The two best banks for income investors

Summary: We are adding ANZ and NAB to the Income First model portfolio at 6 per cent weights. These stocks are more compelling than CBA and Westpac from both a yield and a value perspective. Even though the market is discounting ANZ and NAB as the relative quality of earnings is not as high as their peers, these are risks worth taking for the additional income, especially considering all four banks are extremely solid. |

Key take-out: The Income First Model portfolio is now a shade under 30 per cent invested, with five stocks included. We have probably hit our limit in terms of bank exposure and will look to add further to the portfolio throughout the August reporting season. |

Key beneficiaries: General investors. Category: Income. |

We are delighted to advise that we are kicking off Eureka Report's Income First model portfolio today. As you know, we have already launched a growth portfolio, a LIC portfolio and an overseas equities portfolio (you can view these portfolios on our website here). This latest portfolio is designed for income focused investors and I have detailed my approach to selecting investments in a recent feature: Introducing our Income First model portfolio (July 20).

You may recall I have already released my first three recommendations (Dick Smith, G8 Education and Automotive Holdings Group). Now I'm adding two banks – ANZ and NAB – to the mix, increasing the stock exposure to five, and the portfolio to just under 30 per cent invested. During this establishment phase the portfolio is invested to a point less than our minimum level of 50 per cent, but this is temporary as we establish our portfolio in coming weeks.

Initial inclusions and weightings

Our first 'pick' was Dick Smith Holdings Limited (DSH), which we bring into the portfolio at an initial 6 per cent weight. While, there are some uncertainties and competitive pressures in the consumer electronics landscape, DSH pays a solid dividend, and the board appears keen to continue to pay an income stream to shareholders (see our review of DSH's income prospects: Dick Smith's decent dividend, July 27).

We include childcare centre operator G8 Education Limited (GEM) with an initial 4 per cent weighting, mostly for its juicy 24 cent per annum dividend, paid quarterly, which equates to a gross dividend yield near 10 per cent. We recently initiated coverage of GEM with a buy call and a valuation of $4.65 (see G8 Education: Rewards and risks, August 3).

Our initial portfolio will include Automotive Holdings Group (AHG) as a 7 per cent initial weight. Automotive dealer AHG has a very robust business model, and pays a gross dividend yield of around 6.8 per cent, including franking credits. The company is expected to continue to deliver solid earnings and cash flow through its aggregation strategy, buying small car dealerships and introducing the benefits of economies of scale (see AHG is stronger than ever, August 3).

Choosing bank stocks

The portfolio will focus on stocks that are growing dividends, so it will become underweight the banking sector. However, at least in the shorter term, we believe that there is a strong case to include some bank exposure to assist in producing near-term income. While we are not covering these stocks or making Buy recommendations, we are including them in the portfolio.

But, given our caution that most of the capital rerating in banks has been priced to its limits (indeed ANZ has now confirmed it will raise $3 billion, evidencing that the pain of paying dividends to absolute limits might be starting to set in) – and that payout ratios are starting to reach towards ceilings – we have elected to take a 6 per cent weighting in the two big four banks that we believe offer the most to income investors. Notwithstanding this, we believe that investing in banks for the dividends requires caution at this point in the cycle, something made acutely clear by the recent slump in ANZ shares following a surprise $3bn capital raising.

Selecting ANZ and NAB

Our approach to selecting bank exposure has been to conduct peer analysis, and to lean on consensus forecasts. Given that the big four banks have enough similarities such that structural risks are similar, we have taken the view that if we monitor key metrics, we will be able to select the best yielding banks when considering the risks to capital. At present, this leads us to include ANZ and NAB in the portfolio at 6 per cent weights. Here's why.

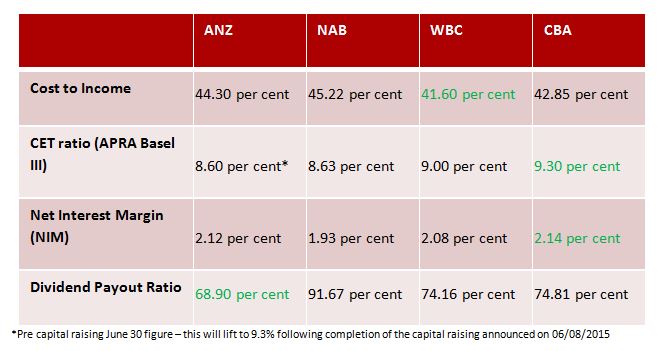

As can be seen in the below table, CBA and WBC probably have the best earnings quality. Cost to income ratios are lower, Common Equity Tier 1 capital ratios (CET ratios) are higher (although these are historical annual figures and CBA may be lagging if these were updated), net interest margins have been higher and risk, in terms of funding exposures, were deemed a touch lower.

However, our express objective is to generate as much income as possible for a given level of risk. We have the pleasurable position of picking from four extremely solid, world class banking assets and taking a wonderful income stream. So that is how we will frame our decision. Yes CBA and WBC appear to stack up a little better on some banking ratios, but in the end these are shades of grey.

Now, the only figure in this chart I've not mentioned is the dividend payout ratio. Clearly, ANZ inspires a bit of confidence with its lower ratio, but it is worth noting that this is near the top end of the company's 65 per cent – 70 per cent payout range. So, across the board, we believe that there is little room for dividend growth through payout ratio rises. NAB's payout is curious. But, if we consider the fact that NAB's earnings have been hurt by write downs, and problems in the UK, this payout ratio is inflated, and less of a concern.

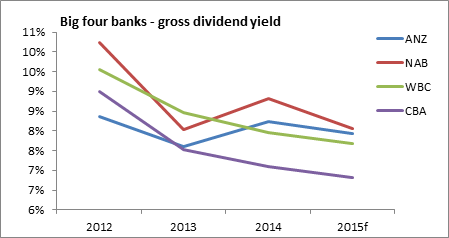

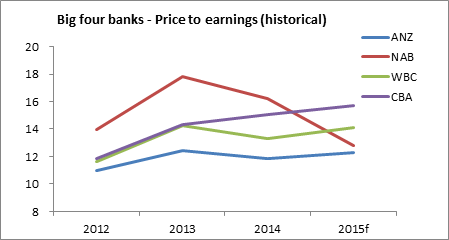

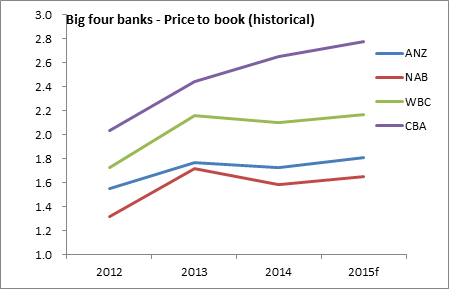

So, if we aren't focusing on measures of earnings quality primarily, what has led us to add ANZ and NAB to the portfolio? The answer is simple. They are more compelling from both a yield and a value perspective. The below three charts show that as per FY15 forecasts ANZ and NAB provide investors the highest gross dividend yield, the lowest price to earnings ratios, and the lowest price to book ratios. So, the market is discounting NAB and ANZ because the relative quality of earnings is not as high. That's fine. But for the purposes of bank investing in an income focused portfolio, these are risks that are worth taking for the additional income. In fact, the difference between the 6.8 per cent gross yield forecast for CBA and the 8.02 per cent forecast for NAB is in our view sufficiently material to justify the portfolio decision, and the ‘additional risk', when bank risk is considered in its context.

Source: Bloomberg, Eureka Report

Source: Bloomberg, Eureka Report

Source: Bloomberg, Eureka Report

Growing future earnings

Looking more closely at NAB and ANZ, we believe that there are positive themes to both banks that might assist in growing earnings and dividends in the future.

First, NAB has endured a rocky run in the UK. The underperformance of the UK business has damaged the bank in terms of market sentiment. However, following a significant capital raising through rights issue, and the announcement that NAB will look to demerge its Clydesdale bank through IPO within the calendar year NAB looks to be in a position to unlock value that has been otherwise overlooked in recent years.

Second, ANZ's exposure to Asian markets has the potential to continue to provide ANZ with a source of earnings, cash flow and dividend growth not offered in other ASX-listed banks. While there are difficulties in this strategy, and the Asian growth strategy has probably not delivered to date, there are some emerging shoots of promise from the banks' exposures to corporate banking and markets.

In our view ANZ and NAB might have more risk in terms of earnings quality when compared to CBA and WBC, but they probably also have more upside opportunity should things go well. In the meantime, we are happy to take the strong dividend yield into the portfolio. It is worth noting that ANZ and NAB operate on a staggered financial year, ending in September, and will next report in November 2015.

ANZ's $3bn capital raising and the thirst to shore up capital reserves

We still see some risk in banks generally, which explains why as a portfolio we are taking positions only in the two banks that we feel provide a justifiable level of dividend yield for the risks involved. Recent directions in APRA regulations indicate that banks are going to need to hold more Tier 1 capital, and this is likely to see a continued deterioration in bank profitability. Thus far, NAB has raised $6bn through a rights issue and flagged the demerger of its UK assets, WBC has sold down its stake in wealth manager BT, and on Thursday last week (August 6) ANZ announced a $3bn capital raising. ANZ shares were sold off some 8 per cent upon reopening, showing that risks to capital in bank stocks should never be ignored.

In terms of the ANZ capital raising, $2.5bn was successfully raised from institutional investors at $30.95 per share, and the remaining $500 million will be allocated to shareholders through a share purchase plan. The retail leg will be priced at the lower of a 2 per cent discount to the 5 day volume weighted average price (VWAP) for ANZ leading up to the close date of the offer, or the same price as the institutional leg. Given that ANZ shares were trading at $32.58 prior to entering the trading halt, the price discount is unlikely to exceed 5 per cent. The offer is likely to result in the issuance of around 100 million new shares, which will dilute group earnings per share (EPS) and dividend per share (DPS). We note that our expectations for the final dividend are below that of the consensus in the market; we are expecting around 95 cents as a final dividend for ANZ, but note the possibility for this to be slightly lower.

Finally, it is important to consider whether this round of capital raising from the banks, which is the largest and most pertinent since the GFC, should be thought of as capital raised to pay dividends. In our view, the answer is no. The banks' models have been set up to pay out dividends, and fund themselves organically based on a set of assumptions regarding regulatory regimes and reserve assumptions. APRA's recent changes, and willingness to continue to lift requirements and standards for banks, move the goalposts, and have necessitated these capital raisings.

If the largest banks hadn't needed to raise capital in this context, one could make the argument that they were being too conservatively run in the first place, and were not maximising shareholder returns. While we acknowledge that there are negative themes in the sector for the banks, and that regulatory changes are moving in a direction that will erode profitability, we continue to believe that ANZ and NAB offer an attractive level of dividend yield in the short term given the risk involved.

Portfolio summary

Overall, as mentioned, we are pleased that we now have a portfolio that is a shade under 30 per cent invested, with five stocks included. At present we think we have probably hit our limit in terms of bank exposure and will look to add further to the portfolio throughout the August reporting season. At present we believe there is ample opportunity to seek out solid income generating equity securities that have the propensity to grow the income stream into the future.