The shock of being forced back to work

Paris was always worth it and you received return for whatever you brought to it ... this is how Paris was in the early days when we were very poor and very happy

― Ernest Hemingway, A Moveable Feast

Whatever the political mistakes of the Abbott government in warming Australians up for a tough budget, there is still a chance some of the policy decisions kept secret until Tuesday will be game-changers for the Australian economy.

To date, the Abbott front-bench has mostly scared voters by engaging with the topics it has leaked – the debt levy, the petrol excise hike, university fee increases and the like.

There has been less talk about what will be a major shift in Coalition policy -- if it eventuates -- namely the Commission of Audit’s suggestion to scrap Family Tax Benefit part B.

The Commission suggested replacing the benefit, which is not means tested up to family incomes of $150,000 p/a, with an equal payment available only to single parents.

In the Commission’s words, the family payments system would thereby “be better targeted to those in need and simplified to boost workforce participation”.

If adopted, this would involve abandoning the Coalition’s intention when it introduced the payment in 2000 -- namely, to give more parents the choice to stay home to raise their kids.

Many, including this columnist, think having a parent (of either sex) at home during infant years is a boon for kids developmentally and flows through to social benefits for society more generally.

That’s why Howard and Costello introduced the Part B benefit in the first place, with Costello famously exhorting parents to have “one for mum, one for dad and one for Australia”.

That, with the sharp rise in immigration during the Howard years, would keep the population and GDP rising and, though they did not say it explicitly, create future generations that ranked highly on scales such as the human development index – well educated, long-lived and prosperous.

So what has changed? Well, at this very moment not a lot, but things will change.

As covered extensively in recent months (Does WA care about Shorten’s jobs crisis, March 31), the boom times in which the FTB payments were created are coming to an end.

Australia faces falling terms of trade, albeit it at a surprisingly gentle rate so far, and GDP growth that does not necessarily entail job creation.

The iron ore and coal may pour into the ships, bolstering GDP, but few workers will be needed for that particular hub of economic activity – just as the lion’s share of profits will flow to the overseas investors who own the capital tied up in the mines.

Yet, somehow, there must be jobs growth and economic growth in other sectors.

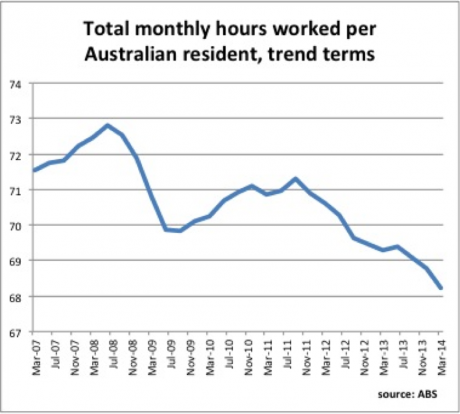

To understand why, here is an updated chart showing the total number of hours worked per Australian resident. This metric shows much more clearly than the unemployment rate what’s going on in last week’s labor force data from the ABS.

The chart gets ever more alarming as three trends continue:

– business confidence is low, meaning fewer full-time or permanent jobs are being offered (remember, part-time workers who want more work are not counted as unemployed)

– the number of retired people is increasing, particularly as the baby-boomers either hit 65 or at least hit the preservation age, allowing them to access their superannuation

– longevity is increasing more than anyone expected just a decade or two ago producing, as Paul Keating pointed out on the ABC last week, a much bigger group of 80 to 100-year-olds than he foresaw when he set up compulsory superannuation in the early 1990s.

What this all adds up to is more people, but fewer hours of work (at least at present) providing the wealth to support them.

That is where the Family Tax Benefit change comes in. As difficult as it is to say (and hear), the government is effectively saying, “we can’t afford one parent to stay at home any more”.

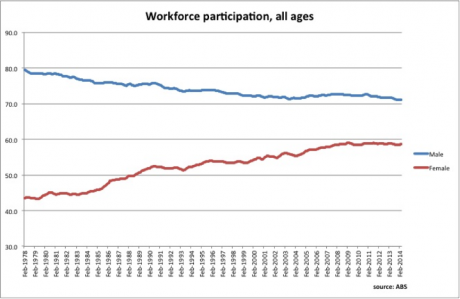

A look at the long term change in workforce participation for working age Australians (15-65) shows clearly that while for a very long time female participation was creeping up, it is now flat-lining, as is male participation (see chart below).

Put another way, there are too many working-age people relying on the wealth of others -- whether living in a household with the breadwinner, or receiving support from the taxpayer.

The Abbott government is clearly determined to change that, not only in the FTB change (if it arrives) but through expected changes to disability pension provisions and cutting welfare payments to under-25s.

It also intends its paid-parental leave scheme to keep mothers in touch with their workplaces, and hence to be more likely to return to work -- although if the Commission of Audit gets its way, it may funnel more public money into childcare, which would do much more to help mothers back into the workplace.

While the thought of fewer children getting one-on-one attention from parents during their infancy is, to this columnist at least, a very sad development, the demographic and economic trends outlined above make it hard to see an alternative.

Stay-at-home parents must return to work, it would seem -- unless we very quickly learn to be what Hemingway called “very poor and very happy”.