The Week Ahead

No highlights, but plenty on offer

Thank goodness there is a solid week of overseas events -- the domestic economic calendar is decidedly sparse.

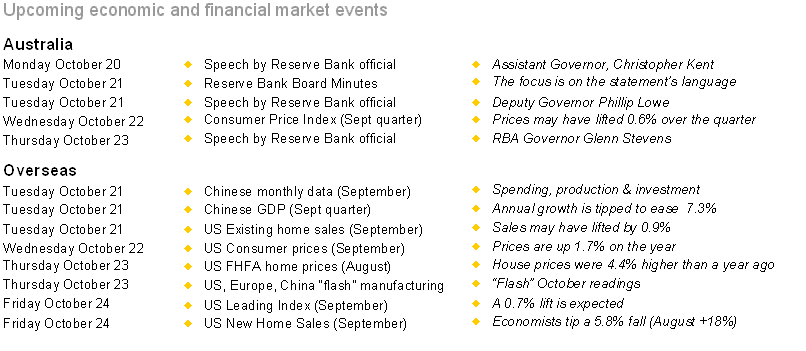

In Australia, inflation data dominates with a number of speeches by Reserve Bank officials, while overseas there are 'flash' readings to detect the health of manufacturing sectors, in addition to Chinese quarterly GDP and monthly data on spending, production and investment.

In Australia, the week kicks off on Monday with CommSec's quarterly survey of state and territory economies -- a broader view of how the state and territory economies are performing. There are a few surprises, with a surprising shift at the top of the economic leader board.

The good news is that while there is a paucity of economic data in Australia over the week, there are still some speeches by Reserve Bank officials to watch.

On Monday Christopher Kent, Assistant Governor, Economics delivers a talk at the Leading Age Services Australia National Congress in Adelaide. And on Tuesday, Phillip Lowe, Deputy Governor, delivers a speech at the Commonwealth Bank Australasian Fixed Income Conference in Sydney. On Thursday the Reserve Bank Governor Glenn Stevens, delivers a speech prior to the annual general meeting of the Australian Payments Clearing Association.

In addition on Tuesday the Reserve Bank releases the minutes of the last Board meeting held on October 7. The focus is likely to be on the housing market and Australian dollar.

Despite the Aussie dollar having fallen by around 8 per cent in the past month, policymakers have made no secret of the fact that it is still hampering the rebalancing efforts across the economy noting that “the exchange rate has declined recently, in large part reflecting the strengthening US dollar, but remains high by historical standards, particularly given the further declines in key commodity prices in recent months”.

On Wednesday the September quarter inflation figures are due (the Consumer Price Index). In the June quarter the CPI lifted by 0.5 per cent to stand 3.0 per cent higher over the year. Excluding volatile items, the key underlying inflation measures rose by around 0.7 per cent in the quarter to stand 2.8 per cent higher over the year.

The slide in the Australian dollar is likely to contribute to a modest lift in imported prices. But the full currency impact should be felt in coming months. Overall CommSec is tipping a tame result for the CPI. The headline (or All Groups CPI measure) probably rose by 0.6 per cent in the September quarter with the annual rate of inflation falling from 3.0 per cent to 2.4 per cent.

The various underlying measures of inflation probably rose by around 0.8 per cent in the quarter and by 2.8 per cent over the year. In other words, inflation remains within the Reserve Bank's 2-3 per cent target band.

In the September quarter seasonal increases in electricity, gas, water and council rates are balanced against lower health costs due to effects in the Pharmaceutical Benefits Scheme. Seasonal price increases also tend to occur in international travel and accommodation costs.

Overseas: China vies with the US for investor attention

There is the usual bevy of economic indicators for release in the US with home sales and prices dominating the schedule. However, the spotlight shines solidly on China. Chinese economic data is now a regular feature on the global economic calendar. However, China has still some work to do to rival the US in terms of the breadth and depth of information provided.

On Tuesday, not only are the Chinese September quarter economic growth figures released but also the monthly figures on retail sales, production and investment. Economists are tipping the economy grew at a 7.3 per cent annual rate in the September quarter down from 7.5 per cent in the June quarter. Production may have lifted 8.9 per cent over the year with retail sales up 11.7 per cent.

In the US, the week kicks off with the release of existing home sales on Tuesday.

On Wednesday, the Consumer Price Index for September is issued. At present, core or underlying inflation is running at a 1.7 per cent annual pace. Economists expect that the core measure rose by 0.2 per cent in September, keeping inflation at a tame 1.7 per cent annual rate.

On Thursday the US Federal Housing Finance Agency releases August home price data while the influential Chicago Federal Reserve National activity index is issued.

And on Friday, the leading index is issued in the US together with new home sales data. A healthy 0.7 per cent lift is expected for the leading index, showing that the US expansion remains on course, while new home sales may have dipped by 5.8 per cent in September after the outsized 18.0 per cent gain in August.

Sharemarket

In the US, the profit-reporting or earnings season picks up pace in the coming week. Forty companies deliver results on Monday including Apple, Chipotle Mexican, IBM, Halliburton, and Peabody Energy. On Tuesday, 118 companies will report including E*Trade, Coca-Cola, Lockheed Martin, McDonalds, Harley Davidson, and Yahoo!.

Thursday is the busiest day in the reporting calendar with 263 listed companies slated to issue profit results including Amazon, Caterpillar, General Motors, 3M, Microsoft and Resmed. And on Friday, 73 companies are slated to issue results including Procter & Gamble, United Parcel Service and Wynn Resorts.