The Ticker: Modern business life

On today's blog:

- Let's hope retailers are ready for an online Christmas

- Why the ASX won't break last year's Christmas capital raising record

- Stopping the rise of the machines: Meet Google's new method for tripping up web bots

- Economists agree: Australia is not heading towards a recession

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter

1pm - Let's hope retailers are ready for an online Christmas

Yesterday, The Ticker revealed how Australian retailers have rekindled their investment in physical stores despite the rise of online retail. Meanwhile, over in the US, the opposite has happened in response to the trend.

We argued that the debate around online retail has stagnated in Australia, and that this Christmas may be a true test of our retailers' online capabilities.

And what a test it's shaping up to be.

Today online retailer eWAY published its online Christmas spending figures, showing a rapid uptick in online Christmas spending in Australia over the past five years. Based on its own data (which excludes other merchants and terminals), the company processed a whopping $319 million in Christmas transactions last year. This year, it expects that figure to rise to over $400m.

This is just one payment provider. The real spend across the board will be significantly higher. Given these figures, we can only hope our major retailers are finally ready for an online Christmas.

12.30pm - Why the ASX won't break last year's Christmas capital raising record

In business circles, December is usually a rather subdued month, as many ease into the Christmas period.

But for our local exchange, the ASX, it's one of the most hectic periods of the year -- simply because companies are keen to squeeze in their capital raisings or market debuts before the Christmas break.

Last December, the ASX set a new record for the total amount of capital raised on the exchange in a single month. It was easily the busiest month over the past year.

It even topped previous Christmas periods. As far as we can tell, it was the strongest month for raising capital on the exchange since 2005, which is as far back as the available data goes.

That said, this Christmas the exchange may struggle to reach last year's record. As you can see from graph below, the vast amount of capital raised came from new listings.

And compared to earlier years, fewer and smaller companies are expected to list on the exchange before this Christmas. We can't confirm the estimated figure below, as many of the companies have only provided the ASX with a tentative list date.

But it is looking as if the 2013 Christmas capital raising record may hold for at least another year.

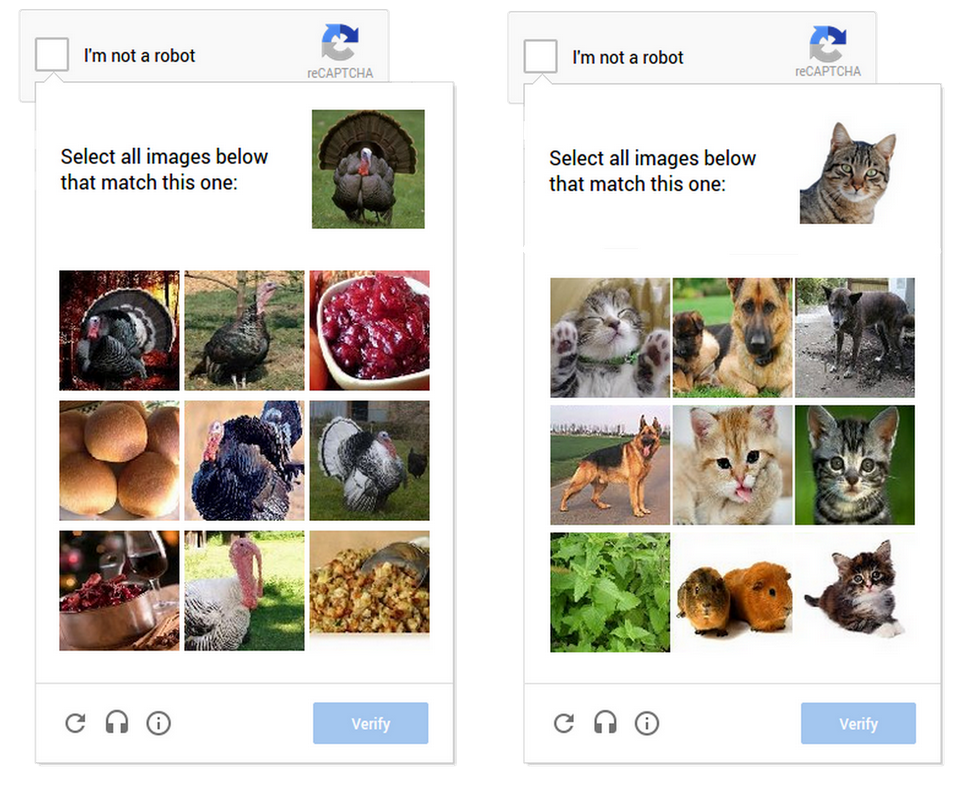

11.15am - Stopping the rise of the machines: Meet Google's new method for tripping up web bots

The CAPTCHA: the bane of every internet user's existence.

Since its inception, this tool has been used to stop virtual robots from swarming websites and creating fake accounts and spamming users. It works by simply presenting a problem that a robot can't solve. However, sometimes humans can't solve them either. I'm sure we've all been at the receiving end of an impossible CAPTCHA code.

Google's new, aptly named No CAPTCHA reCAPTCHA uses an improved risk assessment to help users dodge this bot challenge. Sadly, this won't kill the CAPTCHA; the tool will still be used to ensure Google's algorithm is foolproof.

The company is also experimenting with other methods of authentication such as picture recognition for its new CAPTCHA tool. Again, this is easy for humans, but tough for machines.

No CAPTCHA reCAPTCHA is yet to go mainstream on the web, but Google expects the tool to become commonly used as more web companies adopt its technology. If you are interested to learn more about Google's new tool, check out the video below. You can read its original blog post here.

10.30am - Economists agree: Australia is not heading towards a recession

Uh-oh. Somebody said the R-word.

The phrase ‘income recession' is splashed across the press today, and it has some wondering whether we are heading for a full-blown downturn.

The debate was kick-started by ABC's AM program. Here's a snippet from today's show.

CHRIS UHLMANN: Alright, if we come to some of those measures in a moment but let's look at the scorecard. Unemployment is rising, profits are falling, investment is down, wages are flat, inflation is near zero. Now I'm old enough to remember what a recession looks like and all the signs are bad at the moment, aren't they?

JOE HOCKEY: Well, well, you are wrong. Employment growth this year has been running at twice the pace that it did last year…

CHRIS UHLMANN: Unemployment is at 6.2 per cent…

JOE HOCKEY: …and 12,000…

CHRIS UHLMANN: …youth unemployment, 13 per cent.

JOE HOCKEY: Yeah, and it's too high. But we've got twice the employment growth this year than occurred last year under Labor; around 12,000 jobs a month created in Australia this year.

Consumer confidence back at long term levels…

CHRIS UHLMANN: After being hammered by the budget.

JOE HOCKEY: …and business confidence and business conditions back to long term averages. The fact is we've got a pipeline of new infrastructure coming into play. We now have a record number of dwelling approvals and we're going to see a significant increase in housing construction over the next few months. So I don't want this idea starting to spread as a result of poorly informed commentary that Australia is going to have a tough 2015. It will get better.

Growing criticism over Joe Hockey's performance as Treasurer has intensified fears that the economy is in trouble, and that it is beyond the government's control. And the campaign from the opposition isn't helping Hockey's cause.

.@joehockey is this what ‘real momentum' looks like? The Budget has hurt jobs, growth and the economy. #auspol pic.twitter.com/MEVxIGHVDS

— Chris Bowen (@Bowenchris) December 3, 2014

So, what is going on? Are we in trouble? Are we heading for a recession, or is the word simply being thrown around as a means of pouring cold water on the Coalition's economic credentials?

We put a simple question to three economists: Is Australia heading towards an actual recession in 2015? Here's what they had to say:

Saul Eslake, Bank of America Merrill Lynch's chief economist

“If by ‘actual recession', you mean consecutive quarters of negative growth in real GDP, then my answer is ‘no'. GDP growth will continue to be boosted by resources exports, with LNG exports coming on stream from the beginning of next year. And there's no historical evidence to suggest that an ‘income recession' is a leading indicator of a GDP recession.”

Stephen Koukoulas, managing director of Market Economics

“Recession in 2015? Very unlikely, but recent events have increased the chances we do stumble into one. Those recent events include a pig-headed RBA, which has sat idly by and let an over-valued Aussie dollar undermine growth and it has failed to cut interest rates as the downside momentum in national income and real GDP has gathered speed. The collapse in commodity prices and a weaker world make a recession possible and it will be more likely if China weakens further. Against this is some hope the penny will soon drop at the RBA and it will cut rates aggressively. GDP near 2 per cent in 2015 will feel like a recession for many parts of the economy, but an actual, broad-based recession is still unlikely.”

Craig James, chief economist, CommSec

“No, and there is no such thing as an income recession. If petrol prices fall for two straight weeks, is the petrol market in recession?”

9am - Interesting reads from around the web

Should we embrace nuclear power? It isn't ‘economically feasible' in Australia, but neither is our renewable energy push.

A new type of market high: Australia's first medical marijuana company is three times oversubscribed and is expected to launch on the ASX later this month.

Has human progress ground to a halt? A look back at an era where hype for technology actually met the reality.

Reclaiming the blogosphere: How Medium is trying to bring back the web we lost.

Don't believe every graph you see: Here's a quick guide on how to effectively lie with charts.