The winner in the CGT change debate

Summary: Labor's proposed changes to negative gearing and capital gains tax would likely have a lesser effect on DIY fund holders than investors buying assets outside of super. Because superannuation tax rates look likely to stay as they are, those who buy property through their super would be doing so in a lower tax environment than those investing after July 1, 2017, should new negative gearing restrictions and a cut to the capital gains tax discount come into effect. While the Coalition's plans in this area are less clear, if there was a plan to implement a cap on the number of properties or dollar value that could be negatively geared, DIY fund holders would still be in a more favourable position. |

Key take out: SMSFs will come out on top if either side makes changes to negative gearing or CGT rules. |

Key beneficiaries: Superannuation accountholders and SMSF trustees. Category: Superannuation. |

Capital gains tax and negative gearing are back in Canberra's headlights – never a good thing for property investors.

Both tax regimes seem set for change – but we're a long way from knowing exactly how, or when.

Labor has set out an actual policy, which would increase taxes for property investors. The Coalition is flying flags on both CGT and negative gearing. They seem to be saluting a new one each day, but lowering it (literally, by retracting it) before sunset.

But while policies will evolve ahead of this year's federal election, investors know one thing for sure: When you change investment rules, you distort a market, creating winners and losers.

Labor's proposed changes to negative gearing and capital gains tax would do just that. One of those winners, in a relative sense, would be self-managed super funds.

SMSFs would still lose if Labor's CGT and negative gearing policies were implemented. But the pain would be less than what would be inflicted on, say, mum and dad investors, who would lose significant tax breaks.

The advantage of a DIY fund is precisely because of super's low tax rate.

For more detail on exactly what Labor announced, see Scott Francis's piece (read: CGT and negative gearing under threat). In essence, negative gearing will be removed for all but purchases of new property from 1 July 2017 and the capital gains tax discount will be dropped from 50 per cent to 25 per cent of investor's marginal tax rates for assets sold after 12 months or more.

How will these rules impact on SMSF investing in property, post-July 2017? Let's look at a few general rules first.

*The first is that a negative-gearing strategy works best for those on high marginal tax rates (high-income earners). If two identical properties (next door to each other) were negatively geared and owned, respectively, by someone earning $250,000 a year and another person earning $80,000, the tax benefits are bigger for the higher-income earner.

If one was owned by a SMSF, which pays 15 per cent on income, the tax benefits to the super fund would be significantly lower.

*Second, because of the lower tax rate and benefit, negative gearing is less of a benefit to SMSFs and their decision to purchase.

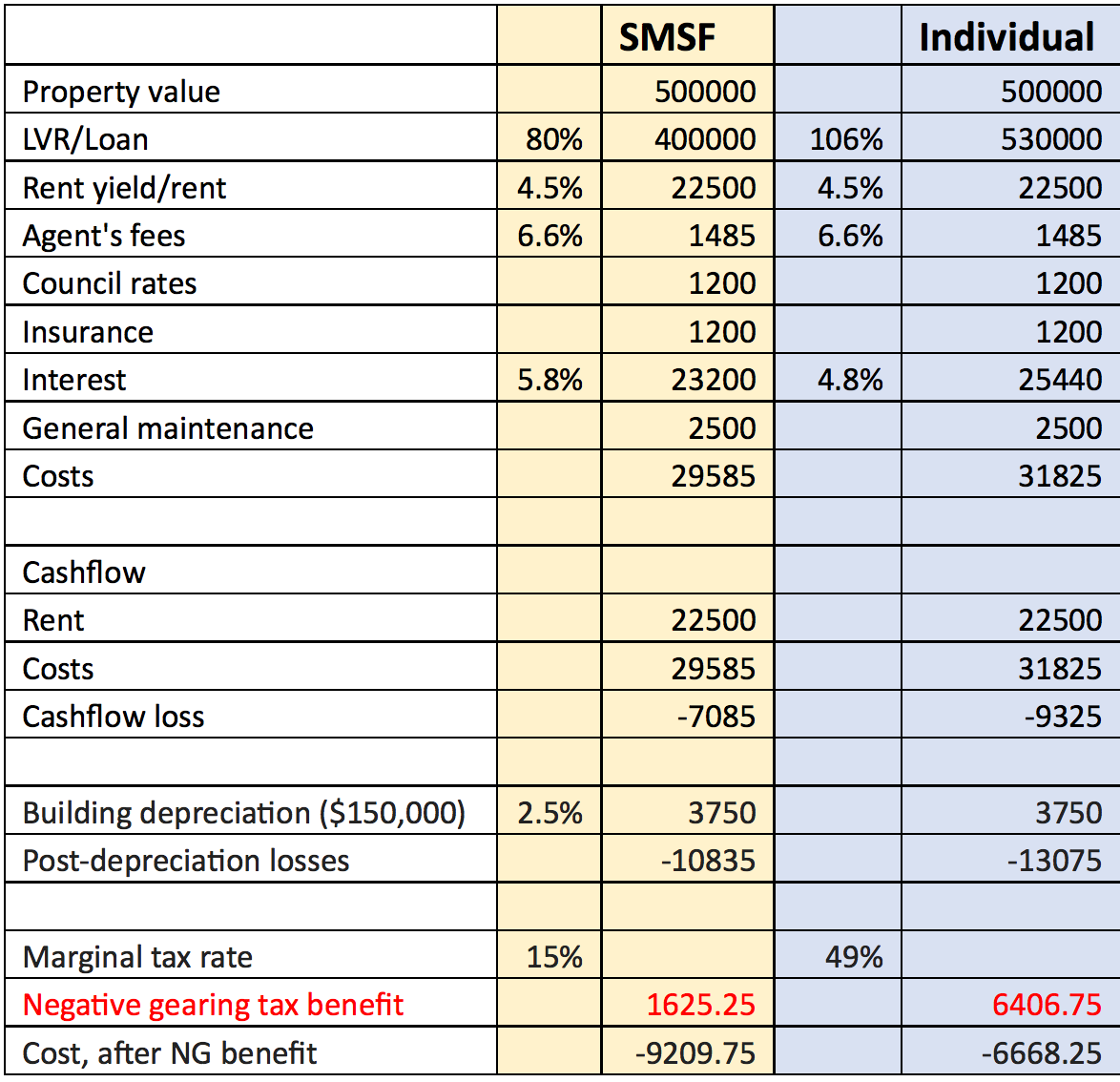

The following table outlines the purchase of the same property, by a SMSF and an individual investor on the highest marginal tax rate.

Table 1: Gearing benefit inside and outside super

(Note: The table above does not assume a brand new property for purchase as at July 1, 2017. The purchase price assumes an established property, roughly 10 years old, with a special building write-off base of $150,000. Depreciation for fixtures and fittings have been ignored. Assumptions in this table, including interest rates and ongoing costs, are estimates.)

Geared to 80 per cent for the SMSF and 106 per cent for the individual, this property will give the greatest tax deduction to the individual.

When an individual is borrowing, they will work on the assumption, in this case, that there will be a tax deduction of approximately $6406.75 coming to them when they do their tax return. That's a significant benefit to expect from a negative gearing strategy and will have an impact on the investor's decision to invest.

However, for the same property, the total tax benefit to the SMSF is only $1625.25. It's roughly one-quarter of the tax-return benefit that would apply to the individual.

A tax return of $1625 is far less likely to sway SMSF holders into purchasing an investment than a $6406 tax return for an individual.

That is, take the two tax returns away and the SMSF might still readily make the decision to invest, given it will only “cost” them a return of $1600. The individual would think much harder about the investment before hitting the “go” button if they were going to miss out on $6400.

SMSFs were previously able to gear with higher loan to valuation rations (LVRs) into property. However, edicts issued by the Australian Tax Office in 2014 – and reaffirmed more recently (see my column on November 4, 2015: Does your SMSF pass the smell test?) – mean that they will not realistically have the option to do LVRs of 100 per cent, or 106 per cent, in the future. Those who did in the past have a deadline of June 30 2016 to get those loans back on commercial terms.

Recent lender changes have had an impact on the relevant benefit to SMSFs because of some changes to conditions, such as LVRs on offer. As I have previously mentioned (read DIY property investing gets a body blow, January 27 January, 2016) explains how lenders are generally reducing LVRs for loans to investment properties. Many lenders will reduce their LVRs from 80 per cent to 70 per cent. While this means that a SMSF has to put in far more capital at purchase for the deposit (around 35 per cent of the purchase price), it would also further reduce the negative gearing benefits, from around $1600 a year to below $1200 a year.

CGT – Good news

Labor's policy announcement focused on CGT and negative gearing changes for individuals – on the CGT front, specifically that the current 50 per cent discount on CGT for assets held for more than one year will be reduced to 25 per cent – CGT is applied at your marginal tax rate (often 45 per cent for many investors).

So, while others are going to see their CGT exemption dropped form 50 per cent to 25 per cent, super funds will continue to receive their current exemption, which is currently a one-third reduction in the gain, before taxation.

When a super fund makes a capital gain of $100, the gain is reduced by one third (to $66.67), which is then taxed at 15 per cent. The impact of this is to add up to an effective CGT rate for super of 10% of the gain.

And from the Coalition …

The Coalition has made several attempts to begin the debate on how they're going to make changes to CGT and negative gearing. But, anything floated has, in very short order, been rescinded, retracted, or even denied.

The two broad ideas that have been floated include:

1. Limiting negative gearing to a certain number or properties.

2. Limiting negative gearing to a dollar value (say, $20,000 or $50,000 a year)

Both ideas were quickly hushed, by either the leadership, or the Coalition backbench applying pressure.

But both options would also hand a relative advantage to SMSFs over retail investors, for much the same reasons as they would for Labor's policy.

As SMSFs can only access lower LVRs and have lower tax rates, the negative gearing tax benefits lost would be lesser than for individuals investing outside of super.

And while thousands of Australian mums and dads are negatively gearing multiple properties against their incomes, the number of SMSFs negatively gearing a property portfolio would be miniscule.

The information contained in this column should be treated as general advice only. It has not taken anyone's specific circumstances into account. If you are considering a strategy such as those mentioned here, you are strongly advised to consult your adviser/s, as some of the strategies used in these columns are extremely complex and require high-level technical compliance.

Bruce Brammall is managing director of Bruce Brammall Financial. E: bruce@brucebrammallfinancial.