The Week Ahead

Labour market and motor vehicle sales data will dominate local headlines, while a raft of US indicators will also be closely watched.

Population in the spotlight

- The December quarter demographic (population) figures are released on Thursday. For the past 18 months, Australia has maintained an annual rate of population growth close to 1.8 per cent. While down from the 2007-2009 period when annual growth averaged 2 per cent, it is above the decade-average of 1.6 per cent and well-above the 20-year average of 1.35 per cent.

- As has been the case since 2006, net migration is the major driver of population growth. In the year to September, Australia’s population rose by just over 405,000 with migration accounting for 241,000 of the gain and natural increase (births less deaths) accounting for the remainder.

- Treasury has made no secret of its desire to grow Australia’s population, largely to address the challenges of the ageing population. The PPP strategy seeks to employ policies that increase population growth (migration, baby bonus); increase productivity growth (structural changes to industry); and increase labour force participation rates ('carrot' and 'stick' measures to get people into jobs).

- Interestingly, because the PPP strategy has been maintained for some time under numerous governments, Australia now has one of the fastest population growth rates of advanced nations in the world.

- African, Middle Eastern and Pacific Island nations dominate the list of countries with fastest population growth. Of the more advanced nations though, the United Arab Emirates has population growth near 3.0 per cent with Luxembourg around 2.5 per cent, and Saudi Arabia near 1.7-2.0 per cent together with the Philippines and Malaysia. It is estimated that population is declining in a raft of European nations and Japan.

The other indicators

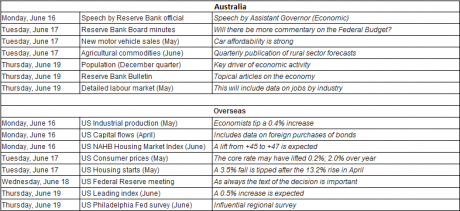

- On Monday, the assistant governor (economic) at the Reserve Bank, Christopher Kent, will deliver a speech on labour market developments at a Wall Street Journal seminar. And on Tuesday the Reserve Bank is again centre-stage with the release of the minutes of the Board meeting held a fortnight earlier. The main interest is whether there was any discussion of the federal budget at the last Board meeting.

- Also on Tuesday, data on new motor vehicle sales is released while the Department of Agriculture releases the quarterly Agricultural Commodities publication, a report that includes forecasts of prices, production and exports.

- On Thursday, the Reserve Bank releases its quarterly Bulletin, a publication that contains topical articles on the economy and financial markets. Also on Thursday, the Bureau of Statistics issues detailed labour market figures for May, figures that include the latest break-up of employment across industry groups.

Overseas: US Federal Reserve under scrutiny

- In the coming week, a gamut of ‘top shelf’ economic indicators in the US will compete for attention with the latest meeting of US central bank policymakers. In contrast, it is a quiet week for new economic data in China.

- In the US, the week kicks off with the May industrial production figures, to be released on Monday. Economists tip a rebound, with production lifting by 0.4 per cent after a 0.6 per cent contraction in April. On the same day, data on capital flows is released together with the homebuilder sentiment index (NAHB index) and the New York Federal Reserve manufacturing survey.

- The US Federal Reserve kicks off a two-day policymaking meeting on Tuesday with the decision handed down at 4am AEST on Thursday. In addition to the statement and forecasts, the Fed chair, Janet Yellen, conducts a news conference at 4.30am AEST. The Fed is expected to further wind back its bond buying program and Janet Yellen will be quizzed on the likely start of interest rate increases.

- Also on Tuesday, data on consumer prices and housing starts are issued together with the normal weekly chain store sales figures.

- On Wednesday, data on the broader trade measure (the current account) is released for the March quarter.

- On Thursday, the influential Philadelphia Federal Reserve survey is issued together with the leading index and the weekly estimates of jobless claims -- new claims for unemployment insurance.

- In China, the only economic data of note is May house prices, with figures scheduled for release on Wednesday.

Sharemarkets, interest rates & the Aussie dollar

- The 2013/14 financial year is fast coming to an end. And by all accounts it has been a ‘quiet’ year for the Aussie dollar. But how quiet? Over the financial year to date, the Aussie dollar has broadly traded in an 11-cent range against the US dollar. That is down from the range of just over 15 cents in 2012/13 and the lowest result in eight years.

- Since the Aussie dollar was floated in 1983, the currency has traded, on average, in a range of 13-14 cents over a 12-month period.

Share this article and show your support