significant time for Silex as all four products it is attempting to commercialise are expected to hit “value-adding” milestones.

Further, it will not need to tap shareholders for extra funds to reach these milestones.

The most significant of these milestones is for its laser uranium enrichment technology, which could become the gold standard for enriching fuel for nuclear power plants as it is far more efficient than the current centrifugal method.

The most exciting thing about Silex is that the royalties it is entitled to extend to perpetuity. No other Australian-listed company with a perpetual royalty stream comes readily to mind.

The biggest challenge to commercialisation of this technology was also dealt with back in September last year after US authorities granted Silex’s joint venture partners, GLE, approval to build the first commercial plant in that country. GLE is a JV between GE and Hitachi, the two biggest nuclear power plant builders in the world.

But investors used the news to lock in some profits as the stock was trading close to a 1½-year high of $4.35. The stock has since shed 28% as buyers stood on the sidelines due to uncertainty over when GLE would commit to building the plant.

While GLE may take its time, it is unlikely to walk away from what is already proven to be a viable technology given the resources GLE has poured into advancing Silex’s laser system.

Silex’s other projects relate to solar energy, semiconductor manufacturing and precision instruments.

AtCor Medical Holdings (ACG)

A more obscure, but stronger, outperformer is blood pressure device maker AtCor.

The stock is so small (market capitalisation of $14 million) it doesn’t qualify to be included in the Small Industrials Index.

But the pocket rocket managed to beat the market by a 28.4% margin in the three days since February 21 when it announced a record interim net profit of $2.3 million compared with a loss of $900,000 for the same time last year.

Atcor has never made such a big profit, even for a full year, and it can thank strong demand for its device from US pharmaceutical and research companies as that bolstered its top line by 43 % to $5.4 million for the six months to end December.

AtCor has developed a better way to measure blood pressure as its non-invasive device also picks up early signs of cardiovascular problems.

While it has been proven countless times that the market doesn’t always want to buy the proverbial “better mouse trap”, especially when it comes to the highly conservative medical fraternity, confidence is growing that AtCor’s strategy to drive market adoption is working.

Management is looking to gain market acceptance for its device by targeting companies running clinical trials, as its technology allows clinicians to study the effects of new drugs on the heart.

If AtCor’s device gains enough traction in the laboratories, it could very well find its way into hospitals and doctors’ rooms.

AtCor is only suited for investors with a tolerance to risk, as it is hard to say what type of penetration rates it can eventually achieve.

But, at this early stage, there is plenty of room to grow given that the addressable market size for the clinical trial industry is estimated at around $100 million a year.

AtCor didn’t give an outlook, but assuming that management can continue to sustain sales momentum, the stock is looking very cheap given that it is trading on a price-earnings multiple of seven times just on its half-year profit number alone.

MaxiTRANS Industries (MXI)

The transport equipment manufacturer is another standout from the reporting season, with an “announcement effect” of 13.5% on the back of a record first-half result, which was released on February 22.

Net profit more than doubled over the same time last year to $12.9 million on the back of a 42% surge in sales to $189.9 million for the six months to the end of December 2012.

Strong demand for its tippers and trailers from the agriculture and mining sectors has been credited for the stellar result, which came in ahead of market expectations, and management is painting a bright second half on a strong order book and high enquiry activity.

MaxiTRANS, which has a market cap of around $240 million, will also appeal to yield seeking investors as its interim dividend has jumped to 4.25 cents a share from 2 cents a share.

If management can sustain its earnings momentum, the stock will produce a yield of around 9% once franking credits are included. While MaxiTRANS’ earnings and dividends might not be as stable as others, such as a telco, its relatively conservative payout ratio of 61% should provide some buffer.

The stock also has capital growth potential even though it closed at a record high of $1.29 on Tuesday as it is trading on an undemanding one-year forward price earnings multiple of around nine times, or around a 20% discount to its peers.

These opportunities only represent a few of the reasons why it is important to stay alert when it comes to the junior end of the market. As the saying goes in small cap land – if you snooze, you lose.

Speaking of opportunities, it is worth noting that rental financing company Thinksmart has jumped nearly 20% since my article a fortnight ago on stocks to watch during the reporting season.

I wrote that if the embattled company can show a turnaround in earnings for the six months to end December, it would be grounds for a re-rating in the share price.

Management delivered on this milestone and readers would have had the chance to jump on board as the market didn’t react to the news for a few days as the stock is not well followed.

One only needs to look at its rival Flexigroup to see what the potential upside could be for Thinksmart if management can continue to build on this early success. Turnaround stories usually take a couple of years to fully play out.

The other stock mentioned was mining software company RungePincockMinarco. The stock has not moved much since its half-year result on February 18, and that is no real surprise as I found the company’s outlook light on detail.

What investors want to see is management tabling a more concrete strategy on how it would push software sales, an area it has a poor track record in. The lack of new detail on the progress of its restructure was also underwhelming.

At some stage, Runge will make a good turnaround story. Sadly, the company isn’t quite there yet.

The third company in the article, safety equipment developer Mobilarm, is yet to report its results. Keep an eye out for it as it is likely to be an interesting read.

Brendon Lau is the small caps writer for Eureka Report and may have interests in some of the stocks mentioned in the article.

| Like what you’ve read from Brendon Lau? Then register your interest in an exciting new venture focused on small capitalised stock investment opportunities. CLICK HERE to register your interest now. |