The Ticker: Modern business life

On today's blog:

- The major roadblock holding back negative gearing reform

- Our neighbours don't see Australia as the land of opportunity

- CPI beats expectations in September quarter

- Three reasons why Woolworths won't sell BIG W

- A clarification from the Attorney General on metadata disclosures

- The next threat to Medibank: comparison websites

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3pm - The major roadblock holding back negative gearing reform

An interesting commentary piece by Fairfax's Gareth Hutchens on why we should abolish negative gearing has once again reignited the debate around this controversial tax policy.

It's an interesting read, which also ties in the idea of using superannuation to buy property. We couldn't help but take note of this comment tied to the article.

The figures aren't spot on, but the commenter has a point. Our economics editor Callam Pickering picked up on this research earlier this year, but given the ongoing nature of the debate, we thought it would be worth revisiting.

Here's what Lindsay David, Paul Egan and Philip Soos wrote about political ownership of property from earlier this year:

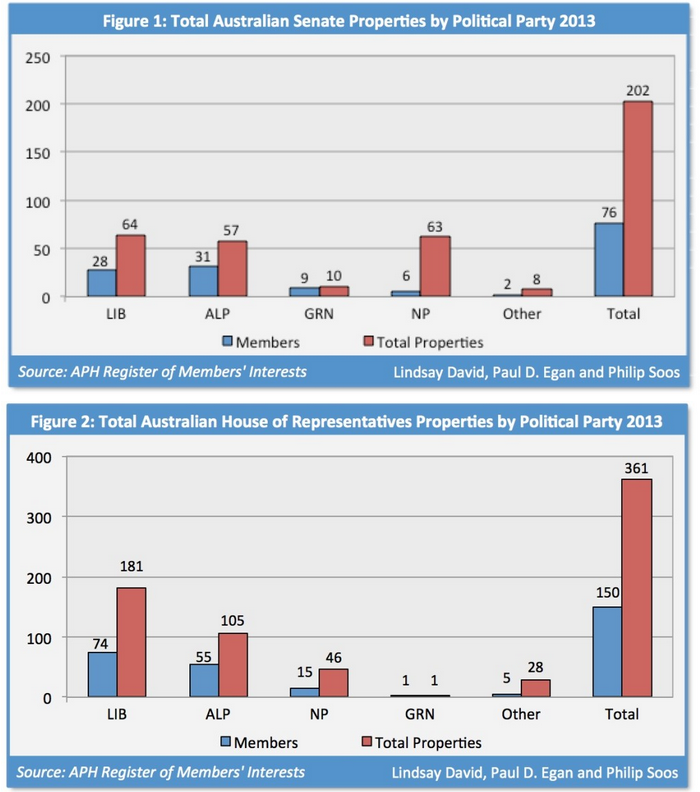

Australia's federal political class own an enormous property portfolio, with only 13 of the 226 members (6 per cent) not holding any real estate. In the Senate, 76 members own a total of 202 properties – 2.7 properties per Senator – estimated to be worth around $107 million.

Further, 91 per cent of all Senators own real estate (57 per cent investment/commercial property/vacant land, 41 per cent owner-occupied and 2 per cent recreational), 75 per cent have a mortgage, and the top ten control a colossal 95 properties.

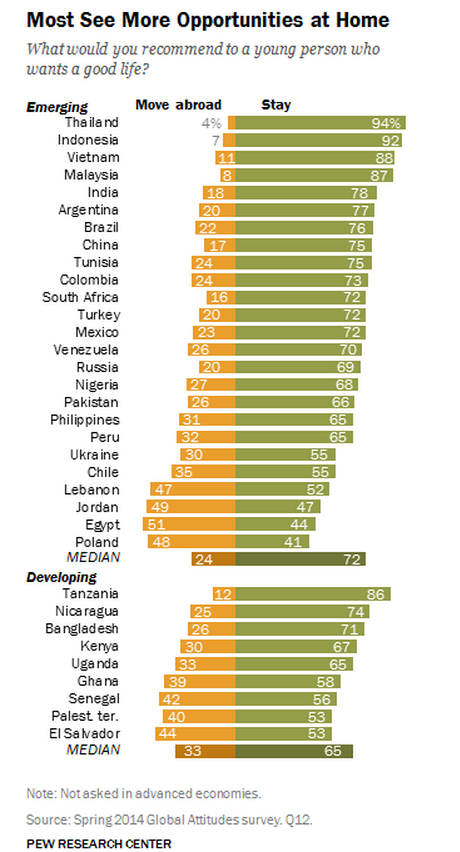

1.30pm - Our neighbours don't see Australia as the land of opportunity

Here's an interesting graph from the Pew Research Centre's recent global survey into inequality and opportunity. You can see the full study here.

12pm - CPI beats expectations in September quarter

By Chris Kohler, BuisnessNow

The ABS Consumer Price Index showed a 0.5 per cent lift in the September quarter, slightly higher than the expected 0.4 per cent rise.

The year-on-year figure showed a 2.3 per cent rise – hitting expectations on the head.

The trimmed mean gauge of core prices, however, rose 0.4 per cent from last quarter, compared with the median forecast of for a 0.5 per cent gain.

The Australian dollar temporarily slipped on the release but regained ground and is back at the $US87.8 cent mark. Traders may have been betting the figures would see the RBA leave at a record-low 2.5 per cent for an extended period.

I don't know why you'd sell #AUDUSD on that CPI release...unless of course you just want to sell it :)

— Greg McKenna (@gregorymckenna) October 22, 2014Core CPI much weaker than expected, now smack-bang in the centre of the RBA's target band. The door for additional easing is ajar #ausbiz

— David Scutt (@David_Scutt) October 22, 2014Here's what our economics editor, Callam Pickering, had to say about the figures.

Pretty sure RBA will ignore CPI weakness due to one-off factors (carbon tax) but another weak result in January will result in a rate cut

— Callam Pickering (@CallamPickering) October 22, 2014

11.45am - Three reasons why Woolworths won't sell BIG W

Woolworths has moved to hose down reports that it's looking at offloading its ailing retail chain Big W.

"Woolworths has no plans to sell BIG W, and notes that this market rumour is incorrect,” it said in an ASX statement.

The company emphasised that its general merchandise division, which includes Big W and NZ online retailer EziBuy, is key to its growth strategy.

Here's some context to that statement:

- Big W only just launched its revamped online retail strategy

Woolworths bought NZ online platform Ezibuy last year, and only just revamped Big W's website a couple of months ago.

- The retailer also just installed a new leadership team

From Big W's annual report:

"We introduced a new BIG W senior leadership team, including a new Managing Director and heads of Merchandise & Buying, Marketing, Finance and Human Resources."

"FY15 will be a year of significant change under the new leadership of Alistair McGeorge. Alistair brings extensive international general merchandise experience and will continue to develop the strategy whilst also bringing a strong focus on execution."

- Woolworths is looking for a Kmart-style turnaround with Big W

Given the new leadership team, Big W is likely looking to follow in Kmart's footsteps by streamlining its merchandising and pricing strategy. Here's what happened when Kmart Australia CEO Guy Russo, who started back in 2008, cut down the retailer's range, focused on prices and strengthened its supply chains.

10.30am - A clarification from the Attorney General on metadata disclosures

After yesterday's blog post, and a resulting discussion on Twitter, The Ticker reached out to Australian Media Communication's Authority to confirm exactly why two different government agencies were reporting two very different figures agency metadata use in Australia.

That request was then directed to the Attorney General's office who offered this reply:

"There is no conflict between the AGD and ACMA reports. The TIA Act annual report includes the authorisations made by agencies to access non-content information. The ACMA report includes the number of resulting disclosures made by industry. There is not a one-to-one relationship between authorisations and disclosures."

"For example, a senior officer within an enforcement agency may authorise the disclosure of information from a carrier. If the carrier has multiple pieces of information relating to that request, the carrier will report the number of “disclosures” made. The ACMA report will include the larger figure of disclosures from industry; the AGD report will include the smaller number of authorisations from agencies."

So, in layman's terms, the number of requests for metadata from the telcos by government agencies is on the rise. But, the amount of disclosures from the industry to government has remained somewhat stable.

9.30am - The next threat to Medibank: comparison websites

Medibank Private's risky share portfolio has already raised concerns among prospective investors. And now analysts are pulling at another thread of its business: customer acquisition.

Following an interview with Mathias Cormann on the ABC's The Business earlier this week, Forager's Steve Johnston posted this blog about the risks Medibank faces in growing its customer base.

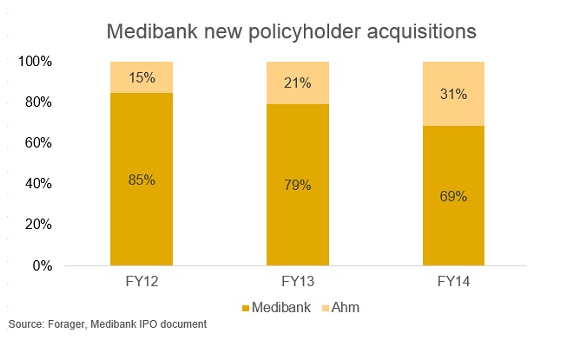

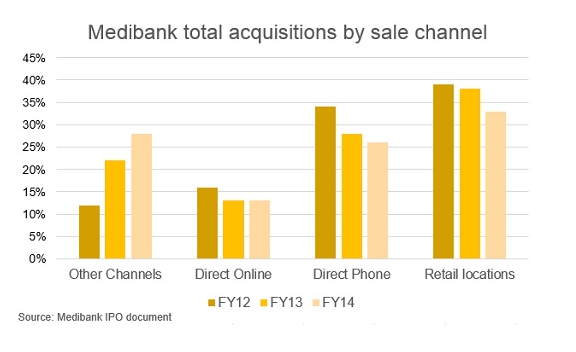

Jumping off a couple of graphs from the Medibank prospectus, he argues that the majority of Medibank's growth is coming from its discount insurance business ahm and that this is primarily being driven by the rise of comparison websites like iSelect and comparethemarket.

“I'd be willing to bet it that almost all ahm customers are coming through these comparison sites. Ahm's growth is replicated in the growth of ‘other' as a Medibank sales channel, which grew from 12 per cent of Medibank's total acquisitions to 28 per cent over the same period,” Johnson wrote.

Johnson adds:

“I don't want to overplay the threat to Medibank's business. It's not a big enough issue to give the float a miss – on the merits of the IPO I don't have a strong view either way. But it's more of an issue than Cormann is letting on. Comparison websites are stealing market share at a rapid rate. They increase price competition and increase churn rates (Medibank's churn rate is up 16 per cent over the last two years).”

“That can't be good for industry profitability.”

As for Cormann's reply, here's an excerpt of what he said when the point was raised by The Business:

“I was a senior executive in a private health fund in Western Australia over ten years ago, and we were dealing with those comparison websites then. I don't agree with the proposition that this is a new phenomenon. This is a phenomenon that has actually been in place in private health insurance for some time.”

“Private Health insurance in Australia is a well-functioning, very competitive well regulated market.”

“In the context of the aging population, timely and affordable access to healthcare will continue to become more and more important.”

9am - Interesting reads from around the web

We hope you are enjoying The Ticker. If you're keen to write in or suggest posts for the blog, feel free to get in touch via the details at the top of the blog. Otherwise, here is today's reading list:

A couple of weeks ago it was revealed that Oracle's founder Larry Ellison bought a Hawaiian island. Here's a virtual tour.

Another timeline of the Ebola crisis. This time though, it's charting the outbreak through company quotes.

Time to channel Fox News? This former investor thinks Network Ten can only be restored through a right-wing revolution.

Augmented reality 2.0. Google is backing a US start-up that is looking to turn digital dreams into a visual reality. The question on everyone's lips: how?

When simply driving a fast car isn't enough. A list of the 10 most obnoxious car features.

Now, you too can play drug lord. Toys-R-Us has started stocking toy figures of the characters from Breaking Bad.