The Ticker: Modern business life

That's all for today's blog. The Ticker is taking a long weekend and will be back on Wednesday. Be sure to check out Business Spectator's weekend email for this week's best posts. Today's stories are below:

- Highlights from today's Short-Term Markets Outlook Conference

- Trust me, I'm using graphs

- Keeping Australia's young rich list in perspective

- Smiles all round in emerging economies

- One graph on NAB's business banking debacle

- Ebola is trending on social, but for how much longer?

- The World Bank just quietly slammed Australia's investor protection laws

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3.30pm - Highlights from today's Short-Term Markets Outlook Conference

By Chris Kohler, BusinessNow

Here's a list of some of the key points raised during the today's session with communications minister Malcolm Turnbull, Platinum Asset management's Kerr Neilson, and Goldman Sachs Tim Toohey. It was hosted by The Australian's Adam Creighton.

On the US Fed and QE:

Toohey: “You've got to give the Fed some credit – they've done exactly what they set out to do… The US is genuinely past the crisis but the Fed won't be hiking rates until Q3 next year.”

Neilson: is more concerned about what the currencies will make of the Fed's QE halt.

On Australia and growth:

Neilson: “The chance we're going to have strong growth is remote – it's not clear that we're in an inflationary world.”

Toohey: "We're got a really sharp decline in mining investment over the next three, four and five quarters. And that's going to be very disruptive… And there's hardly a lot of employment growth vs. population growth."

On the Murray inquiry and the banking sector:

Neilson: “It is remarkable how profitable they are – they're not very grateful for their privileged position… Why should banks earn such high ROEs when they have these fall backs?”

Read more on The Australian's BusinessNow blog

2.40pm - Trust me, I'm using graphs

Struggling to find credibility for your claims? Then it's time to learn how to create graphs.

A new study out of Cornell University in the US has found that the average person is more likely to trust a claim if they see it presented to them in a graph.

“If a claim ‘looks and smells' scientific, a person may be inclined to believe it,” the study found.

“In other words, communications may be made more convincing without any alteration in content, simply by virtue of being presented with elements associated with science.”

The study revolved around the use of data visualisations to argue the merits of various medications, but you could easily extrapolate its finding to a raft of other areas such as journalism or business. Graphs are growing in popularity on the web due to their ability to communicate complex terms simply, and their ability to be easily shared across social networks.

The real lesson behind this research is that the average reader needs to learn to scrutinise data and the conclusions that they can draw from it as they would with anything else.

But don't worry, you can trust The Ticker. After all, we use plenty of graphs.

You can read the full study paper here.

2.10pm - Keeping Australia's young rich list in perspective

Congratulations to all of the entrepreneurs who made it onto BRW's young rich list. It's quite a feat.

But to put this year's list in perspective, we graphed it against Forbes' US billionaires list. It seems it's one thing to find success in Australia, and another to strike it rich in the US.

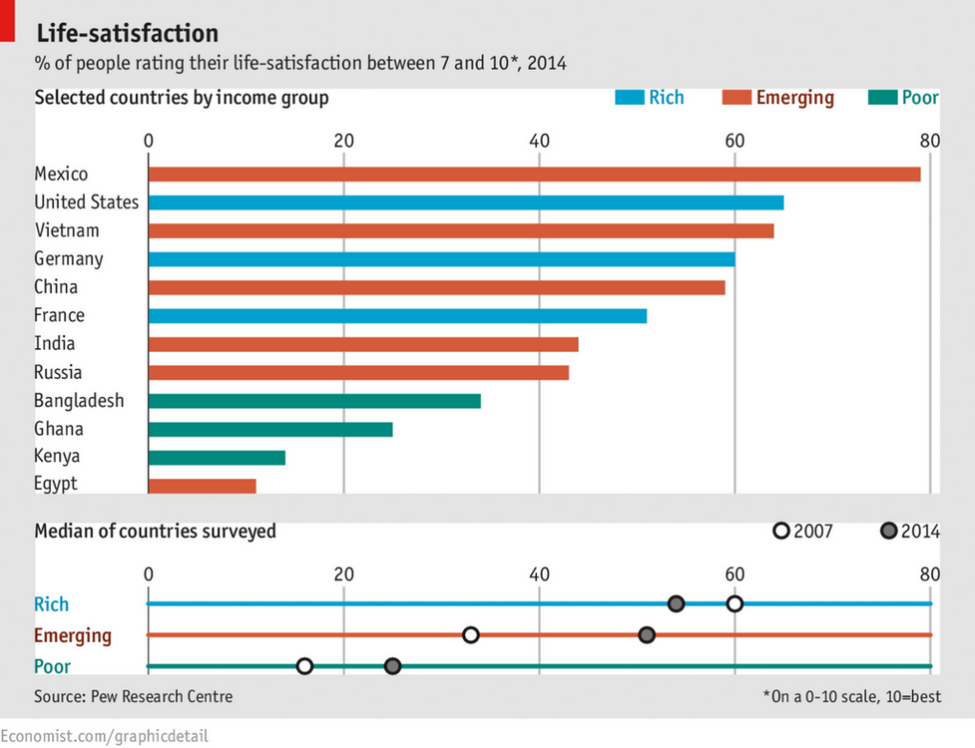

12.10pm - Smiles all round in emerging economies

By Chris Kohler, BusinessNow

Rate your ‘life satisfaction' on a scale of one to 10. Not an easy thing to do – it doesn't seem possible to have a more broad assessment of your life – but have a go anyway.

If you think you score anywhere below seven, you should look to some surprisingly chuffed countries for a reality check.

You probably wouldn't expect countries like Mexico and Vietnam to outrank Germany and France in the happiness/satisfaction index – but that's what's going on, according to The Economist's story on recent Pew research - emerging countries are just as happy as rich ones.

I guess rich people are just harder to please.

Have a look at the full story on The Economist.

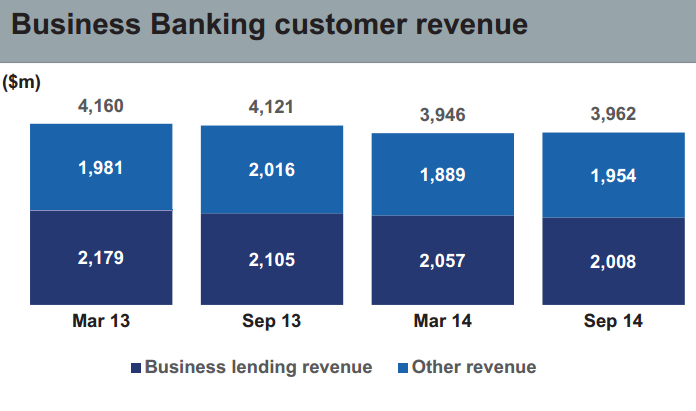

12pm - One graph on NAB's business banking debacle

So far, the media focus on National Australia Bank's annual results has been about the looming sale of its UK arm. But there are deeper problems afoot: its business banking division is also trending backwards. So, how is the bank going to fix this? Here's an excerpt from today's KGB interview with Andrew Thorburn.

Robert Gottliebsen: Andrew, going back to Australia and looking at your core business of business lending, in the smaller business sector you're being killed on market share, particularly the one to five million turnover area, which is core for your business. What on earth is going wrong?

Andrew Thornburn: So Bob, you're right. If you look at that graph, we are holding market share in a couple of important segments, but we're under a lot of pressure and we have been losing share in others. However, if you also look at where two thirds of our revenue is, in what you might call SME, then we are seeing growth in that. This half we're seeing revenue growth of 2.8 per cent compared with to the previous half. Where we're really under pressure on revenue is in corporate and property and institutional lending where margins are really under pressure and you can see the revenue growth there is negative.

So, I think we still have a good business in this SME heartland. You know, it's the NAB, long-standing NAB position, and we still have the number one business bank there, although it's under threat and has been because competitors have targeted us. We have had some de-risking of our book. If you look at the asset quality, it's better than it's ever been.

And I do think, I'm acknowledging that we've taken bankers out. We've introduced a new service and fulfilment model that hasn't worked yet. We're going to fix that. So, we're putting more people back in the front line and we're fixing a number of things which I think, Bob, will help not just stabilise the business, but set us up for some growth in the future.

You can read and watch the full interview here.

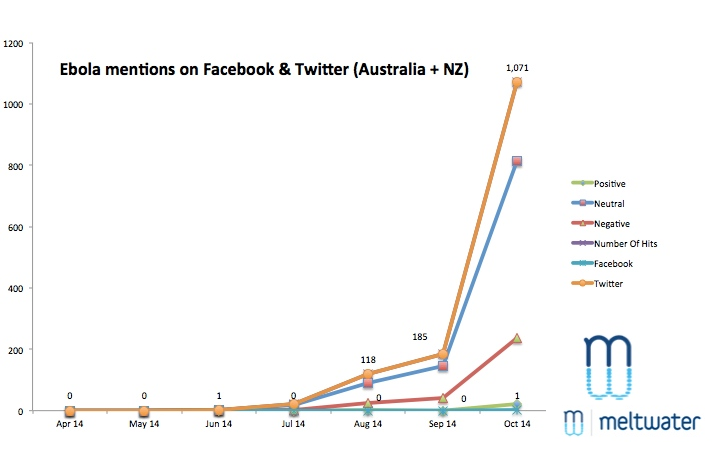

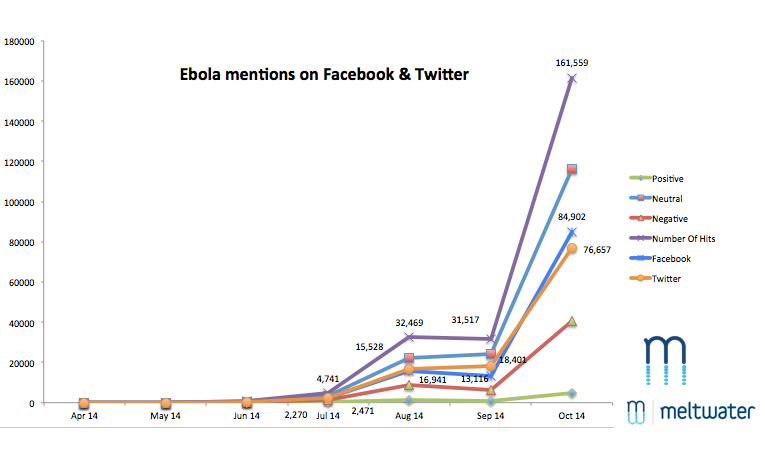

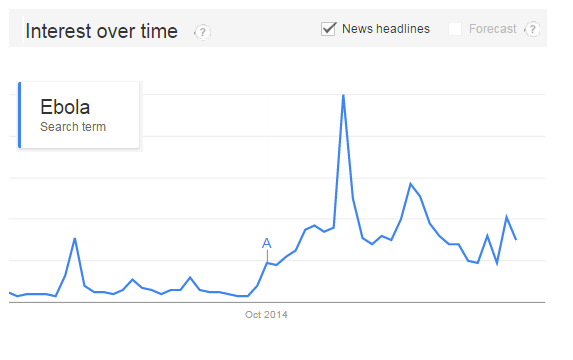

11.45am - Ebola is trending on social, but for how much longer?

It's official: Ebola has gone viral in Australia. But don't panic. We're only talking about social media.

New data from media monitoring firm Meltwater shows that mentions of Ebola in Australia on social media have grown by over 500 per cent in the past month.

The findings are in line with the firm's global analysis of the chatter about Ebola on social.

But a more nuanced look at the data on Twitter shows that interest in Ebola has actually waned over time. Spikes in Tweets are also closely tied to headlines on the matter.

Google searches in Australia are also down since spiking on October 9.

So, could Australia's Ebola panic soon be coming to an end? We'll have to wait until the next patient scare to know for sure.

10.20am - The World Bank just quietly slammed Australia's investor protection laws

First, the good news: The World Bank recently ranked Australia as the 10th best country in the world for conducting business. But don't pull out the party poppers just yet.

Hidden in the ranking lies another curious data point: We ranked 70th for our laws surrounding the protection of minority investors.

Shareholder rights hit the headlines earlier this month after the government announced it would scrap the 100 member rule, which forces companies to hold a general meeting at the request of a 100 or more minority shareholders.

Reducing shareholder rights can also have a flow-on effect to the wider economy. As the World Bank notes in its Doing Business report:

“For entrepreneurs seeking to develop or expand a business, access to external financing is a crucial concern. Stronger legal protection of minority investors increases the confidence of investors in markets, making them more likely to invest.”

“Econometric research shows that investors' willingness to provide entrepreneurs with equity capital is a significant factor in the development of financial markets, which in turn promotes economic development.”

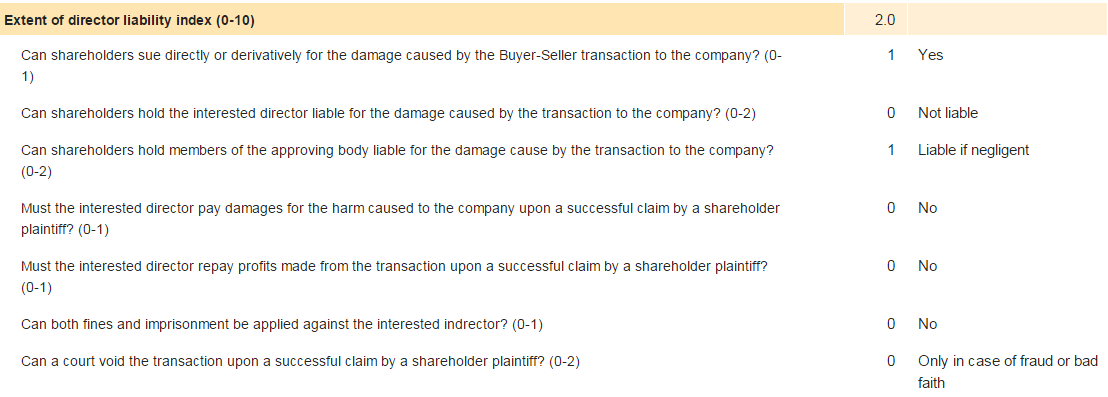

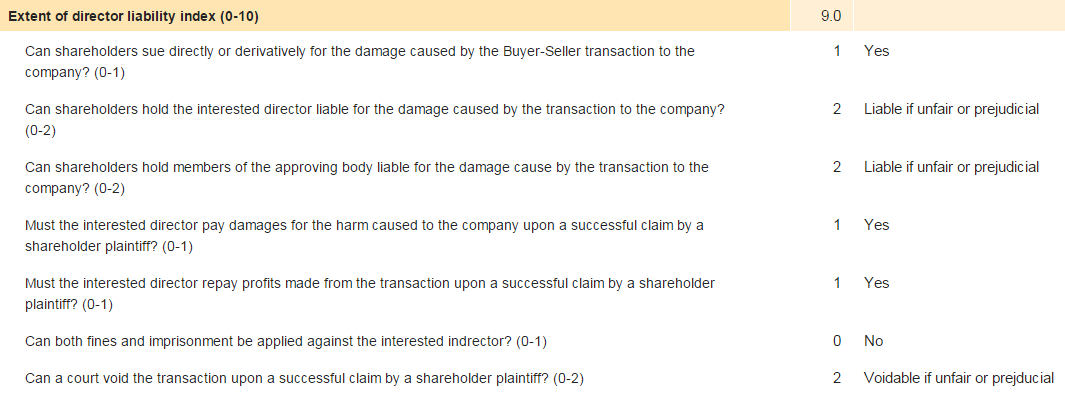

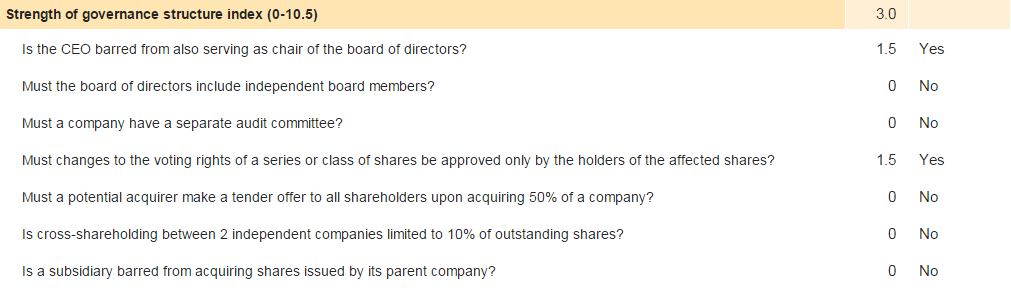

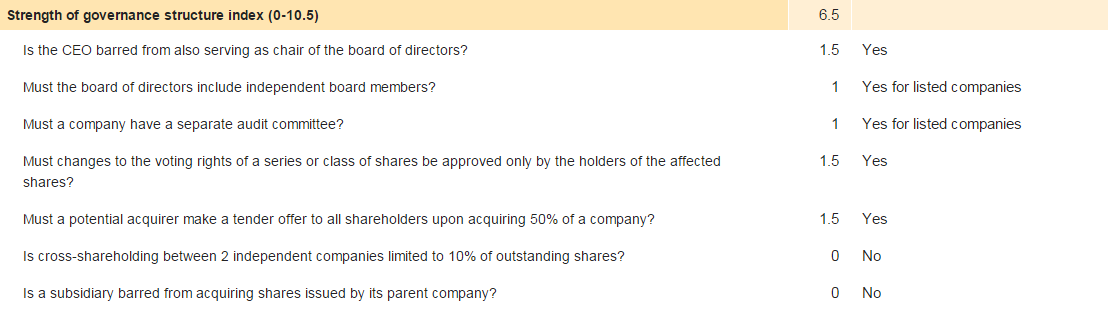

So why did Australia receive such a dismal rating? Well, according to Jonathan Kirkby, a senior operations officer at the International Finance Corporation, we performed very poorly in two key criteria: director liability and governance structure.

Here's how we rated in both criteria. For comparisons sake, we also included New Zealand's scores, as our Tasman neighbours ranked as the best country in the world for protecting minority investors.

Director liability

Australia

New Zealand

Corporate governance structure

Australia

New Zealand

It is worth keeping in mind that this is just one assessment of Australia's shareholder laws. Director of the Key University Research Centre for Corporate Governance at the University of Technology, Sydney, Thomas Clarke, says that the country ranks quite favourably in the IMF and OECD's studies on global corporate governance.

9am - Interesting reads from around the web

The truth behind ‘innovation'. A captivating read on how some of the boldest and most revolutionary ideas come about.

This is your brain; this is your brain enjoying storytelling. A psychological explanation on why we all love a good story.

A primer on Coke's new drink, Coke Life. Simply put: The can is green to make you think it's healthier.

The Antares explosion: confronting the inevitable risks of space travel. An important issue as we head into the era of space tourism.

Why the end of US quantitative easing is good news for Australia and the share market. It's all about economic rebalancing.

In bad taste? A Dallas man thought it would be a good idea to dress up his home up as an Ebola treatment centre for Halloween. A picture of the house is below. Happy Halloween -- for those in Australia celebrating it.

made some new banners that will be up tomorrow! #EbolaHouse pic.twitter.com/UDDH48KHsK

— Ebola House (@EbolaHouse) October 26, 2014