The Ticker: Modern business life

On today's blog:

- Why educate when it's so much easier to scare?

- Glenn Stevens is not the RBA's longest speaker

- The all-important Yammering Index is finally falling

- Ludlam: The metadata debate goes way beyond National Security

- Aussie dollar sinks on Fed statement

- Some hilarious examples on why Australia has a red tape problem

- A theory on why Medibank's share price could double in five years

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3.10pm - Why educate when it's so much easier to scare?

A primer on Australian politics from Tristan Edis' piece earlier this week:

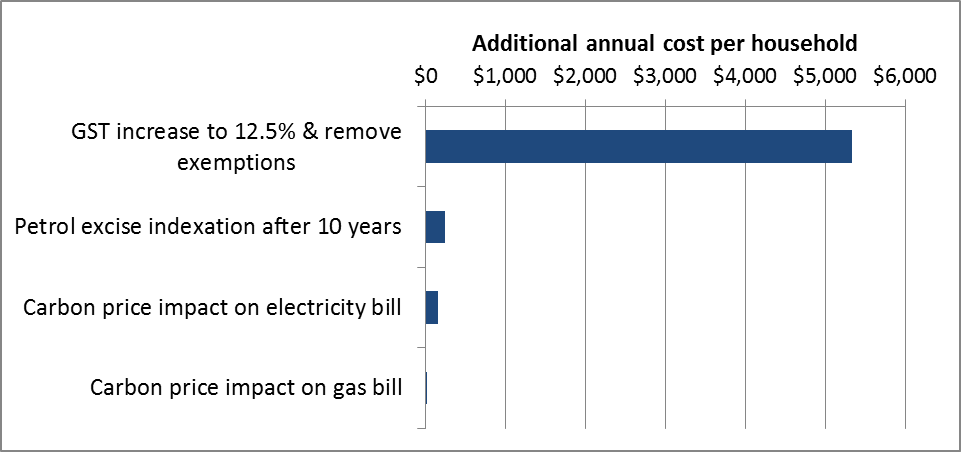

Essentially what Abbott is suggesting we should do with the GST, and what he has just done with indexing the excise tax on petrol to inflation, each represent a bigger hit to the average household budget than the "great big electricity tax", as he and his offsider Greg Hunt termed the carbon price.

In addition the impact of the carbon price was offset by changes in income tax scales and increases to pensions and other government payments, just like what we could do with the GST. Abbott has shown, perhaps better than any other politician in Australian history, how choosing the route of the scare campaign is so much easier than ‘mature' policy debate.

Figure: Increased annual cost to households from carbon price, indexation of petrol excise and increase of GST to 12.5 per cent

Sources: Federal Government Treasury estimates increase of GST to 12.5% and removal of exemptions would cost the average two-income family with 2 children $205 per fortnight. Petrol excise cost impact is based on effect of indexation after ten years based on ABS data about passenger vehicle fuel consumption and assuming 2.5% annual inflation. Carbon price impact on electricity bill based on Australian Energy Market Commission analysis and assuming average household electricity consumption of 6000 kilowatt-hours. Gas bill impacts based on Government carbon intensity estimates and Bureau of Resources and Energy Economics data on total household gas consumption.

Read the rest of the story here.

2.10pm - Glenn Stevens is not the RBA's longest speaker

You're off the hook, Glen. Image: AAP

In response to the WSJ's yammering index, we decided to do its own word count expose. We turned to the RBA and yammering of its senior officials, who kindly post the transcripts of most of their talks online.

We stuck to transcribed speeches made in 2014, and pulled an average from the word count five most recent speeches. We also excluded addresses to parliament and inquiries. Due to a lack of talks from Luci Ellis, Guy Debelle and Christopher Kent this year, we could only pull their four most recent speeches. We also edited out sub-headings and chart mentions to level the playing field. Some at the RBA are more graphically oriented than other. Here's what we found:

So, as we gave away in the headline, Glenn Stevens is not the longest speaker. In fact, going by word count, Luci Ellis gave the longest average RBA speech in 2014. But you can't blame her: financial stability is quite complex. At least she tries to brighten up her talks by inserting graphics.

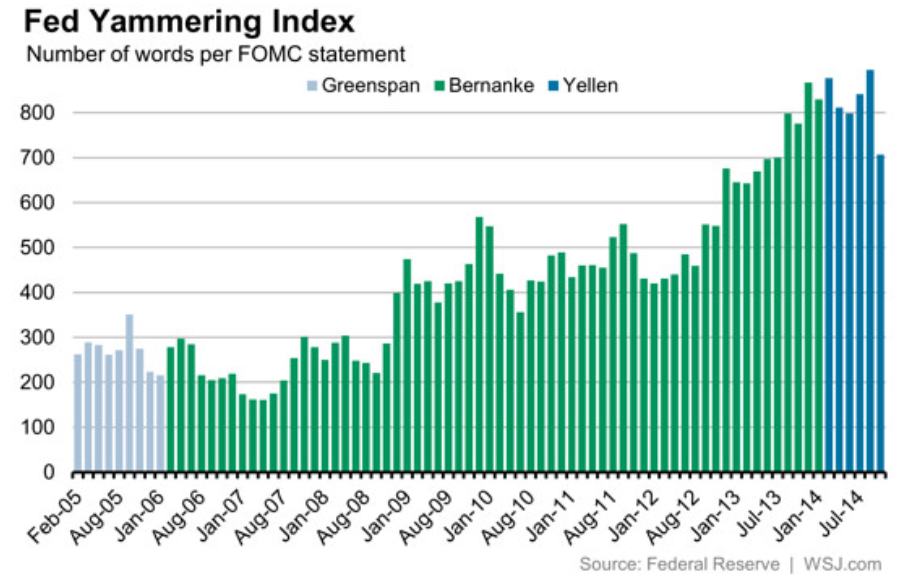

1.30pm - The all-important Yammering Index is finally falling

By WSJ, BusinessNow

The end of QE3 may signal a watershed moment in Federal Reserve communications: The Federal Open Market Committee's statement is finally getting shorter. Today's 707-word statement was the shortest in more than a year, and 188 words shorter than the statement in September.

So, forget the content of speeches… the number of words used will tell you everything you need to know about the economy. Maybe not.

Read more at the WSJ

11.45am - Ludlam: The metadata debate goes way beyond National Security

Here's an excerpt of an interview our reporter David Swan conducted with the Green's spokesman on the metadata issue, Scott Ludlam. You can read the full transcript here.

DS: This stuff has reared its head around the same time as this piracy stuff from the government. Do you feel they're linked?

SL: The government would never admit this, but I think the very fact that they want service providers to track and store data volumes, tells me that maybe part of what's driving this is that whole copyright or anti-piracy agenda, where they want to know who's hitting BitTorrent sites and how much they're bringing down, so that they can force service providers to choke the internet or potentially knock them offline. I think there's a number of different agendas, including that one, that are kind of piggybacking along under this cloak of national security. But actually it's got nothing to do with it.

DS: What is the actual agenda, if it's not national security?

SL: I don't think there's any doubt it's been driven in part by the Attorney-General's office, and by some of the agencies who have given evidence to our enquiry into this issue, that there are entirely legitimate law enforcement and anti-corruption uses for metadata, and no-one really contests that. My argument is the legal framework for protecting privacy while permitting access is really deeply out of balance and flawed.

I think that's partly what's driving it, and that's from the agencies' point of view, but from the government's point of view you've got George Brandis and Tony Abbott prosecuting really steep and expensive regulation of technology that they barely understand. I think that's partly just a desire to stand up and look as though they're doing something tough. It's just a desire to look as though they're strong and tough on national security, but actually they're quite illiterate as to the basic technology itself.

DS: Do you have a definition of metadata yourself?

SL: No, we're calling on the government to define it. At the moment we've got two working definitions; one is a negative definition which is just 'everything except content', and the other is a more formal definition that the Attorney-General's department uses as a rule of thumb. This formal definition breaks metadata into two categories, of material that identifies participants to a communication, so basically subscriber data, and then material that allows communication to occur. So maybe cell tower triangulation, and the metadata that's created in the process of the triangulation or the communication taking place.

We've been relying on that working definition, but of course that's nowhere near precise enough to give to a service provider and say 'we want you to store all of this stuff', which is partly why the industry's costs are so high.

Read the full transcript here.

11.25am - Aussie dollar sinks on Fed statement

By Daniel Palmer and Chris Kohler, BusinessNow

The Australian dollar slumped a full US cent on the back of the Fed's statement announcing the end of QE, making it one of the worst nights for the currency this month.

Over the past 24 hours, the Australian dollar has seen a high of $US89.13c and a low of $US87.76c, with both extreme points reached after the close of local trade.

This graph shows how significant the Fed statement was to the Aussie dollar.

The fall is mirrored by US dollar gains.

11.05pm - Some hilarious examples on why Australia has a red tape problem

Australian businesses don't need government to wrap them in red tape and regulations; they are just as good at doing it themselves. That's just one of the conclusions for Deloittle's latest report into red tape and internal company rules in Australia. Here are some interesting examples the consulting firm uncovered in its research:

- A company that uses weekly executive team meetings to approve small taxi fares.

- A firm rejects application forms from potential customers if they are completed in blue ink.

- A business insists its engineers sign off on new parts at a fixed location, making them walk up to 15 kilometres a day around the workplace.

- A company asks its say receptionists must record every coffee made for a guest or letter received, but can order as much alcohol as they like.

- A company created a 200-step handover process to reduce the potential for overrun projects. It instead blew-out project time, as it took up to 270 days to get ‘approval for approval'.

- The firm that insisted staff complete an ergonomic checklist and declaration when they moved desks, then introduced ‘hot desking' such that everyone spends 20 minutes a day filling out forms.

9.50am - A theory on why Medibank's share price could double in five years

By now, we've all read our fair share of Medibank speculation. However, amid the torrent of free advice going around at the moment, this note from firm 100Doors caught our eye.

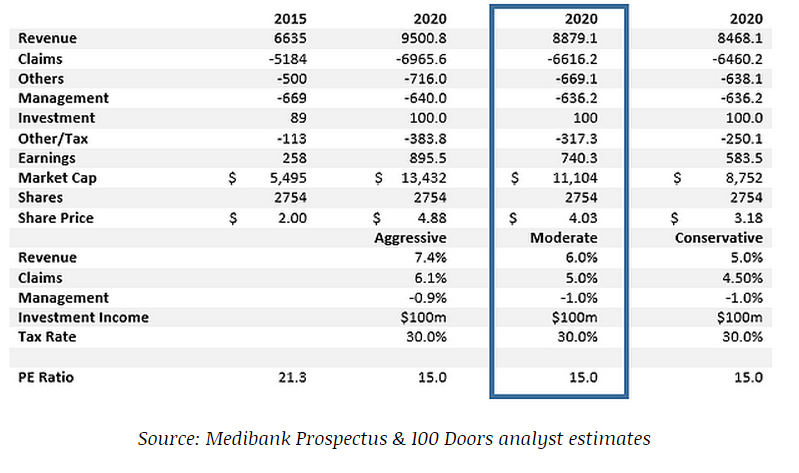

The group claims that under a certain set of justifiable conditions, Medibank's considered $2-per-share stock price could double to $4-per-share by 2020. The chart below captures the crux of their calculations.

There are a few assumptions that we would be remiss not to mention. For starters, 100Doors believes Medibank will see 6 per cent annual revenue growth, which they say is a “comfortable” assumption given the health insurance industry as a whole has seen much higher growth of 8.1 per cent per year over the past five years.

Meanwhile, it also assumes claim costs rise by 5 per cent over the same period. In the past three years, Medibank claims costs have come in at around 6.1 per cent, but 100Doors believes Medibank will be able to negotiate better rates with hospitals as a private entity.

As for its controversial investment revenue, the group attempted to normalise the impact of this by keeping it at $100 million per year. The estimate also excludes buybacks and share dilutions and also assumes that corporate tax rate will remain at 30 per cent.

We'll keep an eye out for the next note from 100Doors, which looks to be an interesting read as it will consider the impacts of health outbreaks -- like Ebola -- on Medibank's business.

You can read the full note here.

Also, be sure to check out the rest of our Medibank IPO coverage:

- The truth behind the Medibank hype

- The risk of banking on Medibank

- Medibank investors must read the fine print

8.50am - Interesting reads from around the web

The US Fed just announced an end to quantitative easing. Here's what that means and what it did in seven charts.

Investing in Medibank? Here's ten points to consider before sinking your money into the health insurance firm.

Here's a map of Australia's unemployment hotspots. It pretty much proves the fact that Tasmania is in trouble.

Time to put some thought into your Christmas presents. A new study shows that demand for vouchers is on the decline.

There's one thing that's worse than the prospect of no privacy on the internet: Fake, malfunctioning “privacy” apps.

The future of fraud? It will move beyond credit card skimming and onto targeting enterprises and economies.

Everything you need to know about China's currency the renmibi -- in interactive charts.