The rise of China's global challengers

Cameramen take photos in front of the headquarters of Alibaba Group at night in Hangzhou city, east China's Zhejiang province, 10 November 2013.

When we think of China as the world’s factory, images of endless rows of Chinese workers slaving away on $2 a day dominate our imagination. Though that it is still true in many parts of China, the country’s industry is undergoing a fundamental transformation.

Chinese companies’ cost advantage over competitors from developed markets is eroding. Some factories in Guangdong, the heartland of China’s industrial prowess, have to pay as much as 100,000 yuan ($A19,000) a year for skilled technicians.

Companies from China and other emerging markets such as India and Brazil have built on their traditional sources of strength—low costs and a large captive domestic market—and are expanding overseas in search of new markets and technology.

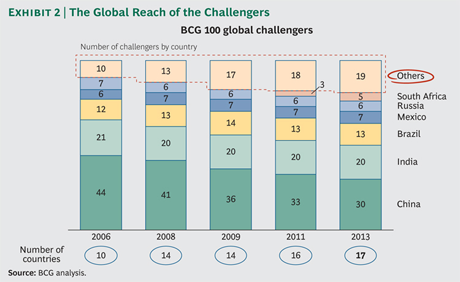

The most formidable of these companies have been dubbed as “global challengers” by the Boston Consulting Group, which has been compiling a list of top 100 global challengers from emerging markets since 2009.

Not surprisingly, China is the home to the largest number of global challengers, with 30 such companies. Some of them, such as Lenovo and Huawei, are already familiar to Western consumers; others are unheard of outside of China.

At the top of BCG’s global challenger league table is Alibaba Group, a Chinese e-commerce giant that is likely to emerge as the world’s third largest Internet company behind Google and Amazon once it is listed this year.

It is the world’s largest online bazaar, which sells more merchandise than Amazon and eBay put together. Alibaba is more than just an e-commerce company. It has amassed more than 250 billion yuan of funds from its army of small business users and is posing a challenge to Chinese state-owned banking behemoths.

Alibaba has also has expanded its presence in the US through acquiring Vendio, an e-commerce site and Auctiva, which provides listing and marketing tools to sellers on e-commerce sites like eBay. It also debuted in Australia last year, primarily catering for a large Chinese customer base.

Alibaba is just one of several Chinese internet giants eyeing opportunities abroad. Tencent, which has a market capitalisation of one trillion Hong Kong dollars ($A150 billion), is expanding its footprint in the US. Just to put the company’s size in perspective, it is more than twice the size of Telstra and just a bit smaller than BHP Billiton.

The Shenzhen-based company is bringing its widely popular WeChat app (a social media messaging service), which has more than 300 million users in China, to the US through a newly announced partnership with the Sun King of the Silicon Valley—Google.

Chinese internet companies also helping the country to change its image as a mere copycat. “Chinese internet companies are no longer behind,” says William Bo Bean, a managing director at the venture capital firm SingTel Innov8. According to the New York Times. “Now, in some areas, they are leading the way.”

If you are in the luxury goods retail space, it is impossible to miss China UnionPay’s red, blue and green-banded symbol with UnionPay in English and Chinese. It appears on doors and cash registers of nearly all leading department stores and luxury goods shops around the world, including David Jones.

UnionPay has recently displaced Masters Card as the world’s second largest card payment system and is fighting tooth and nail with American giants such as Visa in emerging markets, especially in south-east Asia. The company processed more than 500 billion yuan ($A84 billion) worth of payment in 2012 outside of China, according to its chairman Su Ning during a recent visit to Australia.

UnionPay is also one of BCG’s new global challengers in 2013.

The story of Chinese technology giant Huawei is well-known, but worth repeating here. Much ink has been spilled on its alleged role as a Trojan horse for Beijing, but what is often ignored or overlooked is its huge commitment to R&D.

It is written into the company’s constitution that Huawei must spend at least 10 per cent of sales revenue on R&D every year. Last year, it spent $US5.4 billion on research or 14 per cent of its revenue. Every year, the company snaps up the best and brightest engineering graduates from the country’s top universities, offering graduates a 120,000 yuan starting salary, a considerable sum in China.

In 2011, Huawei broke into the top 100 patenting companies in the world when it filed 374 US patents. The company has overtaken Swedish company Ericsson to become the world’s largest vendor of telecommunication gears in 2013, according to Telecom Lead.

BCG intends the global challenger report as a wake-up call for Western executives, who have been accustomed to their technological lead over their emerging markets rivals. “The game has changed,” says BCG. “Increasingly, challengers and multinationals are competing head to head.”

It is worth remembering that Detroit executives summarily dismissed Japanese auto-makers when they first arrived in the US with their tin-box cars. Many decades later, Toyota is the undisputed king of the industry, while American car-makers had to ask the Congress for bailouts.

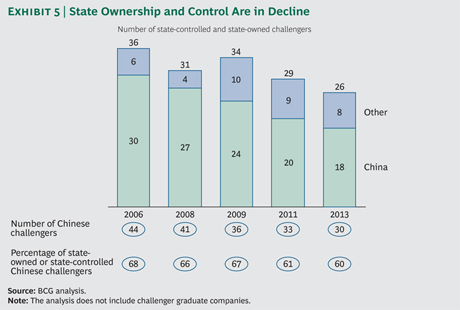

Another notable aspect of BCG’s report is that in 2009 China had 44 companies on the list, of which many were state-owned giants. Over the time, they have dropped off the list, including China Mobile, the world largest carrier by subscriber numbers.

It shows that many of China’s state-owned companies are green-house plants, which cannot thrive outside their natural habitats. On the other hand, Chinese private companies such as Alibaba, Tencent and Lenovo are more responsive to the needs of customers both at home and abroad.

Welcome to the age of emerging market global challengers.

China Spectator will examine the rise of Chinese global challengers through a new series and starting with Alibaba Group this week.

Follow Peter Cai on Twitter: @peteryuancai

Subscribe to the China Spectator newsletter: http://bit.ly/ChinaSpec