The Warburton 'windfall effect'

Climate science doubter Dick Warburton has delivered his review panel’s findings on what the government should do about the Renewable Energy Target. They are almost precisely what was expected by most stakeholders and foreshadowed in my article, Reading Dick Warburton’s Mind. With the review panel arguing in favour of winding-up both the large-scale scheme, which primarily assists wind farm construction, and the small scale-scheme, which provides rebates for solar systems.

If there is one clear implication from the report it is: buy Origin and AGL shares.

These two companies, in conjunction with Energy Australia (owned by China Light and Power) paid bargain basement prices to the NSW Government for several of its black coal generators on the assumption the RET would lead to extra supply from renewables that would push out NSW black coal.

If the federal Coalition Government were to follow Warburton’s advice, the NSW black coal generators, which are now all operating at quite low levels of utilisation with substantial spare capacity, will see significant increases in output. In addition, it is likely to also lead to an uplift in wholesale electricity prices for all generators because NSW black coal is more expensive than Victorian and Queensland coal generators and they will have more opportunities to price their output closer to that of very expensive gas power producers who are the next increment of supply.

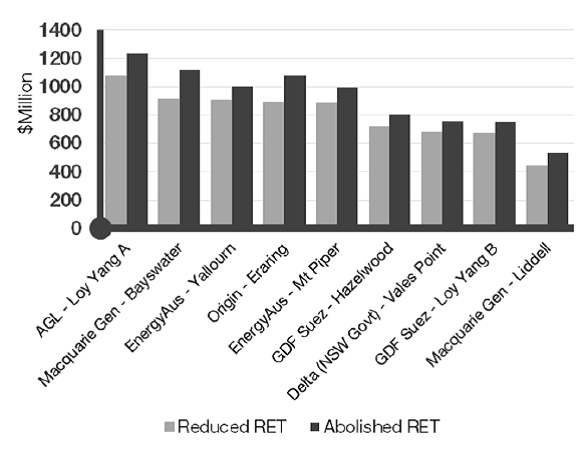

The chart below illustrates net present value of the profit uplift several east-coast power stations will gain if the Warburton Review’s recommendations are implemented. The black bars represent the profit uplift if the RET is closed, while the grey is if it is cut back to cap renewables at 20 per cent market share.

Figure 1: Current value of increased profit, top nine coal beneficiaries of reducing the RET

Source: Jacobs SKM (2014)

AGL is by far the biggest beneficiary because it has recently acquired Macquarie Generation’s Bayswater and Liddell Power stations, and also owns the Victorian brown coal Loy Yang A (also recently bought for a bargain basement price in just 2012). Loy Yang A, as well as other Victorian brown coal generators – including those probably bought for next to nothing by GDF Suez in 2011 (due to the expected impact of a carbon price which is now no longer) – will see large increases in profit because power prices will rise as the more expensive black coal generators set prices in the market.

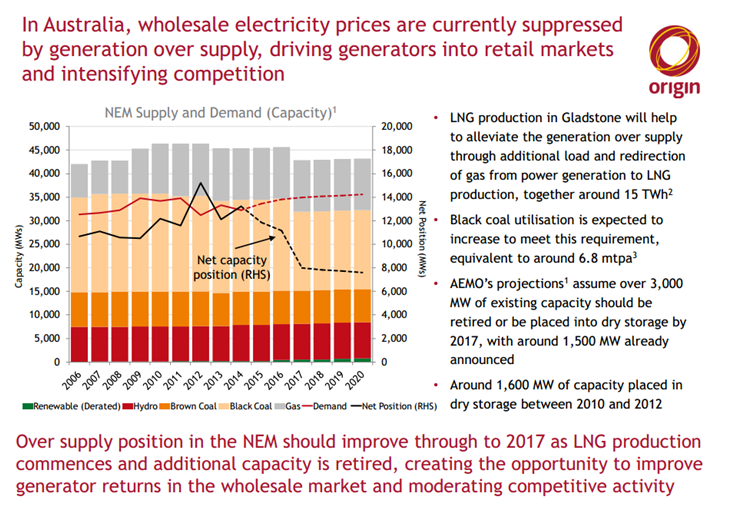

In addition, there is some further possible upside. If you take the time to view the AGL and Origin Energy 2014 financial results webcasts to investors they explain that the current very depressed and oversupplied nature of the power market is about to turn the corner. According to both Origin’s chief executive Grant King and his AGL counterpart, Michael Fraser, next year there will be an abrupt withdrawal of gas used by NSW and Queensland power stations as it gets sucked into the new LNG plants for export to Asia. As clearly explained in the Origin 'energy slide' below, this will result in a 15,000GWh power supply shortfall opportunity for the coal generators. In addition, both of them expect some further closures or mothballing of other power generators. The end result will be, "moderating competitive activity", according to Grant King.

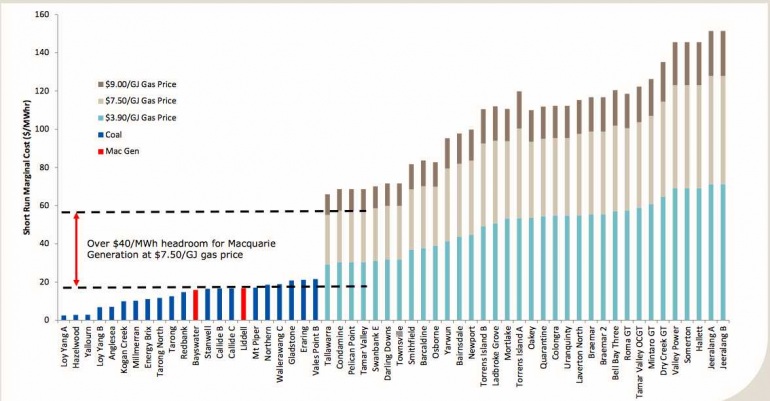

Where this gets interesting is if all the forecasts of continuing depressed electricity demand end up being wrong and/or some extra coal power stations are mothballed. Status quo bias means we all think this could never happen but, given our poor ability to forecast electricity demand, it is quite conceivable. By 2015, once the LNG plants start up, there will be something equivalent to a price cliff that separates the cost of the coal generators from the gas generators. This is illustrated below in a chart taken from AGL’s recent financial results that explained why acquiring Macquarie Generation was such a good deal. It shows something like a $40 gap between gas and coal generators.

Figure 3: Short-run marginal cost of NEM coal vs gas generators at different gas prices

Source: AGL Energy FY 2014 Financial Results

This presents a huge prize for coal generators once the supply-demand balance reaches a tipping point that regularly requires the use of these gas generators.

Now, things might seem incredibly grim right now for coal generators with power prices at around $30-$35 dollars per megawatt-hour. But on top of the 15,000GWh gap due to LNG, the Warburton recommendation would mean something like 25,000GWh less power from large-scale renewables and maybe another 4000GWh from small-scale solar PV by 2020.

All up, this is equivalent to adding the power demand of another Victoria for the existing generators.

Then say, for example, AGL chooses to close Liddell in 2017 – as originally scheduled – that removes capacity capable of producing another 10,000GWh. The Queensland Government may also be sorely tempted to close an old generator to improve overall returns for its planned generator privatisation.

If power demand also surprises on the upside, then it could well be jackpot time for coal generators.