The Ticker: Modern business life

On today's blog:

- Two charts that reveal Australia's global ranking in online retail

- Australia just outranked the US on cyber-freedom

- How illegal sharing actually helped Psy break YouTube

- Why Canberra needs to stop cheerleading Christmas spending

- Not just good for consumers: The other astonishing winner from low oil prices

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3.10pm - Two charts that reveal Australia's global ranking in online retail

We've talked about online retail a fair bit on The Ticker this week. Here's two more interesting graphs on the trend.

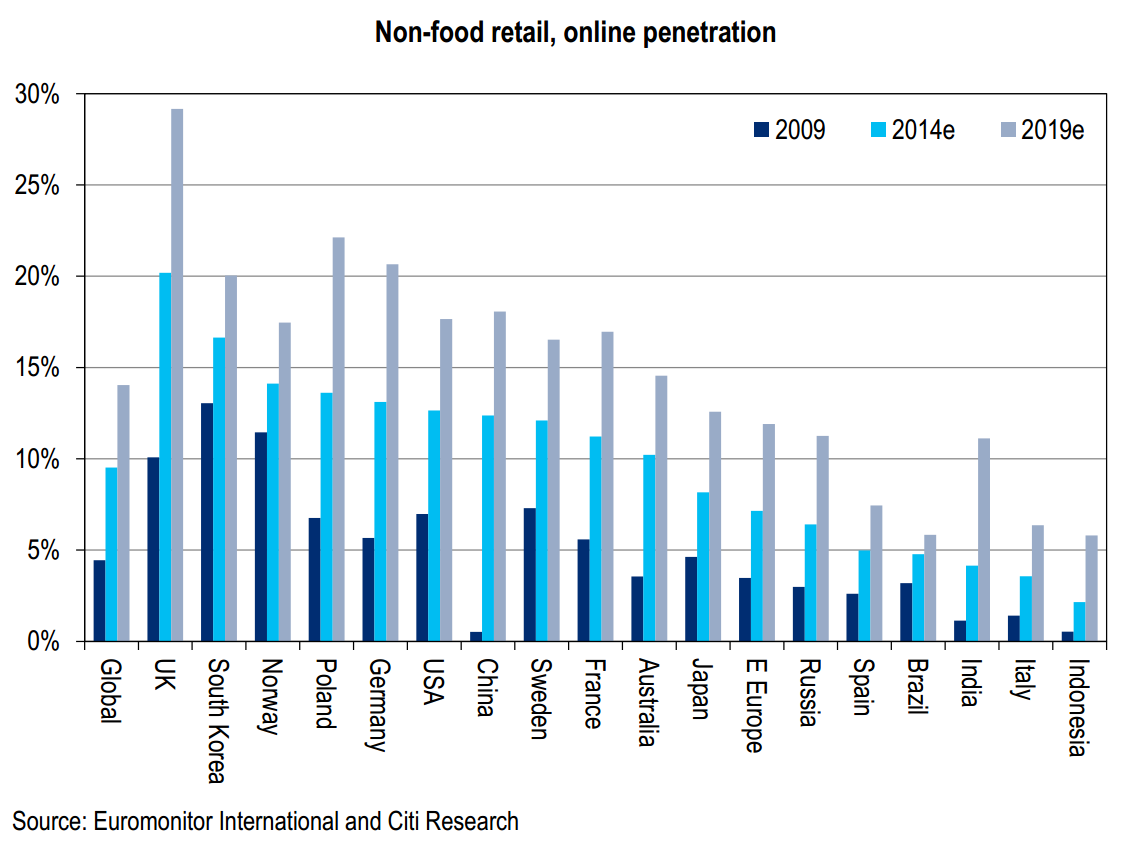

These charts from Citi look at the penetration of online retail in Australia compared to the rest of the world.

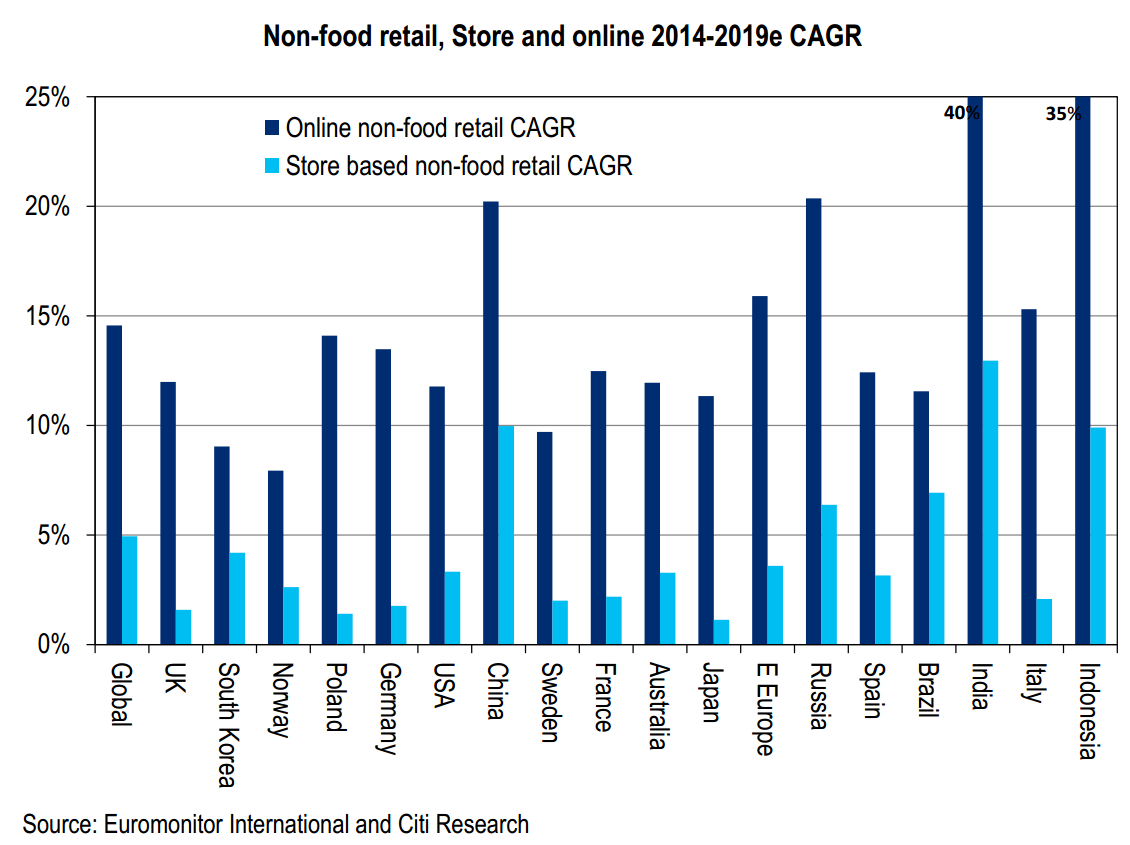

The second graph shows the trend's growth rate in comparison to brick-and-mortar store growth.

You can read our other two posts here:

- Let's hope retailers are ready for an online Christmas

- This graph proves Australian retailers are still underinvesting in online

12.10pm - Australia just outranked the US on cyber-freedom

By Chris Kohler, BusinessNow

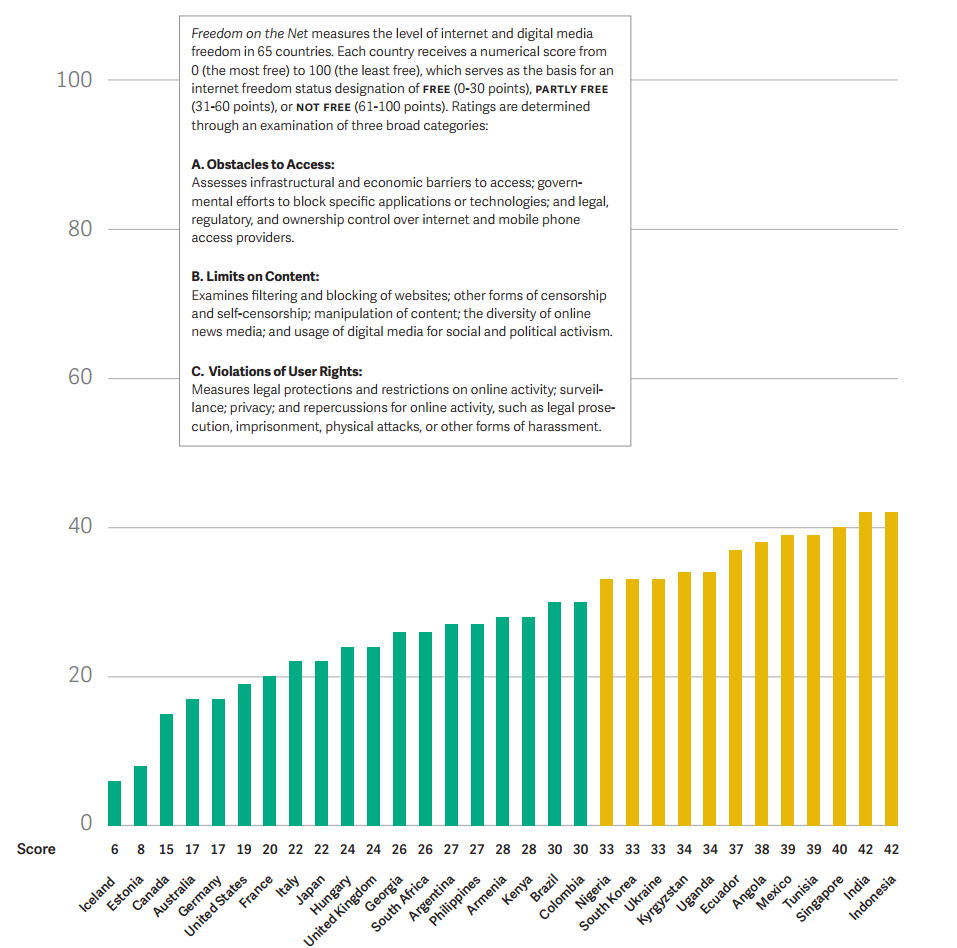

Australia has more freedom on the internet than 97 per cent of the world, according to this year's Freedom House 'Freedom on the net 2014 survey'.

Assuming you're reading this on a computer screen in Australia, your level of online freedom puts you fourth in the world, behind only Iceland, Estonia and Canada.

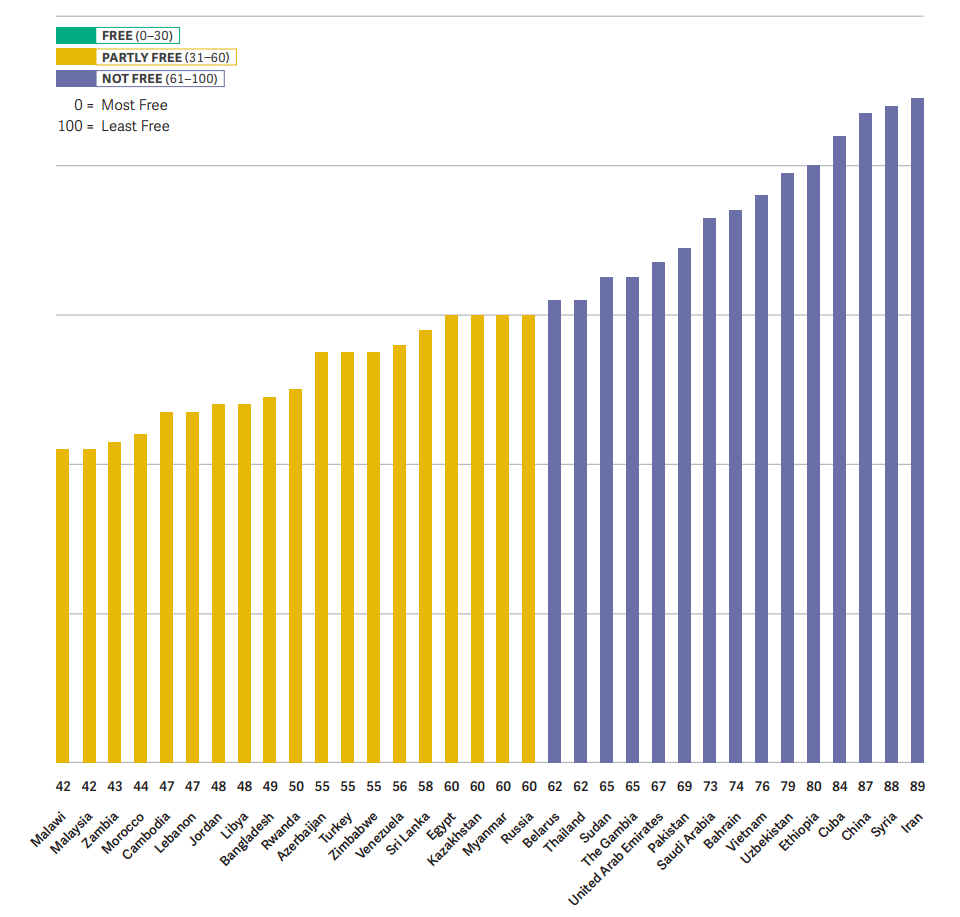

The annual report ranks the level of internet and digital media freedom in 65 countries by giving each a score from 0 (the most free) to 100 (the least free).

Australia's score is 17, which is the same as Germany and better than the home of the brave and land of the free (USA), which got a score of 19.

Freedom House figures out the rankings by looking at things like how difficult it is for people to get and use technology; filtering, blocking and censorship; as well as privacy, surveillance and repercussions for online activity.

Predictably, web surfers in China haven't got much room to move -- but they're still better off than browsers in Iran and Syria, who come in last.

12.00pm - How illegal sharing actually helped Psy break YouTube

There's more to the news that Psy's Gangnam Style video broke Youtube's view counter. It's an interesting example of how sharing and illegal use of content can benefit the artist in the long term.

As we all know, music videos generate a lot of traffic on YouTube. So much so, that Google, Youtube's owner, bought a stake in the world's largest digital music video company Vevo after persistent speculation that it would pull its content off the site.

As a result of the sheer amount of traffic they receive, music videos generate substantial revenue for both YouTube and Vevo. In fact, the majority of the world's most popular Youtube videos are Vevo clips.

South Korea's Psy is the only artist to break the top ten without the aid of Vevo's network. He's also the only artist to have two videos in the top ten.

So what is the secret to his success? Piracy.

As this earlier article from Forbes outlines:

“Interestingly, Psy is making money every day not just from his own video(s), but those of other users from around the world. YouTube has a system for detecting when copyrighted material is being used in a video, and should it be found, the content's owner has the choice of either taking that video down or getting a share of the advertising revenue. Often record labels will quickly remove copies of new singles, so as to centralise views to the one they have uploaded. Psy chose for others to be able to use his track, and is raking in money from the 40,000 or so parody videos, lyric videos and the like that all use Gangnam Style, though calculating how much is a daunting task.”

10.10am - Why Canberra needs to stop cheerleading Christmas spending

By Adam Creighton, The Australian Business Review

Our politicians can barely contain their enthusiasm for the holiday season. Image:AAP

Every Christmas is the same: politicians exhort voters to spend big for the economy, almost as if it were a person. “Don't let Santa down. Go out there and spend for Christmas ... household consumption is actually one of the biggest drivers of economic growth,” said Joe Hockey this week, batting away pesky budget speculation.

It's actually not. In fact, wiser heads would say consumption, especially the mindless or debt-fuelled variety, is the enemy of genuine economic growth. Sure, an unanticipated splurge will bolster the quarterly, and increasingly meaningless, GDP figures but these only estimate the value of final goods and services ratcheted up over some defined period.

…

Australians who choose to save more of their money rather than spend it this Christmas, by investing in bonds, shares and the like, are bolstering their resilience to future economic shocks (and directly providing capital to businesses or government to consume or invest instead). If they put their savings in the bank they are, in effect, lending to other businesses or households.

The bottom line is that saving allows for more consumption in the future, beyond the three-year federal electoral cycle. This might be a rational response, both to our increasingly long lives and to the growing likelihood of crushingly high income tax in the future to bridge the gap between taxes and spending promises.

10am - Not just good for consumers: The other astonishing winner from low oil prices

By Ric Spooner, chief market analyst, CMC Markets

Pizza anyone? Image:AAP

The lipstick theory says that companies selling small luxuries often do well when times get tougher. Racehorses, yachts and luxury cars are off the agenda but we still need to spoil ourselves every now and again. Otherwise, what's it all about?

So if lower petrol prices are leaving a bit more money in your pocket but you're still nervous about the economy and your job security, what do you do? Maybe it wouldn't do any harm to buy a pizza for the family and save on cooking and washing up every now and then.

In the current climate, the lipstick theory says Domino's Pizza is the sort of company that might benefit from lower petrol prices. It won't just be Aussie drivers who stand to gain from lower petrol prices. Drivers all around the world are going to benefit; and part of Domino's appeal is the potential for ongoing growth in its European and Japanese franchises.

Domino's has been a successful operation and expectations for future earnings growth are high so its shares trade on high PE values. It's currently trading at a lofty 37 times F15 earnings forecasts. Traders hoping for a bit more value might look for the share price to return to the 40 week moving average and trend lines of around $23.

9am - Interesting reads from around the web

The first sign of the Murray banking inquiry's wide-ranging impact: It's not out until Sunday, but we now know that it will include recommendations that the government reign in exorbitant credit card surcharges.

Japan's Abenomics has failed: What Europe can learn for the country's failed stimulus plan.

This viral video just won't die: Psy's Gangnam style is back in the headlines after record number of views managed to break YouTube's analytics system.

Despite its recent controversies, Uber just raised $1.2 billion in capital: It plans to spend it on growing its business in the Asia Pacific.

“Traffic was never a problem, everything else was”: The short and tumultuous history of the acclaimed ‘front page of the internet', Reddit.