The Week Ahead

New conservatism

Aussie consumers are still finding it tough to move on after the global financial crisis. While businesses are borrowing, investing and employing again, consumers are reluctant to take on debt. This is no more apparent than in the credit card figures released each month by the Reserve Bank.

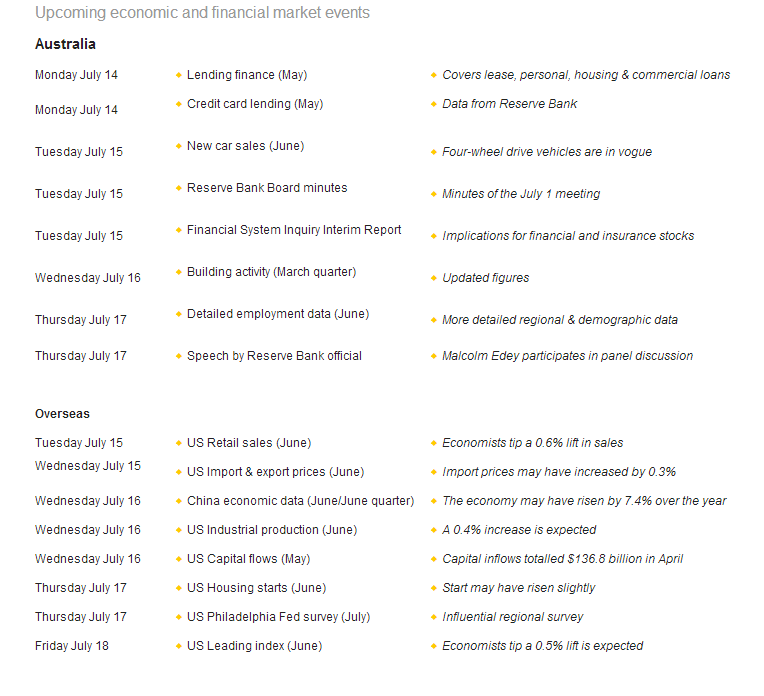

The May data on credit and debit cards will be issued on Monday. In April the number of credit card accounts fell by 5,000 after dropping by 207,000 in March. Credit card accounts are up just 0.6 per cent on a year ago, the slowest annual pace on record.

And not only have cards been cut up, consumers are keeping less debt on their credit cards. The average credit card balance rose by just $5.10 (0.2 per cent) to $3,227 in April. The average credit card balance was 0.3 per cent up on a year ago but in smoothed terms (12-month average) the average balance was down by 2.2 per cent.

That is not to say that consumers aren’t spending. They are, but just paying off more of the outstanding debt each month. In smoothed terms both the average number of credit card transactions and debit card transactions were at record highs in April.

And then there is credit that can be accessed to spend – the average credit card limit rose by 2.6 per cent in the year to April, the strongest growth in 40 months.

The credit and debit card figures are worth tracking to see whether Aussie consumers are becoming more confident and less conservative. If conservatism recedes, the Reserve Bank would move one step closer to lifting interest rates.

Other data to watch

Also on Monday, the Australian Bureau of Statistics releases lending finance figures for May. This data covers all the key lending categories – personal, commercial, housing and lease loans.

Total new lending commitments (housing, personal, commercial and lease finance) rose by 3.5 per cent in April, to $69.4 billion, a six-year high. But while business loans are up 42.4 per cent over the year, personal loans are down 6.2 per cent over the year – a 28-month low.

On Tuesday the Reserve Bank releases minutes of the last Board meeting, held on June 1. No major new insights are expected. And also on Tuesday the ABS releases data on new vehicle sales.

The interim report of the financial system inquiry will be released at 8am on Tuesday, and while any recommendations are preliminary, they may have implications for financial and insurance stocks.

On Wednesday the ABS updates March quarter data on business activity including real (price adjusted) estimates on commercial and engineering construction.

On Thursday, the ABS issues detailed employment data for June. Unfortunately there are no fresh estimates on job creation by industry, but there are fresh regional and demographic estimates to be published. Also on Thursday the June estimates on imports are issued -- a gauge on spending.

Also on Thursday, there is panel participation by Malcolm Edey, Reserve Bank Assistant Governor (Financial System), at the Centre for International Finance and Regulation conference.

Quarterly production reports are expected from Rio Tinto, Fortescue, Woodside and Santos over the week.

Busy times ahead in the US and China

In contrast to Australia, there are a large number of economic data releases to digest in the coming week including the quarterly economic growth figures in China.

Admittedly, the week starts a little sluggishly with no major economic data expected on Monday. But on Tuesday in the US, retail sales data is issued together with import and export figures and the New York Federal Reserve manufacturing survey results for July and weekly chain store sales figures.

On Wednesday, the spotlight shines solidly on China. Not only are June quarter economic growth figures released but also the monthly figures on retail sales, production and investment. Economists are tipping the economy grew at a 7.4 per cent annual rate in the June quarter. Production may have lifted 9 per cent over the year with retail sales up 12.4 per cent.

In the US on Wednesday, data on production, producer prices (business inflation) and capital flows are issued together with weekly home loan figures and the NAHB Housing Market index.

On Thursday in the US, data on housing starts is issued together with weekly claims for unemployment insurance (jobless claims) and the influential Philadelphia Fed index. Analysts estimate little change in housing starts in June.

And on Friday, the leading index is issued in the US together with consumer sentiment data. A second straight 0.5 per cent lift is expected for the leading index, showing that the US expansion remains on course.

US profit-reporting season

The US profit-reporting season has begun. In the coming week 52 companies from the S&P 500 index report quarterly earnings. Zacks expects earnings in the quarter to be up 2.9 per cent on a year earlier with higher net margins offsetting a 0.6 per cent fall in revenue.

On Monday, Citigroup is scheduled to report earnings while on Tuesday, Goldman Sachs, Intel, JP Morgan Chase and Yahoo are amongst those to report their results.

On Wednesday, 16 companies from the S&P 500 index report earnings including Bank of America, eBay, US Bancorp and Yum! Brands. Amongst those reporting on Thursday are Google, IBM and Morgan Stanley. And on Friday, General Electric issues its earnings result.