The Ticker: Modern business life

On today's blog:

- Do we have enough roads yet?

- The flipside of P2P hype

- Does money buy happiness? The results are in

- Meet the bank killers: The world's largest peer-to-peer lenders

- One graph on why we can't trust the G20's grand goals

- A turnaround for Treasury Wines?

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

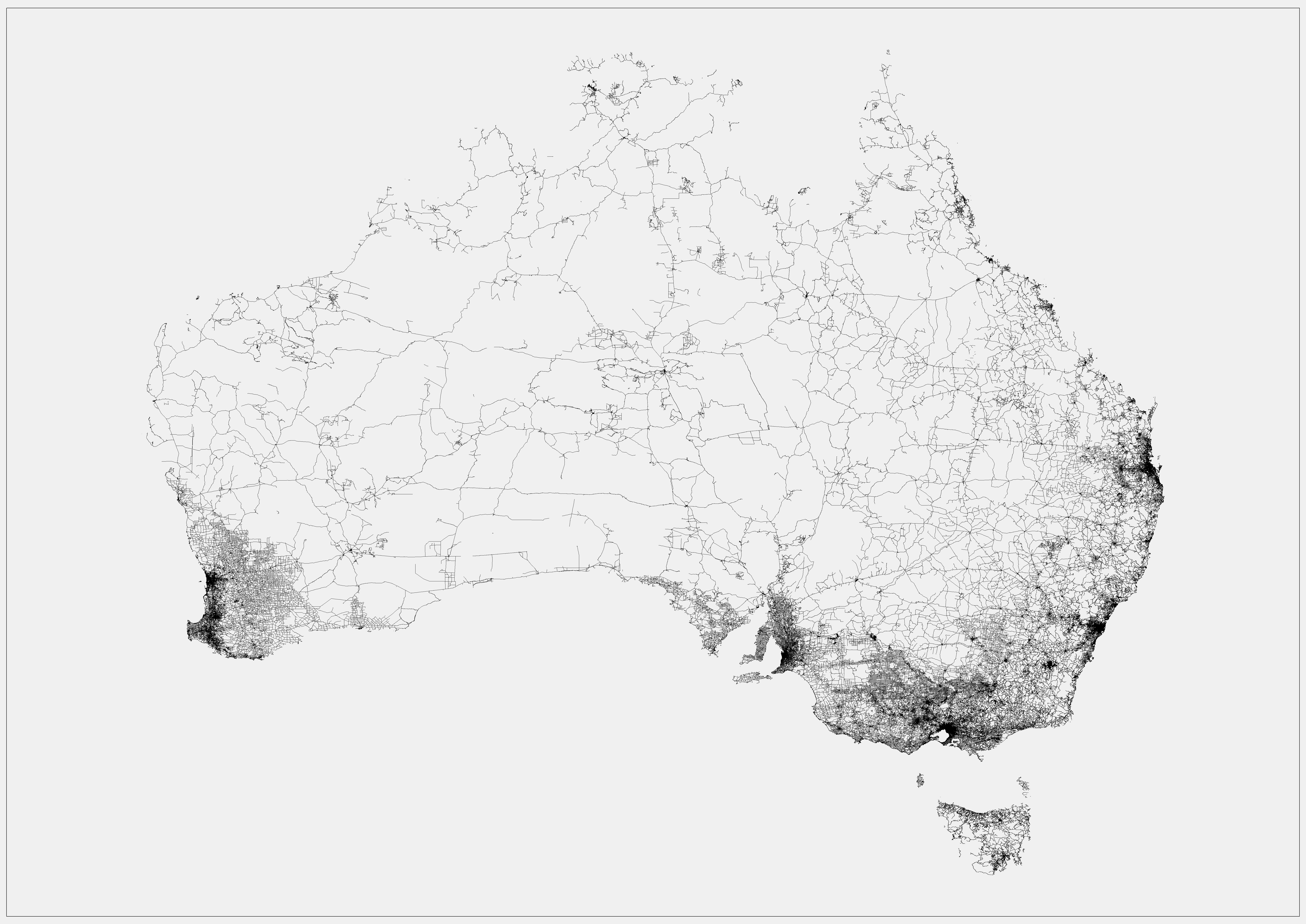

3.20pm - Do we have enough roads yet?

Achieving global growth through large infrastructure projects is set to be a key discussion point at the G20 later this week.

In Australia we've grown accustom to the idea that when politicians talk about infrastructure, they're largely talking about roads. In reality, infrastructure is a much broader topic that ropes includes the maintenance and constructions of hospitals, public transport, utilities and more.

So in anticipation of our impending narrow-minded infrastructure debate, this graphic we found on Reddit -- which only shows roads in Australia -- has us wondering: do we have enough roads yet?

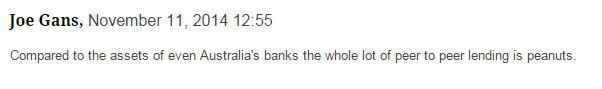

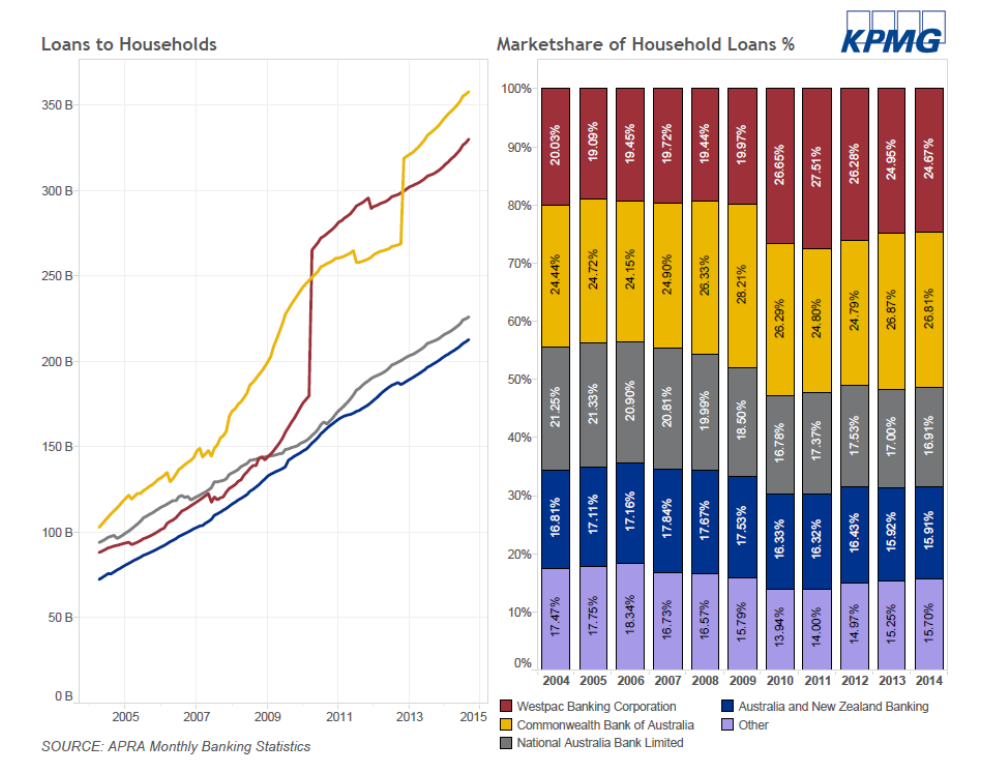

2.10pm - The flipside of P2P hype

One of our commenters posted an interesting reply to our last post on peer-to-peer (P2P) lending:

It's a good counterpoint to P2P lending hype – and, for the moment, it's true.

Our big four banks currently control over 80 per cent of both the business and home lending market. And despite the ongoing rhetoric around the rise of P2P lending, that market share has actually been growing over the past couple of years.

Of course, this could change if P2P takes off in Australia. Though it seems global P2P lending players will face an uphill battle if they choose enter the Australian market.

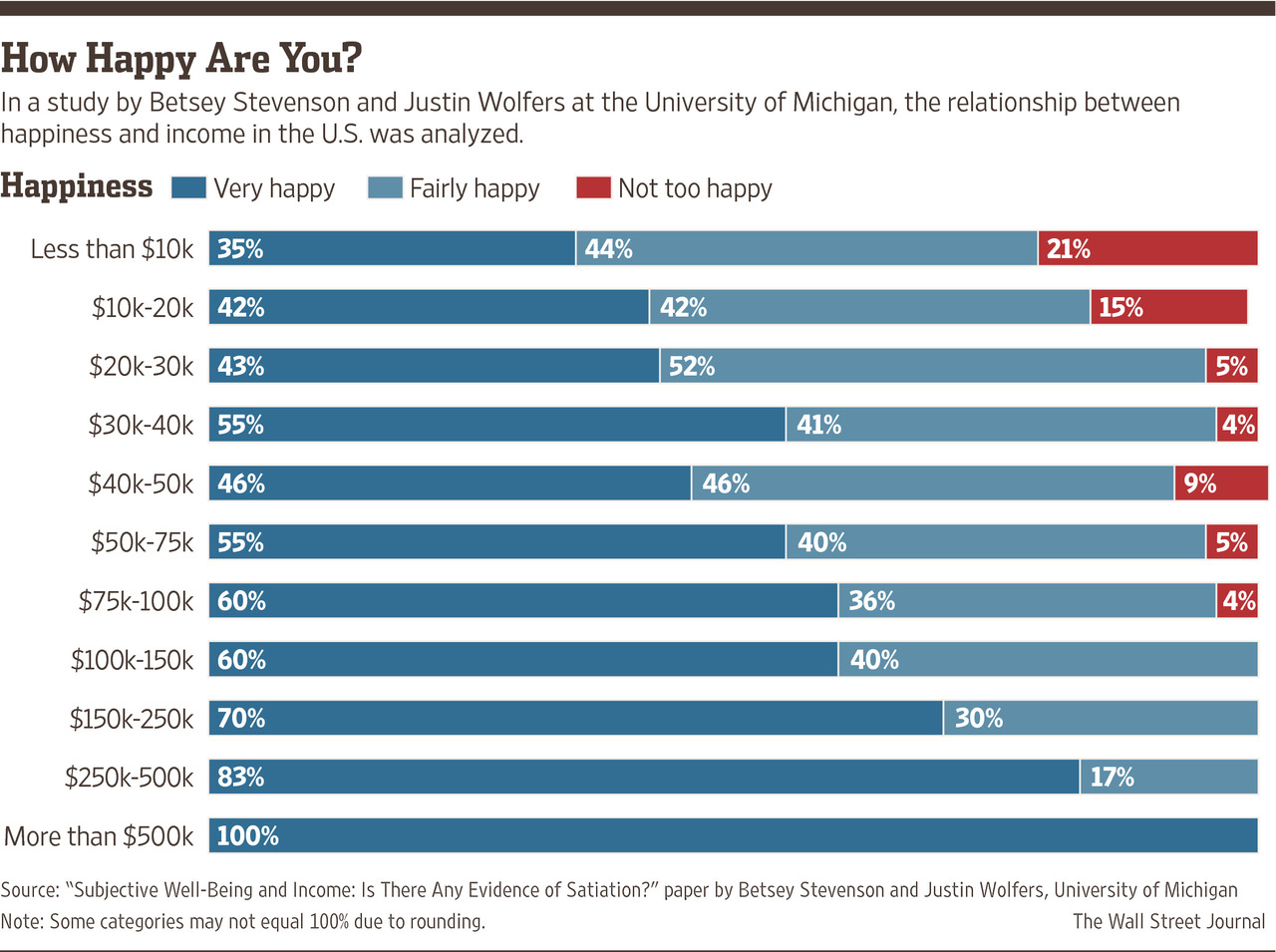

1.30pm - Does money buy happiness? The results are in

By WSJ, BusinessNow

It's an age-old question: Can money buy happiness?

Over the past few years, new research has given us a much deeper understanding of the relationship between what we earn and how we feel.

In short, this latest research suggests, wealth alone doesn't provide any guarantee of a good life. What matters a lot more than a big income is how people spend it. For instance, giving money away makes people a lot happier than lavishing it on themselves. And when they do spend money on themselves, people are a lot happier when they use it for experiences like travel than for material goods.

With that in mind, here's what the latest research says about how people can make smarter use of their dollars and maximise their happiness.

Have a look at the full article here

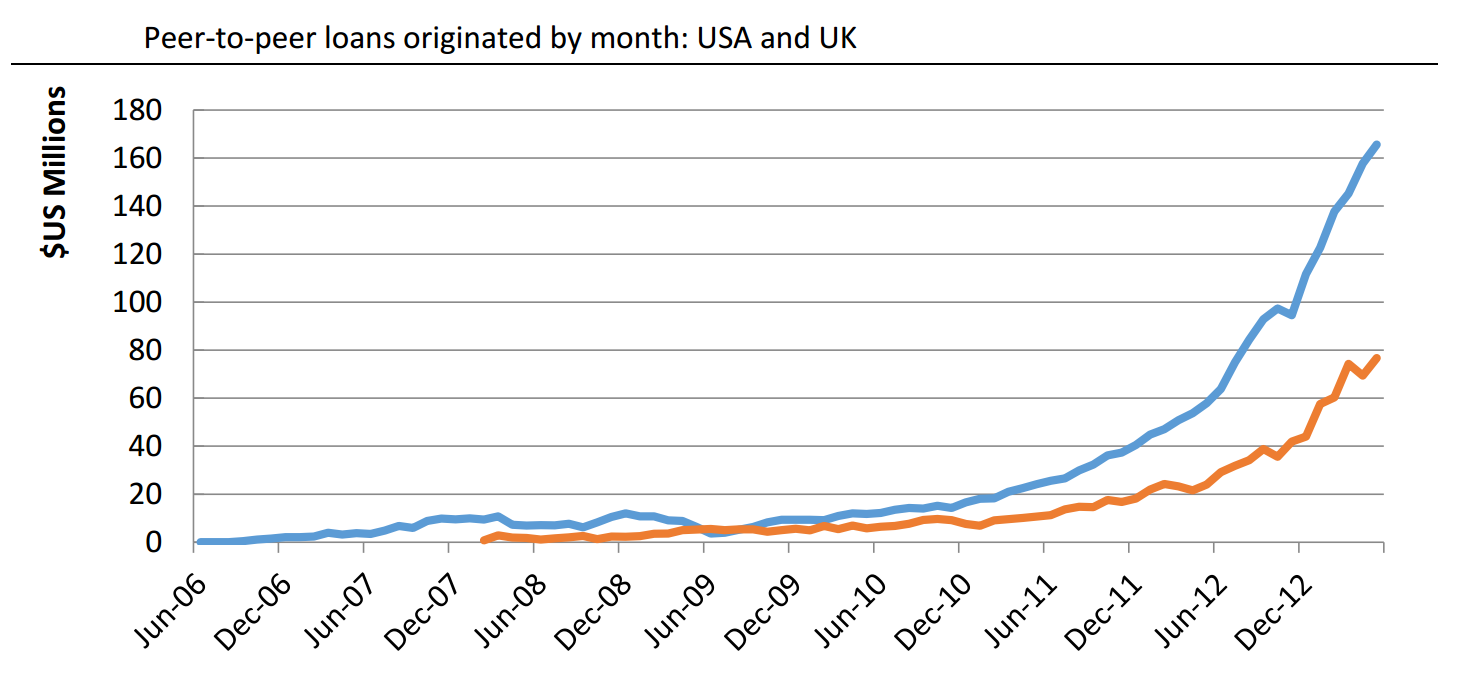

12.30pm - Meet the bank killers: The world's largest peer-to-peer lenders

One of the UK's largest peer-to-peer (P2P) lenders, RateSetter, has just launched in Australia with the aim of shaking up our loans market.

"Australia's financial system is ripe for disruption -- for too long banks have been offering below-par savings and loan deals in the absence of real competition," RateSetter's founder and chief executive Rhydian Lewis said in a statement.

RateSetter is the first global P2P lending vendor to set its sights on Australia. Many more may be set to follow. The International Organisation of Securities Commissions conducted a study (pdf) into the P2P lending landscape earlier this year, here's who they ranked as the world's largest P2P lenders.

The group didn't include Australian P2P lending outfit SocietyOne in its study, saying it is too small to accurately measure. The firm told The Australian Financial Review in March this year that it has issued 200 loans totalling $4 million.

Perhaps this next graph is the main reason why banks and onlookers fear the potential of P2P lending and the impact it could have on the banking sector. Here's how the trend took off in the US and the UK.

10.55am - One graph on why we can't trust the G20's grand goals

Back in 2010, the G20 meeting in Toronto generated more headlines than usual for announcing one of the group's most ambitious goals.

“Advanced economies have committed to fiscal plans that will at least halve deficits by 2013 and stabilise or reduce government debt-to-GDP ratios by 2016,” the group said in its declaration document.

Four years on, this ambitious aim has now transformed into a rolling question around the G20's relevance and the sincerity of their promises. The reason: just one of the G20 countries (Saudi Arabia) managed to reach the 2013 goal, while only four countries (Turkey, Brazil, Saudi Arabia and India) have actually made a dent in reducing government debt-to-GDP ratios between 2010 and 2014.

If 2014's figures are any indication, it's highly likely that the majority of the member countries won't even come close to meeting the 2016 target.

That's not to say that such goals are a waste of time, but there just may be an argument that smaller discussions and forums, such as APEC, yield better results. Perhaps some of the G20's ambitions are simply too broad to succeed.

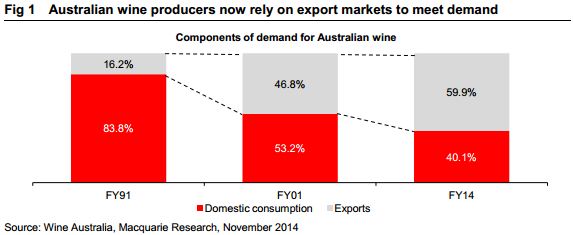

10.40am - A turnaround for Treasury Wines?

By Chris Kohler, BusinessNow

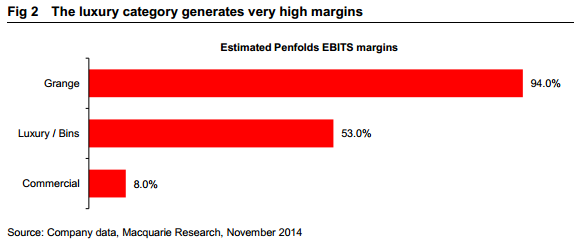

Macquarie has upgraded its view on Treasury Wine Estate to Neutral from Underperform as, it says, luxury wine exports to China have finally bottomed and could heading for growth once again.

“With near-term earnings supported by elevated luxury inventories, a strong Grange release and the cost-out program, we think the company is unlikely to disappoint in F15.”

Figure 1 shows why an improvement in export outlook for TWE makes a significant difference and figure 2 illustrates the difference in margins made out of luxury products like Grange.

In other Treasury Wine news, the company elected to close its underperforming Ryecroft winery yesterday saying “it is simply not sustainable for this to continue.”

9am - Interesting reads from around the web

Everything must go. How Alibaba turned China's singles day into an e-shopping extravaganza.

Joseph Stiglitz on Ebola and inequality. Why the Ebola crisis is a stark reminder of the pitfalls of globalisation.

Lost in the Twittersphere? One year on from listing and it seems the microblogging firm still hasn't found a clear direction for growth.

Red poppy syndrome? Are we forgetting the significance of Remembrance Day?

In praise of oligopoly. How Taylor Swift's stance on Spotify may spoil the music industry.