The Ticker: Modern business life

On today's blog:

- Volatility working well for ASX

- Despite the protests, coal still has some very powerful friends in Canberra

- This graph proves Australian retailers are still underinvesting in online

- The ACCC busts Australia's biggest petrol myths

- One chart on Australia's most profitable industries

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3.10pm - Volatility working well for ASX

By David Rogers, BusinessNow

Increased volatility should be a plus for the ASX.

The average number of trades for November rose 7 per cent versus a year ago. That followed a 9 per cent rise in October, confirming an apparent recovery in trading volumes.

The average daily value traded on market jumped 13 per cent from a year ago to $3.5 billion, and in October it rose 15 per cent to $3.47bn.

The ASX said volatility measures remained below long-term averages in both months, although they have spiked on occasions to well above levels seen for most of the year.

Derivative markets were mixed, with the average daily number of derivatives traded on ASX up 1 per cent. Single stock options average daily contracts traded were flat but index options rose 19 per cent in the month.

Average daily futures and options on futures volume on ASX 24 fell 8 per cent from a year ago and average daily futures volumes fell 7 per cent. Options volumes were down 36 per cent

2.40pm - Despite the protests, coal still has some very powerful friends in Canberra

You don't have to be a pollster to know that coal isn't exactly Australia's most adored resource. Just look at what a flop the Mineral Council of Australia's #AustraliansForCoal campaign was.

I'm with #australiansforcoal because wind farms are such a blight on the landscape (see horizon). pic.twitter.com/s07fP9oWt5

— Ros Lording (@roslording) April 14, 2014Or, more recently, the support Wallabies captain turned anti-coal campaigner David Pocock received when he protested Whitehaven's proposed Leard State Forest coal mine.

Locked on selfie with 5th generation farmer, @Ricklaird14, protesting Whitehaven's new coalmine in Leard State Forest pic.twitter.com/VkgIYlZgYu

— David Pocock (@pocockdavid) November 29, 2014But despite ongoing online rage around coal, it seems both sides of politics are in a bubble when it comes to talking about the resource's future. The proof is in their comments.

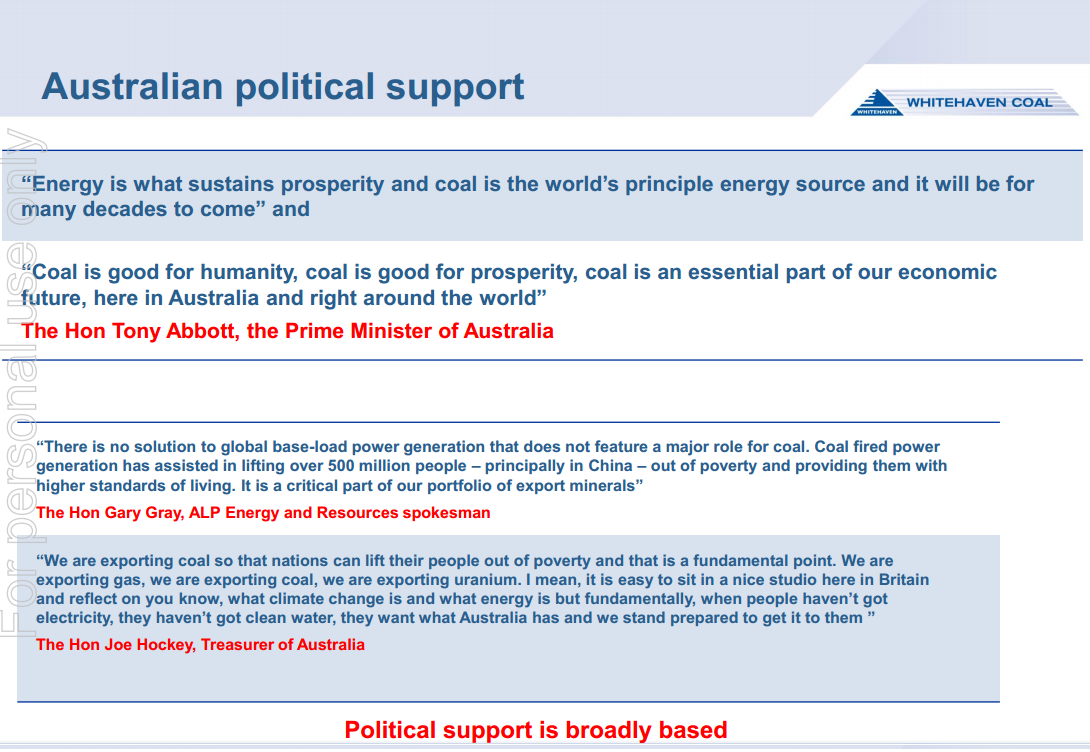

In a bid to present political support for coal to their investors, Whitehaven, a coal miner at the centre of many of these media storms, put together a slide showcasing all of the glowing comments the coal industry has received from politicians in the past year. It also reveals that there is bi-partisan or ‘broadly-based' support (between the government and the opposition) for coal.

To be fair, our politicians do have a point. As we pointed out last month, coal is a major export for Australia and the industry would be one of the leading benefactors of an Australia-India free-trade agreement.

But is Canberra aligning itself a little bit too closely with the coal industry's agenda? The fact that the above slide even exists seems to suggest so.

1.20pm - This graph proves Australian retailers are still underinvesting in online

It's no longer a debate: The US is leagues ahead of Australia when it comes to online shopping. The demand is there, online spending in Australia just hit a record high. But it's still questionable as to whether are major retailers are adequately responding to this trend.

While the US is talking about same-day deliveries and even delivering goods via drones, Australia's retail debate is stuck at a ‘bricks-and-clicks' crossroad where overseas retailers are now considered to be the biggest threat to the industry. In this dynamic our major shopping chains seem to think operating a website is an effective means of keeping up with technological change. Meanwhile, they continue to invest in expanding their physical store empires.

This graph from investment firm Schroders pretty much nails this point. In the US, spending on retail real estate has reduced in response to online. In Australia, we've managed to do the opposite. While the trend was on the decline until 2011, it's rebounded in recent years.

This Christmas will be yet another test for our online retail capabilities. Let's hope that at the end of it we don't end up with another harsh but fair write-up about a major chain failing at online shopping. The screenshot below is just one example of what happened last year.

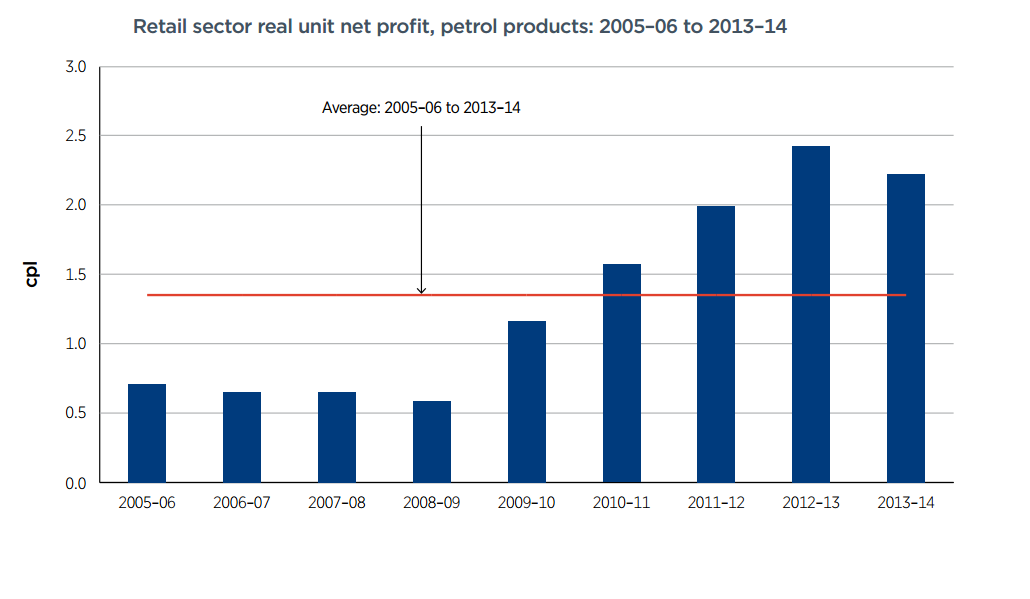

11.40am- The ACCC busts Australia's biggest petrol myths

Drive a car? You may want to read this.

Australia's consumer watchdog, the Australian Competition and Consumer Commission just released its annual report on the petrol industry. Here are some sobering findings from the near 200-page report.

Myth: Petrol prices move up and down on a weekly cycle.

“In each of the eastern capital cities (i.e. Sydney, Melbourne, Brisbane and Adelaide) the average duration of price cycles in 2009 was seven days. By the first half of 2014 it had increased significantly -- the average price cycle lasted over 18 days in Sydney, Melbourne and Brisbane, and over 15 days in Adelaide. In contrast, in Perth the average price cycle duration decreased from around nine days in 2009 to seven days in 2011, and has remained at seven days since then.”

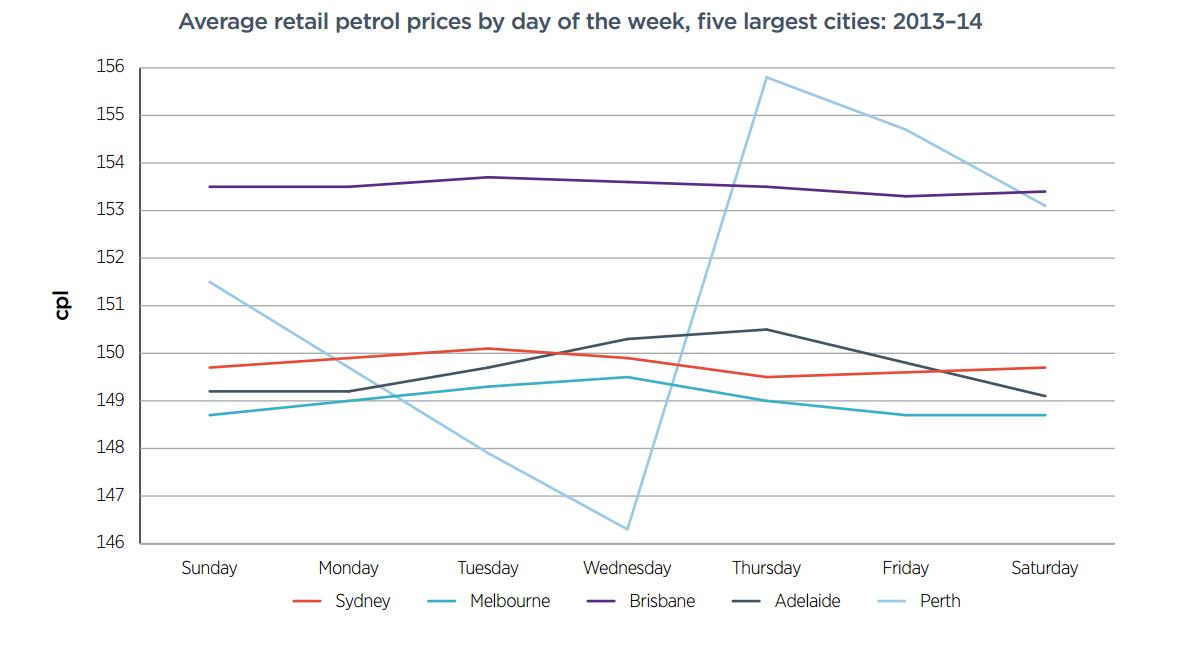

Myth: There is a ‘cheap day' for petrol.

Contrary to popular belief, in most states there isn't actually a day of the week that petrol is cheaper. In the eastern capital cities there was hardly any variation in the average price for each day of the week in 2013-14. But if you live in Perth, it looks like buying petrol on a Wednesday could save you some money.

Myth: Petrol prices climb before a long weekend

“It is often claimed that retail petrol prices always increase before public holidays, and in particular long weekends. ACCC analysis indicates that, over the last five years, the size of price cycle increases before public holidays was on average no larger than the size of price increases at any other time of the year.”

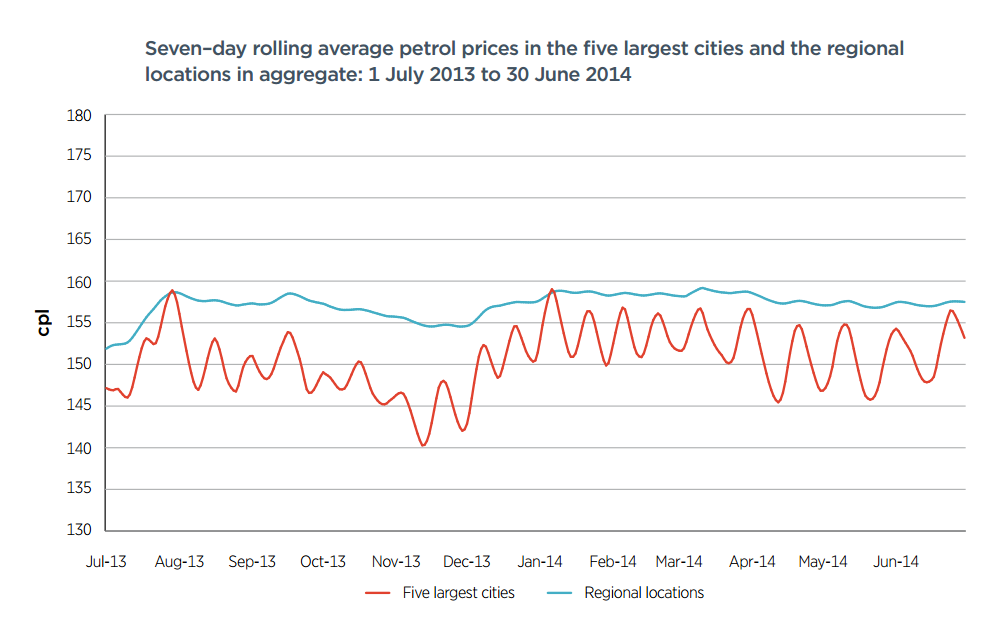

Fact: Petrol is significantly more expensive in regional areas.

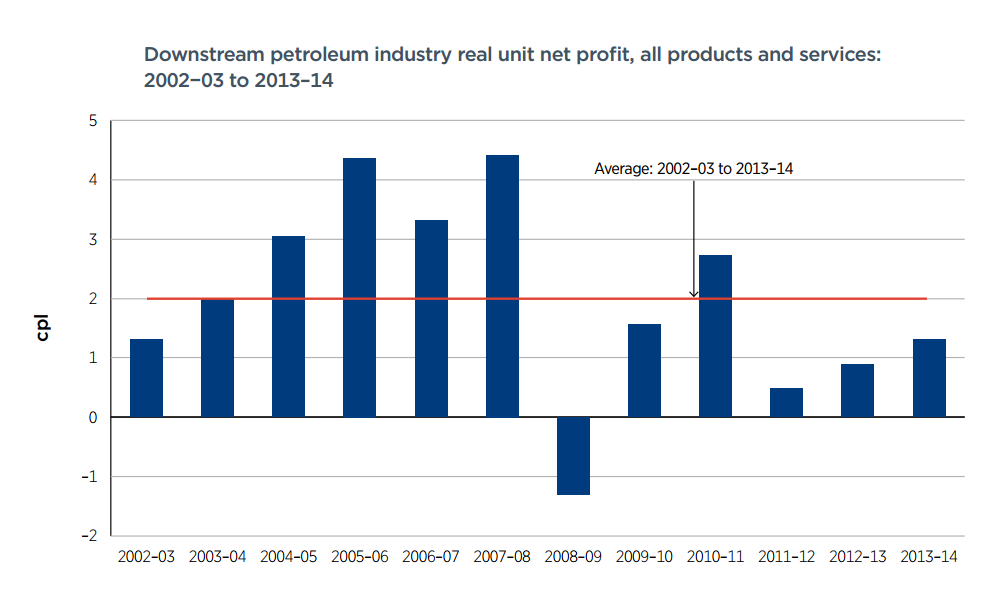

Myth: Petrol manufacturing and distribution is a booming industry

Actually, it isn't. Downstream petrol industry profits are lower than the last decade. This is largely due to international economic pressures, including currency prices and the price of crude oil.

Fact: Petrol retailing is a thriving industry

This year, petrol retailing profits slowed for the first time in five years. Both fuel sales and convenience store sales took a tumble.

The ACCC claims this is a direct result of actions it took that stopped the major chains (Shell/Coles and Caltex/Woolworths) from using supermarket profits to subsidise fuel discount dockets.

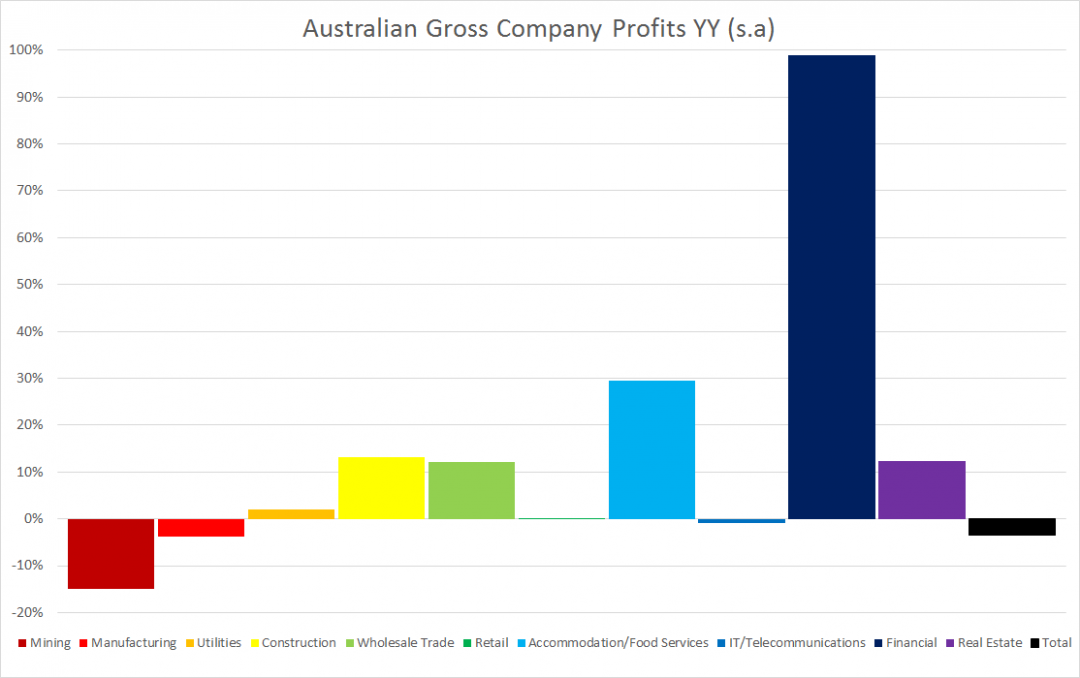

9.30am - One chart on Australia's most profitable industries

Here it is, year-on-year gross company profits, broken down by industry. We found this chart in yesterday's Livewire email, it's by Scutt Partner's David Scutt.

He has a pretty logical explanation for the result too:

A quick industry-specific look at Australian gross company profits for the past year. Financials leading the pack, up a whopping 98.9 per cent on the back of lower interest rates and a lack of substantial insurance payouts, while mining, reflecting the slowdown in China and lower commodity prices, is the laggard at -15 per cent. Elsewhere, real estate and construction recorded growth of 13.2 per cent and 12.3 per cent, unsurprising given recent activity in the housing market, while retail, the largest employer in the country, logged a measly increase of 0.01 per cent.

9am - Interesting reads from around the web

A blast from the past: With university deregulation back in the headlines, it's a good time to revisit Callam Pickering's argument around how the reform will affect student course selection.

Not so free: How politicians abuse the idea of ‘freedom of speech' in Australia.

Get used to low oil prices: Here's a compelling argument as to why the US will outlast OPEC in the current supply war.

Surrendering the wheel: This article sums up the arguments that proponents of self-driving cars will have to face if the vehicles are to go mainstream.

Couldn't they just build sturdier phones? Here's a glimpse at Apple's elaborate gravity-shifting plan to make future iPhones drop-resistant.