The rise of the specialist A-REIT

Summary: The decline in bricks and mortar retail and traditional office spaces has been a challenge for the real estate investment trust space, but by understanding sectors with positive tailwinds, investors can find niche REITs that work for them. Arena REIT focuses on ownership of childcare centres and has taken advantage of the rents on offer in this space, while Generation Healthcare is on our income watch list, given its exposure to the hospital sector. |

Key take out: If the RBA delivers a further interest rate cut, this would benefit the REIT sector. Investors should keep an eye out for trusts with exposure to growing industries. |

Key beneficiaries: General investors. Category: REITs. |

In Australia, REITs have become a key component of the investing landscape, with household names like Westfield leading the charge for many years. However, with structural challenges across the three traditional REIT-focussed industries (retail, industrial & office and commercial residential), investors should take note of the change in performance trend, particularly with the rising returns of niche REITs.

With online shopping reducing the need for bricks and mortar retail, rental yields are in my view likely to experience structural challenges through reduced demand. Additionally, the ability to work remotely for many professionals is allowing large corporates to reduce the number of seats in office buildings, and the risks in commercial residential yields have been well documented in recent press.

That said, there are overall positive tailwinds for the REITs space, so investors would be wise not to ignore them.

* Firstly, interest rates are at record lows, allowing for record low costs of funding in the capital-intensive space.

*Secondly, the RBA's latest statement was somewhat dovish, suggesting that there is a bias or at least a potential for further interest rate cuts in the future.

* Thirdly, the property market in Australia from a valuation perspective has been very strong. This leads to rental yields on properties that appear low, and could provide upside as cap rates catch up with the hot property market.

So, with the traditional sector facing some challenges in terms of demand thematics, there is a clear opportunity for investors to recognise specialist or niche REITs that have exposure to defensive or growing underlying sectors.

The traditional REITs

Traditionally REITs available to ASX investors have focused three categories – on retail property investment (Westfield Group (WFD), Scentre Group (SGC) and Vicinity Centres (VCX), commercial and industrial property (Goodman Group (GMG)) or residential property (Stockland Group (SGP) and Mirvac (MGR)). Some of these, such as Stockland and Mirvac, focus on a combination of these properties, but the major exposures are to one or more of these three major categories.

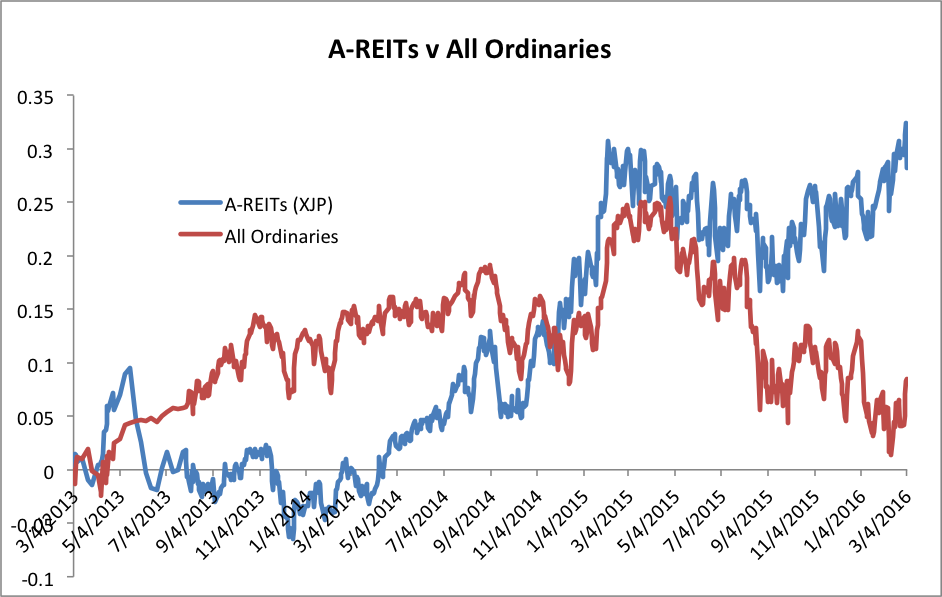

There are tailwinds in my view for the sector as a whole. Interest rates as set by the RBA are at record lows, and property markets in general have been strong. This has led to a recent outperformance in the sector. However, with the potential for valuation gains to slow, the focus now shifts to the underling rental income and which businesses are most able to sustain and grow this distributable income.

Here is a chart of the performance of the A-REITs index (XPJ) since the start of 2013:

The appeal of specialised REITs

The Income First model portfolio has introduced Arena REIT to subscribers, with a buy recommendation first taken on September 28, 2015 (click here to read our ARF initiation). ARF is a REIT that focuses on the ownership and development of properties that provide both childcare and medical centre services, both of which are services with defensive demand. In my view this adds strength to the business' operating income that may not be as apparent in a traditional REIT, and implies that these REITs deserve some sort of premium when priced by investors.

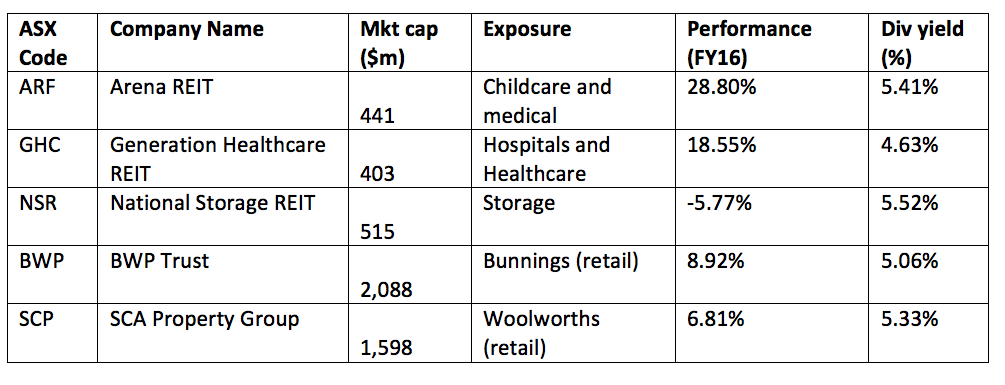

ARF is one example in a sector that has witnessed strong performance from a few niche REITs. The key to understanding and finding more companies like this is to understand the underlying exposure of the properties the REIT owns.

Here are some numbers on recent performance within the REIT sector from businesses that do have a niche exposure:

Specialisation brings potential risk

While it is fine to contend that specialised REITs are likely to provide outperformance due to their ability to withstand traditional risks, it is important to highlight that specialisation brings high specific risk.

Understanding the underlying exposure of the trust to both property valuation changes, and to the potential for changes in tenant demand is key to assessing REITs. For instance, ARF's exposure to childcare is a positive at present because childcare supply has been building to meet strong demand resulting from high birth rates and a higher uptake of long daycare. However, regulatory subsidies are a key support for childcare operators and demographics can change in the long term. For now, we remain comfortable with these risks, but it is important for investors to understand that these niche exposures mean that risks in terms of the operations are somewhat less diversified.

Two REITs with strong thematics -

Generation Healthcare REIT

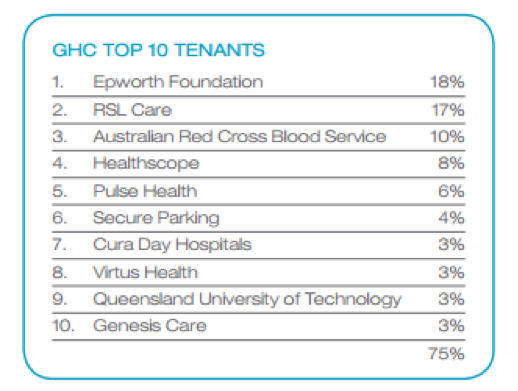

GHC is a small to mid-cap REIT with an exposure to hospitals. The property portfolio is focused on Victoria, with some exposure to NSW and QLD. The group's largest property and tenant is the Epworth Foundation in Melbourne, which leases two Epworth Freemasons sites. Here is a breakdown of the trusts 10 largest clients at the beginning of FY16:

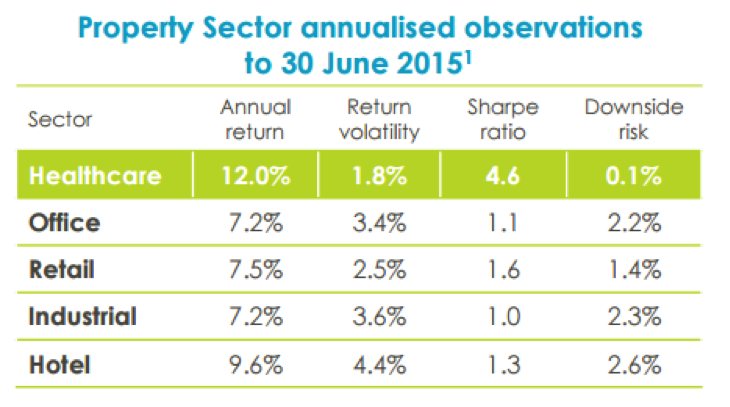

The key reason that GHC appeals to us is that the underlying exposure is to hospitals and the healthcare sector. Health care has strong advantages from a demographic demand perspective, and organic growth rates are lifting across the sector. This stable and growing demand underpins the ability of operators to pay increasing rental costs, and diminishes the risk or volatility of returns. Below is a snapshot of this from GHC's latest presentation.

Overall, GHC is very attractive to an income investor and is on the watchlist for the Income First model portfolio. The company has development projects that are likely to create additional distributable income in coming years, and an attractive profile from both a funding perspective and when considering the weighted average lease expiry (WALE).

For now, GHC's share price has enjoyed a strong period, leading to a lower yield (4.63 per cent based on trailing 12 month distributions). Nonetheless, as the potential for higher distributions in FY17 becomes clearer, GHC may provide a higher yield to investors.

ARENA REIT

ARF's main focus is ownership of childcare centres. The business has a high exposure to Goodstart as a client, but has been working to diversify this mix since listing in 2013. With additional funding to the sector likely to assist centres operating at the lower price end of the long day care market, ARF has upside in terms of its ability to pass on rental increases to increasingly profitable centre operators.

The company's portfolio consists of 179 childcare centres and seven multidisciplinary medical centres. These centres provide a highly visible rental income profile, with 100 per cent occupancy and a WALE of 8.9 years.

Pleasingly, ARF recently upgraded its distribution guidance for FY16, as development sites and rental reviews have added additional distributable income to the group. The company also has a contract with the Victorian government for the development of childcare centres to be leased to YMCA. This project is a boost to the development profile and has the potential to increase earnings and distributions in FY17 and beyond.

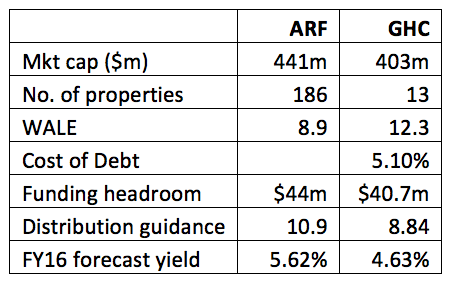

Here's a breakdown of some fundamentals on ARF and GHC:

The future for specialised REITs

The concept of a niche A-REIT has been gaining traction in the local market for some time: a strong example has been the BWP trust- the specialist vehicle which holds Bunnings hardware properties - the market has responded to strong performance and continual delivery on both increased earnings and distributions. Now with BWP, GHC and ARENA attracting a strong following the concept of the specialist A-REIT is clearly established.

With the economic influences for REITs likely to remain strong, investors focusing on income should keep a close eye on opportunities.

In its latest monetary policy decision, the Reserve Bank of Australia hinted that “continued low inflation would provide scope for easier policy”, suggesting that there is some chance of further cuts to the benchmark interest rate. Should this occur, REITs are likely to benefit.

Accommodative monetary policy and a buoyant property market have led to significant increases in property valuations. This in turn gives rental yields (cap rates) the appearance of being at low levels. This is a positive in that there is now strength in the argument that property landlords can make when approaching negotiations for market rent reviews. Low cap rates and high tenant profitability are key to rental increases and ultimately organic distribution growth.

Given this, and given the challenges facing some traditional REITs focused on retail, industrial, office or commercial residential property, the ability to find and invest in REITs that are exposed to sectors with tailwinds will be key moving forward.