The shadow of debt hangs over credit growth

Housing speculation continues to drive credit growth across the country. But the overall response to low interest rates has been relatively subdued, reflecting the high level of existing debt and the fact that many households and businesses remain fairly cautious.

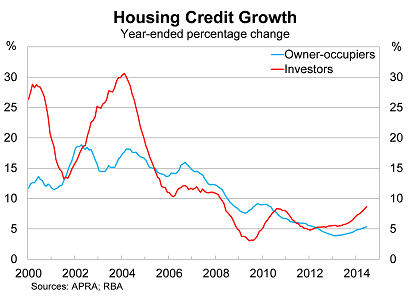

Housing credit rose by 0.6 per cent in June, to be 6.4 per cent higher over the year. Growth continues to be led by investors, with investor housing credit rising by 8.7 per cent over the year -- its fastest pace in six years.

New lending by investors continues to be elevated and, despite losing some momentum in recent months, outstanding credit to property investors should push towards its pre-crisis level of around 10 per cent over the next year.

Credit to owner-occupiers continues to grow at a more moderate pace, rising by 5.3 per cent over the year, reflecting the dominance of investors during the current housing upswing. Nevertheless, credit to owner-occupiers continues to rise faster than income or GDP growth.

In March the Reserve Bank of Australia noted that “the pick-up in investor activity in the housing market does not appear to post near-term risks to financial stability”. The recent Murray inquiry has questioned that viewpoint, emphasising the systemic risks that housing poses for the broader financial system.

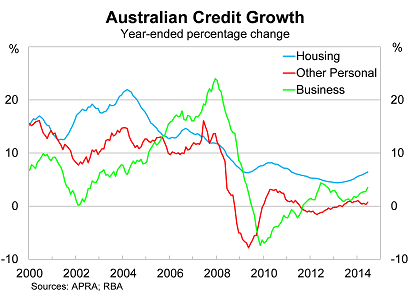

Strong mortgage lending has largely crowded out business lending, particularly for smaller businesses, since the onset of the global financial crisis. Mortgage lending for both owner-occupiers and investors now accounts for over 60 per cent of total credit outstanding at Australian financial institutions.

Bucking that recent trend, business credit managed to rise by 1 per cent in June, to be 3.5 per cent higher over the year. However, this surprisingly strong outcome was driven by extenuating circumstances. The RBA noted that business credit was "boosted by the provision of bridging loan facilities associated with the re-structure of a domestic corporate entity".

As a result, business credit growth should revert back to more normal levels, typically between 0.2 and 0.4 per cent, in coming months.

While low interest rates continue to support lending activity, many Australian firms remain cautious regarding the economic outlook, with some firms continuing to refinance or pay down existing loan balances rather than expand operations.

According to the RBA, there is evidence of greater investment intentions across the non-mining sector, but "plans remain tentative as firms wait for more evidence of improved conditions before committing to significant expansion". This provides considerable upside to the investment outlook but it is largely dependent on conditions improving across the broader economy, which may prove difficult without greater business investment. It’s a bit of a conundrum.

Personal credit rose by 0.6 per cent during June but has been fairly weak since the onset of the global financial crisis. This sits in stark contrast with the enthusiasm households have had for property.

Measures of consumer sentiment have improved in recent months -- with the ANZ-Roy Morgan measure pushing above its pre-budget peak -- and this should support personal lending in the coming months. But real wages continue to decline and the unemployment rate remains elevated, which will continue to weigh on consumer spending.

Low interest rates have boosted lending activity to both households and businesses. But the response has been fairly subdued compared with previous upswings, with most lending directed towards unproductive investment in existing properties.

Australia’s high level of existing debt and the associated interest burden continues to weigh on activity, providing less scope for credit expansion, and has prompted a more cautious approach to investment from many households and businesses. That appears unlikely to change anytime soon.