The Week Ahead

Data, data, data

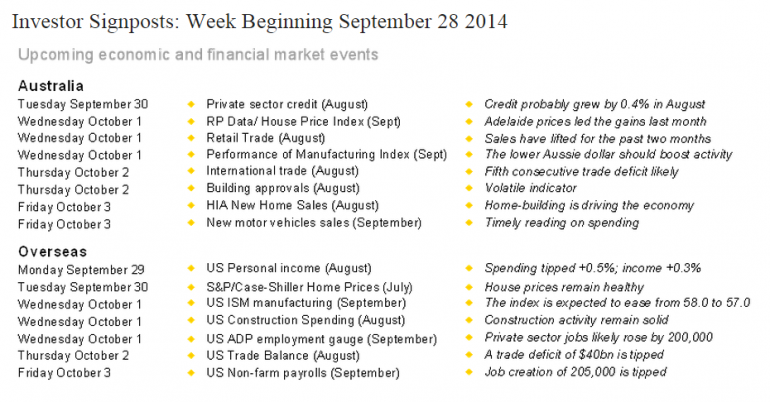

The 'top shelf' indicators return in Australia in the coming week. In China the purchasing managers’ indexes are released. And in the US, arguably the most important monthly indicator -- the employment or non-farm payrolls data -- is issued.

In Australia, the week kicks off on Tuesday when the Reserve Bank releases the Financial Aggregates publication, a report that includes private sector credit or loans outstanding together with money supply indicators like M3. And the ANZ/Roy Morgan weekly consumer confidence rating is also issued on Tuesday.

Housing continues to be the main lending driver but the gains in business and consumer borrowings over the past couple of months have also been encouraging. Business conditions are healthy and it seems to be translating to a lift in business borrowings, with annual growth in June and July at 3.4 per cent -- a 22-month high. Credit probably lifted 0.4 per cent in August or 5.1 per cent over the year, which would mark the strongest growth in five years.

On Wednesday, retail trade data is released. Sales figures have been particularly encouraging in the last couple of months, having risen by 0.4 per cent in July after a 0.6 per cent increase in June. Annual spending growth is holding at a healthy rate of 5.9 per cent, well above the decade average of 4.3 per cent. Even more encouragingly, non-food spending has lifted in recent months. The more upbeat confidence readings and warm weather should have encouraged some early lift in Spring-related spending.

The Performance of Manufacturing index is also issued on Wednesday alongside the RP Data Home Value index for September. The falling Australian dollar should help boost manufacturing activity in coming months while home prices probably fell by 0.5 per cent in September after an outsized 4.1 per cent gain in the prior three months.

On Thursday, August international trade figures are released alongside building approvals data for the same month. The building approvals data is arguably more important than the trade deficit nowadays, serving as a leading indicator for home and commercial building. The problem is that the data is ‘lumpy’ with approvals down 5.5 per cent over April, up 10.1 per cent in May, down 3.8 per cent in June, only to rise 2.5 per cent in July. More importantly approvals are up almost 10 per cent on a year ago.

On Friday, the Performance of Services index is issued alongside data on new car sales and new home sales. Little improvement is expected in the services gauge in September, but certainly readings are tipped to lift in coming months. And new car sales probably tracked sideways over September.

Overseas: US jobs data back in the spotlight

In the US, the week kicks off on Monday with the release of personal income and spending figures together with the pending home sales index and Dallas Federal Reserve business index. Economists tip a healthy 0.5 per cent lift in spending, only partly funded by a 0.3 per cent lift in income. If the data meets expectations, it will support speculation of higher US rates ahead.

On Tuesday, the Case-Shiller home price index is released in the US together with consumer confidence, the Chicago purchasing managers survey and weekly chain store sales. Home prices may have edged up 0.1 per cent while little change is tipped in consumer confidence.

On Wednesday the ADP national employment index is released together with auto sales, the ISM manufacturing survey, construction spending and the weekly report on mortgage transactions – purchases and refinancing. Economists tip a 200,000 lift in private jobs – a precursor to Friday’s official job report.

On Thursday, the weekly data on claims for unemployment insurance is issued together with factory orders and the ISM New York index.

On Friday in the US, the spotlight shines brightly on the September job report. Economists tip a 205,000 lift in jobs, up from 142,000 in August, while the jobless rate is seen unchanged at 6.1 per cent. This is a potential market mover in every way. A strong job report will boost the US dollar further, put pressure on commodity prices and unnerve investors in Asia and Europe.

In China, the official purchasing managers’ index for manufacturing is released on Wednesday with the services variant on Friday. The HSBC purchasing managers’ index is released on Tuesday.

Aussie dollar

The Aussie dollar may have depreciated by 6 per cent in the past two months, but the other side of the equation is the fact that US dollar has been rising. Not only has the US dollar index risen for 10 straight weeks, it has gained 5.6 per cent over that time to four-year highs.

So the weaker Aussie dollar is very much a byproduct of US dollar strength. However the grounds for on-going US dollar strength are a little fragile. Sure, the US economy is strengthening, but apart from a small minority, Federal Reserve policymakers don’t appear in a rush to be lifting interest rates. If US economic data softens and policymakers confirm no rush to lift rates, then the Aussie may start recouping some recent losses.

Craig James is chief economist at Commsec and Savanth Sebastian is an economist at Commsec.