The Ticker: Modern business life

On today's blog:

- Watch the Victorian election's most absurd campaign ad

- At least the gender pay gap isn't as bad for business undergraduates

- Will A$, copper, track iron ore and oil?

- Apple's iPhone 6 has become a long-term win-win for the telcos

- Amcor: A silver lining amid a falling iron ore price?

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

2.40pm - Watch the Victorian election's most absurd campaign ad

Victorians hit the polls tomorrow and by now we're all sick of attack ads. So, here's an unusual departure from what we're used to during election time.

Heads up: if you're at work you will want your headphones in for this one.

Hat tip to The Guardian for un-earthing this clip.

11.50am - At least the gender pay gap isn't as bad for business undergraduates

This week's data drop from the Workplace Gender Equality Agency has brought gender pay back into the headlines. In recent reports, law firms, financial services outfits and management consulting companies have all been pinned as some of the worst offenders for uneven pay.

While it's no consolation, data from Graduates Australia reveals another interesting facet to the gender pay debate: the divide gets worse the further you progress in your career.

Here's what the pay divide looks like for bachelor degree graduates under 25.

And here's what it looks like for graduates of all types of higher education – which includes Masters and diplomas.

10.30am - Will A$, copper, track iron ore and oil?

By David Rogers, BusinessNow

Will the Australian dollar and copper track spot iron ore and oil prices lower?

The fundamentals vary, but at times, commodities and commodity currencies are highly correlated.

As the chart below shows, the strongest correlations occur when global demand expectations change, and there has been no major change in global demand expectations recently.

The prevailing view is that the US is taking up the slack from slowing growth in Europe, Japan and Asia, and that stimulus in those areas will offset reduced stimulus in the US.

But the fact remains, commodities and commodity currencies usually follow the same direction, and iron ore and oil could well lead other commodities and the Australian dollar lower.

10.10am - Apple's iPhone 6 has become a long-term win-win for the telcos

Bigger is indeed better for the telcos. Image:AAP

It's rare to see our two rival major telcos agree, but it seems neither Telstra nor Optus can deny the overwhelmingly positive impact Apple's latest iPhone has had on their business.

In today's Australian Financial Review, Optus said it enjoyed one of its most successful weeks for device sales when the iPhone 6 and iPhone 6 Plus hit shelves last September.

“We sold out of iPhone 6s and it exceeded our previous high, which happened with the launch of Apple's iPhone 5s,” Optus postpaid marketing director Tim Cowan told the paper.

Earlier this year, Telstra's CEO David Thodey made a similar comment about the launch.

“The iPhone 6 launch was pleasing for us and post-paid handheld ARPUs (average revenue per user) are continuing to improve,” he said.

It's that second point that's interesting.

Raising average revenue per user is one of the key business drivers for the telcos. In today's landscape, higher average revenue per user typically means that consumers are opting for higher value plans and are in turn using more data.

We said this was a win-win. This is where that second win comes into play.

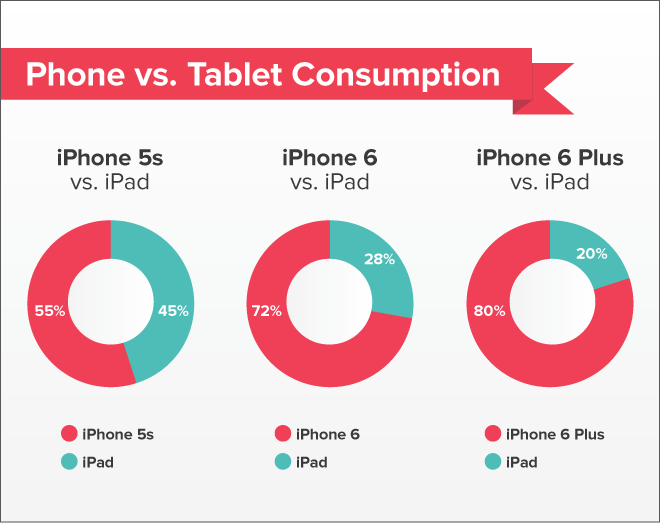

A new study from content aggregation site Pocket found that iPhone 6 Plus users are more likely to consume content on their phone than their tablet.

Content consumption on the app also jumped 33 per cent when its users upgraded from the iPhone 5 or 5S to the iPhone 6 or iPhone 6 Plus, which may be explained by the iPhone 6's substantially bigger screen.

So, why is this good thing for the telco industry? For starters, telcos would prefer that users consume content on their phone rather than their tablet. The majority of tablet sales are Wi-Fi only devices, whereas all smartphones have access to the telco's 3G and 4G services by default.

If consumers are using more data, then they will either opt for higher value plans that cater to their habits or spend more on add-on data packs. So it's a win from device sales and another win from long-term data consumption trends. The telcos can only hope that this trend towards mobile-data enabled phablets continues to grow.

9.50am - Amcor: A silver lining amid a falling iron ore price?

By Ric Spooner, CMC Markets

With iron ore prices falling, the immediate focus for most investors is the impact on mining companies. However, lower iron ore prices will affect a lot of Australian companies -- and it won't all be negative.

Most pundits see falling iron ore prices as being bearish for the Aussie dollar over the medium term. This means one group of winners are shareholders in companies with large international revenues that won't be harmed by weaker commodity prices. The $A value of their revenues will grow as the Aussie falls.

The sharemarket is already acting on this theme. Many of these companies have enjoyed nice rallies in recent months.

Amcor is a case in point. Its share price has rallied more than 10 per cent since mid-October. The global packaging company is an Australian success story on the international stage. Last year only 5 per cent of its sales came from Australia and New Zealand. Internationally, its sales split is as follows: 34 per cent from Europe; 31 per cent from North America; and 30 per cent in emerging markets.

While the emerging markets exposure gives Amcor a growth profile, its products are mainly defensive and so relatively immune to a weaker business cycle. Most of its revenue comes from packaging for food, beverages and healthcare.

Amcor is no longer cheap, priced at around 19 times fiscal year 2015 earnings forecasts, but markets correct and Amcor's chart is showing early signs that the rally might be losing momentum. If its price starts to peak soon, it will be showing divergence with the RSI momentum indicator (see box below the chart). Price will have made higher peaks while the RSI is making lower peaks. This divergence indicates the kind of falling momentum that can often precede a trend change.

Potential buyers might be hoping for a pull-back towards the top of the old range and 55-day moving average around $11.50. This might not be too much of a stretch. It's only a month since the stock was trading at those levels.

9am - Interesting reads from around the web

Scrub the decks: A short history of ‘barnacle cleaning' metaphors in Australian politics and why it may not work for the Abbott government.

Why the world may one day regret globalisation: Here's how a connected world could one day lead us to ruin.

Surprise! Facebook actually has a 10-year plan: Mark Zuckerberg laid it out in his latest results presentation.

The creative class is not screwed: Six ways the internet helps artists make a living.

Hate billboards and street ads? Move to this French town that just banned all outdoor advertising.