The state of play after WA

The theme of the last 30 days – much like the last 12 months – has been politics, with market focus squarely on the Western Australia Senate election re-run on April 5 and the implications for the balance of power in the new Senate from July 1.

After a long lead time, the WA election result was a repeat of the initial outcome in September 2013. With 76 per cent of the vote counted (as of April 14), a 4-2 return in favour of the right-wing bloc (3 Liberal, 1 Palmer United Party, 1 ALP, 1 Green) is now all but assured, resulting in the government requiring six of eight crossbench votes to gain a majority in the Senate from July 1.

Despite a stronger showing from the Greens, which recorded a 9 per cent swing in its favour, primary support for the ALP slumped to just 21 per cent, well short of two quotas (28.6 per cent), with the left bloc subsequently unable to pick up an additional seat as had been widely anticipated. While the Greens will be encouraged by the result, the outcome is not good for the left bloc in the Senate, which now finds itself three votes shy of obtaining a blocking power (38 votes) – likely to be a tough ask.

Acting in an alliance with the Australian Motoring Enthusiasts, the Palmer United Party will control four seats in the Senate from July 1, meaning it will hold a de facto blocking power on all legislation, with the government requiring the support of an additional two crossbench votes to pass legislation, from a group encompassing Nick Xenophon, David Leyonhjelm (Liberal Democratic Party), Bob Day (Family First), and John Madigan (Democratic Labor Party).

While all except Senator Xenophon are largely right-leaning, each brings their own unique agenda to the negotiating table, with two social conservatives (Family First and the DLP), a free market libertarian (Liberal Democrats), and a progressive in Senator Xenophon – meaning the government will be up for an interesting ride, but should ultimately be able to obtain support for many of its key policy initiatives.

The uncertainty shifts?

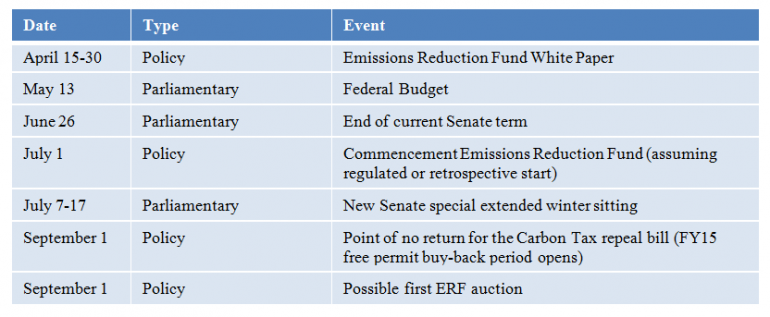

Following the WA re-election, the uncertainty that has plagued local emissions markets once more returns to the radar, however with the sun setting on the Carbon Price Mechanism, market attention now turns to the government’s own Direct Action Plan.

The future of the Carbon Price Mechanism continues to remain in doubt, with the government likely to gain its repeal numbers during the special winter sitting of the Senate from July 7-17. While PUP is yet to show its hand, it remains highly probable that support for the repeal will be forthcoming.

Local power markets have already begun to imagine life without a price on carbon, with the carbon spread within the National Electricity Market significantly tightening since the start of April, largely in response to the WA Senate outcome and the expectation of PUP support for the carbon tax repeal.

All eyes now turn to the Coalition’s own Direct Action Plan, with the Emissions Reduction Fund White Paper expected in the next one to two weeks around the Easter-ANZAC day period.

The government’s ability to gain the numbers to pass its legislation will largely be determined by the design of its White Paper, with its policy currently at an environmental and political crossroad. The more stringent the scheme, the more it is likely to appeal to the left, including Senator Xenophon (and potentially Senator Madigan who supports penalties). The more lenient the penalties, the more likely it is to gain critical PUP support.

The government’s ability to bridge the divide between PUP and the crossbenchers will be a critical watch for the market. While it is unclear how the Senate will respond to the government’s proposed scheme, we continue to assume a July 1 start date for the Emissions Reduction Fund due to the government’s power to regulate its commencement via the existing Carbon Farming Initiative infrastructure. This remains the ace in the hole for the government, and for domestic market participants.

(For a full run down of our policy scenarios and timing expectations, refer to our latest Policy Outlook.)

Market activity

The association between the Emissions Reduction Fund from July 1 and the Carbon Price Mechanism 'true up' in February 2015 remains a key watch for local market participants. There remains potential for a disconnect to emerge between the price the government is willing to accept under the ERF, and what prospective bids participants may offer, with many of the larger CFI participants expected to take a wait and see approach in the ERF initial rounds given the higher prices on offer under the CPM 'true up'.

This may provide an opportunity for existing participants to engage in price discovery while initial participation in the ERF is low.

The government has released a draft methodology for Sequestering Carbon in Soils in Grazing Systems that is open for public consultation until May 6. Activities to build soil carbon can include converting from cropland to permanent pasture, changing pasture species composition, or changing grazing patterns.

The draft methodology relies upon direct measurement of soil carbon to estimate sequestration, however it is not likely to be cost effective to adequately sample very large farms in areas where rates of soil carbon sequestration are low. As a result this methodology is likely to only apply for smaller farms that are already poised to make major adjustments to their land management practices. An offering of tens of millions of tonnes of abatement identified by the original Direction Action Plan therefore remains improbable.

Notable news this month

The Intergovernmental Panel on Climate Change has unsurprisingly called for greater effort by all countries in the latest instalment of its seven-year global warming update. The report notes there is scope for carbon emissions savings from greater energy efficiency in industry, buildings and transport and changes in land-use practices, while the biggest reductions could come from changes to power generation, including the switch to more efficient coal plants and greater use of gas. While the report adds further fuel to the rationale for climate action for those on the left, its repeat messaging is likely to do little to inspire the right.

The Climate Change Authority also recently released a research paper investigating the success of baseline and credit mechanisms in other markets. The paper does not make specific policy recommendations.

As the review of the Renewable Energy Target begins, RepuTex recently analysed the impact of repealing the Carbon Price Mechanism and the introduction of a reduced Renewable Energy Target, with findings indicating large-scale renewable generation is likely to be 40 per cent lower in 2020, while the resulting market conditions probably bringing relief for black coal generation, with a forecast increase of 9 per cent over the same period.

Despite likely gains for fossil fuel generators, analysis indicates that relief may only be temporary, with large-scale renewables probably continuing to experience cost reductions, while the government’s new ‘baseline and credit’ mechanism, the Direct Action Plan, may further dampen the electricity demand outlook for coal generation and place continuing pressure on profit margins. An online summary of the report is available here.

Watch this space

As the dust settles on the WA Senate election re-run, the next four weeks will provide significant insight on the likely shape of the Coalition’s Direct Action policy, and the government’s ability to implement the full scope of its platform beyond the Emissions Reduction Fund.

What this means in terms of final market design remains to be seen, however, early movers from industry and project developers will have one eye keenly focused on the government’s capital pool from July 1, with opportunities likely to be available for those willing to engage in price discovery while initial participation in the ERF is low.

RepuTex’s Market Insider publication is a monthly review of the key events and activity shaping the Australian emissions markets. It was originally published by RepuTex under its Australian emissions markets research service. For more information please click here.