The US giant planning an Aussie solar shake-up

SunEdison, a United States-based, vertically-integrated, solar PV manufacturer and retailing giant has just announced it will be acquiring long-standing Australian solar retailer and wholesaler Energy Matters and associated companies Apollo Energy and SunLock. This acquisition was rumoured to be in train back in early September by Nigel Morris of SolarBusinessServices, but has now been officially announced.

Energy Matters is one of Australia's larger solar wholesalers and retailers. Based on Green Energy Markets data on small scale renewable energy certificate (STC) registrations the company appears to be one of Australia's top 10 solar retailing companies, although this is somewhat obscured by the role of intermediate certificate aggregators. Its young team of managers, led by chief executive Jeremy Rich (see interview here), pioneered the use of an online sales model for solar in Australia, and has a reputation for rolling out premium-end systems. They've also played an important role in developing and defending the solar sector via their funding of research into the merit-order effect of how solar PV was likely to lower wholesale electricity prices in Australia.

SunEdison are one of the biggest solar suppliers in the US market, and expected to ship over a gigawatt of solar PV this year globally, but have been absent from the Australian market. With this acquisition they will become the only major retailer and distributor of solar systems in the country that directly manufactures its own solar panels all the way back to silicon production (it announced a few weeks ago it expects to achieve 40 cents per watt for solar modules thanks to an innovative new process for smelting polysilicon). It represents a very different model for the Australia solar sector which has traditionally been highly disaggregated except at the utility-scale.

A few months ago it was announced that SunEdison would be entering the Australian market with a model of financing solar systems in Australia via customers leasing the system or paying per kilowatt-hour of electricity generated by the system (known as a power purchase agreement or PPA model). This was to be supported with $70 million of finance from Australia's Clean Energy Finance Corporation.

Such a model of financing solar systems is highly common in the US, for example in California around 75 per cent of household systems were sold via PPA or lease financing. However it is relatively rare in Australia where most systems are bought outright, or the customer organises their own financing.

A number of companies are now looking at the PPA model in order to open up new market segments such as commercial business rooftops and lower income and rental households. In both cases capital constraints and the fact that the prospective customer doesn't own the building and is likely to move out of their premises well before the solar system wears out (20-year-plus lifetime is standard), makes outright purchasing unattractive. Under a PPA model, the customer is essentially just presented with the offer of cheaper electricity than what they currently pay. Rather than a capital investment, it looks to the customer like an instant saving on an ongoing expense. The fact it comes via a solar system becomes almost immaterial, other than the customer needs to enter into a long-term agreement to purchase that electricity over many years, or otherwise transfer the agreement to the next building tenant.

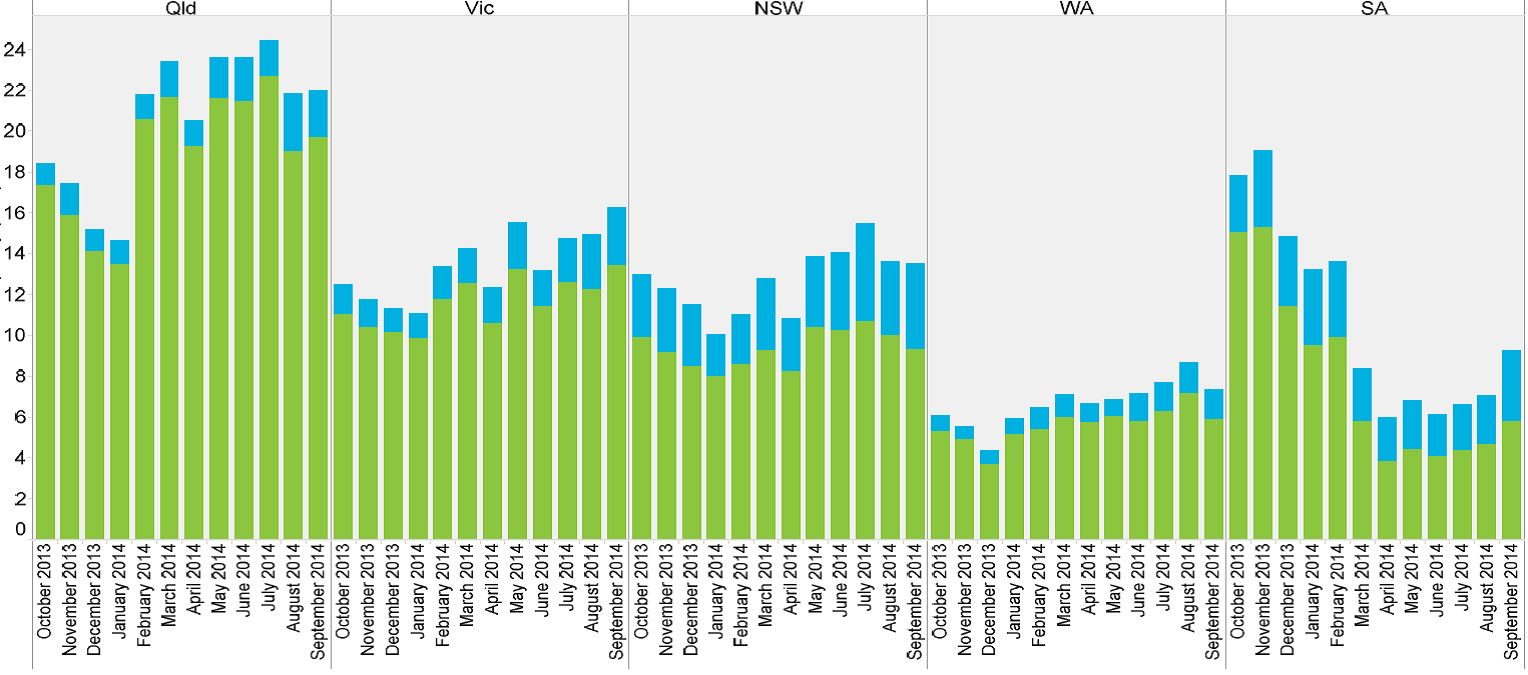

The purchase of Energy Matters signals that SunEdison are deadly serious about aggressively growing their presence in Australia. It suggests we are likely to see the PPA model of financing solar become a lot more common. This could be very useful in opening-up the commercial business rooftop segment which is an unusually small share of the Australian market (see chart below) relative to countries overseas.

Figure 1: Monthly installed capacity residential (green) vs commercial (blue) by state – capacity in megawatts

Source: Green Energy Markets' STC Snapshot – September 2014

SunEdison have a definite advantage over other players in this space because of their extensive experience in managing the risks associated with such a financing model in the US. In addition they have been a pioneer in the development of low cost financing vehicles known as Yield Co's to support such solar installations. Yield Co's involve splitting off the installed systems and associated customer PPA agreements into a separate company. Ownership of the Yield Co is sold on to other investors as a stable, low risk financial annuity not unlike an infrastructure asset. This opens up access to quite low cost finance such as superannuation funds.

Other participants will probably take some time before they can match such a low cost source of finance. At present almost all current Australian participants are only able to offer higher cost sources of finance for solar systems similar to rates associated with financing assets such as motor vehicles. AGL Energy has done something very similar to the Yield Co model when it onsold several of its wind farms to superannuation funds. Yet in that particular case AGL held the ongoing liability to purchase the output from the wind farm.

Australia is a very competitive solar market with some of the lowest rooftop system installation costs in the world. It's not yet clear how SunEdison's more integrated model will stand up, but it adds another dimension likely to be particularly important in opening up the commercial rooftop segment.