The value vault: our picks

| Summary: BHP and Ausdrill are value picks. ANZ remains keenly priced, but it’s time to get out of Flight Centre. |

| Key take-out: There are slim pickings for those looking for value among large caps. |

| Key beneficiaries: General investors. Category: Shares. |

| Recommendation: Outperform (Ausdrill; BHP Billiton; ANZ). Underperform (Flight Centre). |

If you are starting to get excited about equities now that the key stock benchmarks have broken above the psychologically important 5000 level, you might be a tad late coming to the party.

The number of quality large cap stocks that are trading in value territory has fallen dramatically with the market looking marginally expensive at current levels, according to StocksInValue.com.au.

However, there are still pockets of value to be found even as Australian stocks are expected to tread water after the S&P/ASX 200 and ASX All Ordinaries indices rallied 2.8% over the past two weeks.

The jump slashed the number of attractively priced stocks by around 50%, and this lack of compelling value, coupled with the August reporting season and impending federal election, will force most investors to the sidelines.

But stocks typically come back to life during the “honeymoon” period after the Prime Minister is sworn in, and this period of relative calm may not be a bad time to be selectively adding stocks to your portfolio.

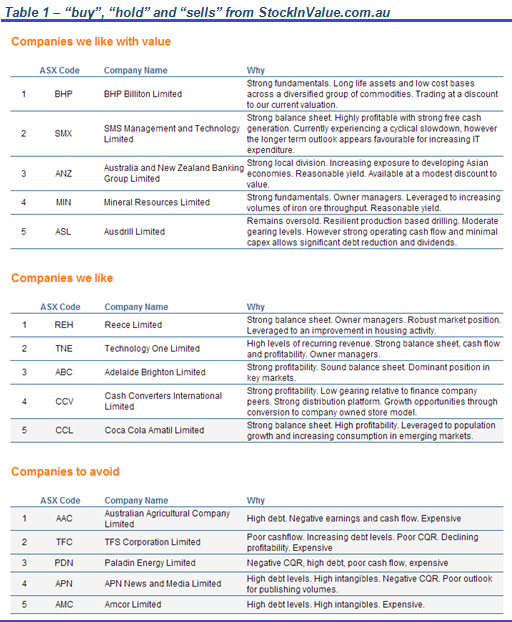

I highlighted five small cap bargains under a buck last week, and this time I’ve asked the senior analyst from Clime Asset Management, Adrian Ezquerro, for his picks among the top 200 stocks using the StocksInValue.com.au website. StocksInValue.com.au is jointly owned by Eureka Report and Clime.

Ausdrill (ASL)

Mining services company Ausdrill is a standout among value stocks, according to Ezquerro.

While Ausdrill may look more like a small cap than a large stock now, the company was a billion dollar market cap stock just six months ago.

The whole mining services sector has been thrown into the sin bin on worries that revenue will plunge with resource companies cutting back on project and exploration spending, but that does not faze Ezquerro.

“I know there are more ‘value traps’ than good value stocks in mining services,” he says. “But Ausdrill is more leveraged to [mineral] production work, which accounts for 85% to 90% of its revenue.”

A “value trap” is a stock that looks cheap but isn’t worth buying due to its poor profit outlook. The analysts at Clime have closely scrutinised Ausdrill and feel that the $375 million market cap stock is being unjustly sold off.

The mining boom is not over – it has just changed from a price to production phase. This means the game now belongs to those that can extract vast amounts of minerals at a very low cost.

This puts Ausdrill in an enviable position and the stock will need to double in value to reach fair value.

“If Ausdrill reduces capital expenditure to pay down debt and fund dividends, the stock could re-rate closer to its net tangible asset value of $2.30 a share,” explains Ezquerro.

But the stock is volatile and a higher risk proposition, and as such, investors should only buy a modest position in Ausdrill, he adds.

Ausdrill gained 5.4% to $1.275 today.

BHP Billiton (BHP)

The transition from a price to a production mining boom puts this mining giant in pole position.

Not only is BHP Billiton a massive mineral producer at the lowest end of the cost curve, but it is well diversified and its shares are still trading within value territory on the StocksInValue.com.au screen.

“We would recommend investors buy BHP in the low $30s as we see fair value at around $40 a share,” says Ezquerro.

While the stock divides expert opinion, I suspect BHP will be well supported on dips as a number of fund managers have been waiting for the stock to drop under $30 before they jumped in.

There is probably more doubt now about whether BHP will sink that low, which could lead to some eager buying on corrections.

However, the question of whether you should own BHP will ultimately come down to your view on China. The stock will only look attractive if you have a positive longer term view on the Chinese economy.

BHP jumped around 9 per cent over the past 2 weeks and it closed at $34.73 on Wednesday.

Australia and New Zealand Banking Group (ANZ)

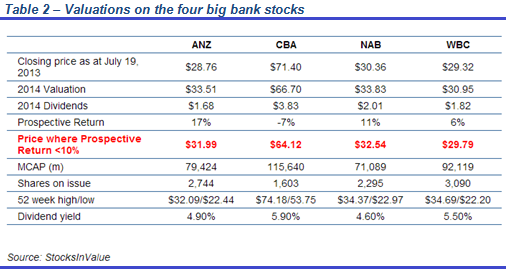

You’d be right to think that there isn’t much value to be had among the big bank stocks, but Australia and New Zealand Banking Group just manages to sneak into the value list on StocksInValue.com.au.

While the risk of rising bad debts and unemployment, sluggish demand for credit and weak business sentiment are weighing on the outlook of the banking sector, ANZ looks attractive because its current share price is hovering at around a 10% discount to its intrinsic value as indicated in the table below.

National Australia Bank (NAB) also appears cheap, but its poor track record and problems with its UK business essentially knocks it out of the running.

“ANZ also presents well across most key metrics,” says Ezquerro. “It is well capitalised and normalised return on equity is healthy [as] we expect it to average about 20% over the coming years.”

Shares in ANZ climbed 6c to $28.98 on Wednesday. The stock has lagged the other three big banks over the past 12-months with a return of around 27%.

Flight Centre (FLT)

On the flipside, the sharp rally in Flight Centre’s share price since the start of the month has just about pushed the stock into the “sell” category.

The travel agency has yet to officially make it onto the “Companies to avoid” list on Table 1, but Ezquerro thinks it is a good idea for investors to start “trimming” their positions even though he regards the stock as a quality investment.

The problem is that Flight Centre’s 15% ascend to $43.13 has put the stock too far out into orbit with the stock’s intrinsic value coming in at 38.3% below the current share price.

Further, Ezquerro suspects that the fall in the Australian dollar will have a negative impact on Flight Centre’s business, even though management has flatly denied this.

Flight Centre benefitted from the high Australian dollar as locals used the strong exchange rate to take overseas holidays. The dollar has fallen 12% in three months, and it remains to be seen how this will affect travel habits.