The recession deception. Readings and viewings. The week ahead

John Addis

Overcoming the economic fear factor

My first visit to Sydney was 28 years ago, when I emerged from Martin Place station, blinking into the light. After a stroll down Pitt Street I caught my first glimpse of Sydney Harbour, a view that to this day no image can fully portray. Even corrupt politicians and inept property developers have failed to dent its resilient beauty.

Resilience, if not beauty, may be the word that best describes the Australian economy. Since the 1990-91 recession, we've dodged the Asian crisis, a dotcom crash and the Global Financial Crisis and have just racked up 25 recession-free years. No country has experienced anything quite like it and, with the economy growing by 3.3 per cent in the year to June, we're still going strong.

Good policy or good luck? Probably a bit of both. Ross Gittins this week called it a “miracle”, saying “one way to be a loser is not to have the wit to realise when you are winning”. So please, raise that morning cup of coffee to your lips and give thanks to this remarkable achievement because there's every chance your portfolio would be worth a lot less without it. And take a bow Keating, Hawke, Howard, Ian Macfarlane, Glenn Stevens, Bernie “The Sandman” Fraser, Kevin Rudd and Peter Costello – yes, even them. We may despise our politicians and bureaucrats, but here at least they have not failed us.

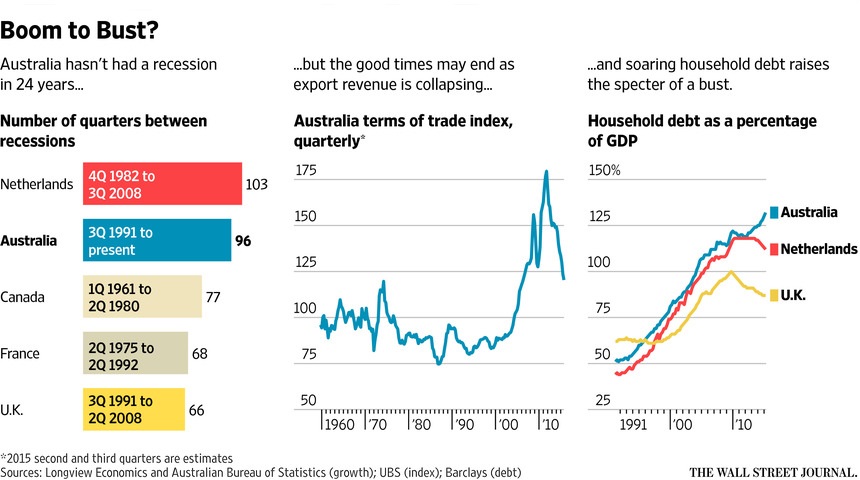

Right, back to the default mindset of the cynic. Do 25 recession-free years mean we're due, and if so, does it mean the next one will be bigger than Ben Hur? That seemed to be the view of the Wall Street Journal 18 months ago, which published this chart under the headline Is Australia sliding into recession?

So far the answer is “no”, although risks remain. The fall in the terms of trade (ratio of export to import prices) has continued, hitting a 10-year low in April as commodity prices fell. But Australian Bureau of Statistics figures released this week show that a five-year slide has come to an end. Commodity prices are edging up, assisting a fall in the July trade deficit (largely down to increasing gold exports). And that top-of-the-cycle investment the resources companies made five years ago? Well, it's bearing fruit. Commodity prices may be lower but volumes have never been higher. Iron ore shipments from Port Hedland hit a record last month.

All of this is a bit of a clue. Those economic growth stats which excited so many commentators this week can largely be explained by strong demand for our iron ore and coal. As Callam Pickering wrote this week: "Domestic demand remains quite weak and that explains why inflation and interest rates currently sit either at or near historically low levels.”

So, not so great after all, but not to be sneezed at. Most countries would love our problems – except perhaps our frightening household debt.

In 1988, it would have taken eight months of after-tax income for the average household to become debt free. By last year that figure had ballooned to 22 months. Meanwhile, disposable income growth has been far less than the growth in household debt, much of which has been shovelled into property speculation. But it's made people feel richer (the wealth effect) and they've spent more as a result. Household consumption was up 0.4 per cent in the June quarter, 2.9 per cent for the year.

So why didn't things play out as the WSJ thought? The fall in commodity prices hit the exchange rate, making our export-driven tourism and education sectors more attractive. Since 2013, they've been flying. The Reserve Bank has also done a fine job of pumping up house prices with lower interest rates, which has helped the construction industry and consumer spending. Infrastructure investment is also increasing and commodity export volumes growing.

There was a belief that the end of the biggest mining boom in history would inevitably trigger a recession (I'll own up to that one) but the “rebalancing” appears on track. Rising interest rates would surely test household debt but even that seems unlikely, at least according to the 10-year bond rate. Deflation seems more of a problem than inflation right now.

Even the latest capital expenditure figures – down by a record 25 per cent last financial year – were brushed off, with some commentators (and, interestingly, the RBA) questioning their usefulness. 'Crapex' is, apparently, the term.

We're not the only country successfully rebalancing, either. Xiao Geng, a professor at the University of Hong Kong, lists some stunning stats over at Project Syndicate. Online retail sales have more than doubled in three years and are expected to account for 40 per cent of retail transactions by 2020 (that's the Alibaba and Tencent effect).

This is helping to push up China's household consumption, which now accounts for 60 per cent of GDP (the comparable figure in Australia is about 75 per cent). The Chinese slowdown, goes the argument, masks a shift away from investment-led growth towards consumption – more “changing gears” than a “deceleration” according to Zhang Jun, professor of economics at Fudan University, Shanghai.

Again, I'll stick my hand up. I watched with horror as China pumped over a trillion US dollars into its economy in the teeth of the GFC. That helped Australia avoid a recession but also led to massive over-investment in Chinese property and infrastructure. Empty cities, vacant apartments, underused rail lines and airports. It couldn't end well, could it? And yet here we are, five years down the track, and it's pretty much as you were. What's that old joke about economists forecasting nine of the last five recessions?

This week I spoke with a high-performing fund manager that told me their portfolio consisted of 60 per cent equities, 20 per cent cash and 20 per cent gold stocks. You can appreciate the cautiousness behind those numbers. Global growth is meagre, deflation a real threat and Europe weak. Then there's sovereign debt levels, the growing ineffectiveness of interest rates to boost growth and Donald Trump's hair, if not the rest of him.

These are major problems, no doubt, but we have a tendency to overstate them.

“Forecasters often feel incentivised to pump up the probability of worst-case scenarios,” said Philip Tetlock, an expert in political forecasting at the University of Pennsylvania. For more evidence of that proposition, compare the first chart above with this one:

You can see the similarity. Both are from the Wall Street Journal. The first essentially forecasts an Australian recession and the second cites three cases – the US sequester, Grexit and Brexit – where doom-laden predictions failed to materialise, at least in terms of sharemarket reactions in the short term. More durable parallels exist. After the GFC governments around the world embarked on the biggest credit creation project in history. That provoked a flurry of warnings about hyperinflation, none of which eventuated.

All of this is a bit of a problem for investors. Because we tend to overestimate threats to our wealth we end up with damagingly high portfolio-turnover rates and greater transaction costs. I'd also guess it increases the tendency to sell low and buy high.

That might be one of the lessons from all the threats Australia's economy has faced over the past few years, and the impressive recent economic growth figures despite despite recession-free for 25 years. If forecasters aren't much cop at forecasting, why not forget trying to guess the future, stop worrying and simply hang on? Because y'know, it might never happen.

Click here to read this week's Eureka Weekly Review PDF.

Readings & Viewings

The New Yorker on investor letters as a literary genre: “What we're dealing with here, in essence, is rich people wanting more money. That creates issues of tone.”

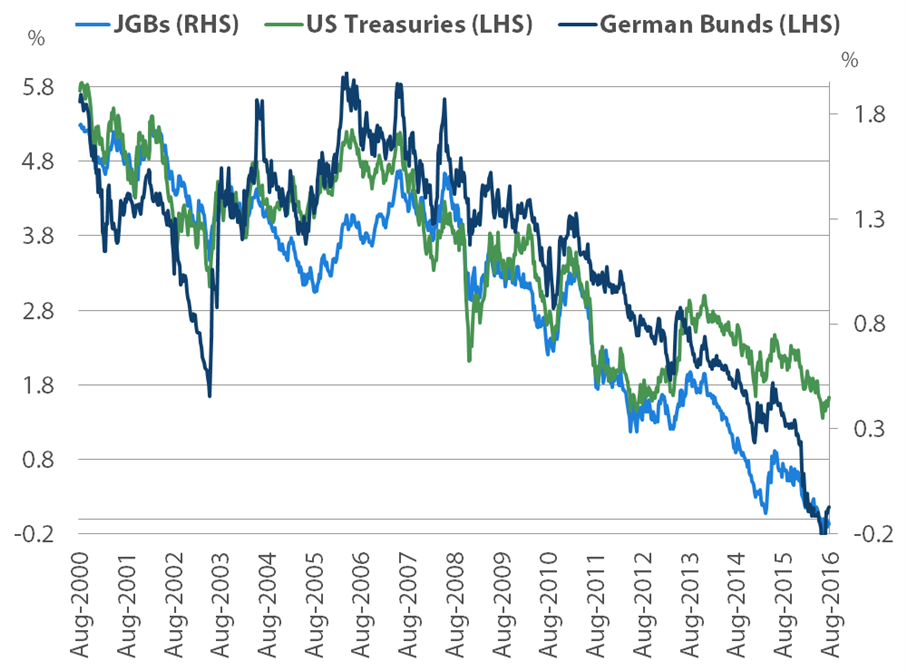

Citing the chart below, Sydney-based Roger Bridges, of Nikko Asset Management, asks if we're seeing the end of a 35-year bond rally?

But, if you're hunting for yield, Ghana has just launched a $US750 million Eurobond issue with a yield of 9.25 per cent. But it's not one for the fainthearted. The troubled African nation withdrew from a similar transaction last month on the grounds the yield was too high.

How Fox News women took down the ‘most powerful, and predatory, man in media'.

If you're waiting for a good read to hit the bookshelves, the final works of F. Scott Fitzgerald will finally be published in April next year, 80 years later. Scribner will publish I'd Die for You, a collection of stories that were considered too controversial to print in the 1930s.

Radio National interviewed the author of a new book on the ‘the intellectual godfather of modern Islamic fundamentalism', Sayyid Qutb, who was hanged 50 years ago. The book focuses on his two-year visit to America, as well as three other less infamous tourists.

We all know that the world's wilderness areas were shrinking. But a new study by the Wildlife Conservation Society, using data mapped over the last 20 years, shows that it's even worse than many thought.

Matt Taibbi says the candidate who made a brilliant farce of the US election now finds the joke's on him.

But the Lowy Institute's Crispin Rovere says with two months to go the US election is Trump's to lose! “Whomever wins the debates in 2016 will be the next president of the United States.”

Meanwhile, The Donald has been digging himself into (another) hole this week over his comments about Islamic State, oil and the US military.

Elsewhere, the Irish are developing a taste for Canadian mushrooms. Dublin-based Fyffes PLC, better known for importing bananas, has gone bananas on fungus.

Here's one for the car buffs. Fortune has just released its list of the rarest cars on Earth. It includes something called “a stealth car”, the Rimac Concept One, made by a little-known Croatian firm. Here's what it looks like:

London has reportedly lost half its nightclubs and 40 per cent of its live music in eight years, with the decline highlighted this week with the closure of, apparently, its most famous nightclub. Shutdown proponents argue it's about preventing drug deaths, others see less altruistic motives.

Philippines President Rodrigo Duterte has been given the nickname 'Duterte Harry' over his sanctioning of killings of drug-makers, dealers and users. And he's continuing his offensive against the United States.

Otis Redding, who died in a plane crash aged 26, would be turning 75 today if alive. Here's the blues singer's biggest hit, (Sitting on the) Dock of the Bay.

Speaking of birthdays, actor Hugh Grant turns 55 today. Here's a typically ‘Hugh Grantish' scene from probably the last film of his golden era, 2002's About a Boy.

Mitchell Sneddon's recipe of the week: “I'm a big fan of including tomato in jams. Tomato and chili jam is also very good. My grandmother used to make this. Also, it's ‘Woman's Weekly tried and tested!'”

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

Global share markets were mostly up over the last week but Australian shares fell slightly. Mixed US data, the ongoing soap opera over what the US Federal Reserve will do and the absence of further European Central Bank (ECB) easing likely constrained gains. Despite some gyrations global bond yields were little changed globally. However, Australian bond yields rose in response to strong data and perceptions that the Reserve Bank of Australia (RBA) may have finished cutting interest rates which in turn helped drag down the Australian sharemarket. Commodity prices rose, particularly oil on the back of a sharp Gulf of Mexico storm related fall in US crude inventories. The combination of stronger than expected Australian economic growth and a lower US dollar saw the Australian dollar rise.

G20 leaders said all the right things after the latest summit in China about the limits to monetary policy and putting more emphasis on fiscal policy and structural reforms, but there was little if any market impact – perhaps because we have heard it before. For example, what happened to the 2 per cent growth boosting commitment from the 2014 G20 summit?

In the absence of a greater focus on fiscal policy and structural reforms to boost growth, central banks still have inflation mandates to meet and the pressure falls back on them. And on this front the “easy for longer” story remains. Mixed US economic data – notably slower payrolls and business conditions surveys – and the absence of inflation pressures makes it hard for the Fed to justify a rate hike this month. And in the meantime the Bank of Japan and ECB remain under pressure to do more.

The ECB left monetary policy unchanged as expected at its meeting in the last week and the lack of any significant change to the ECB's economic forecasts and President Draghi's comment that an extension of the current quantitative easing program was not discussed led to a hawkish market interpretation of the meeting. However, with inflation remaining well below target, the ECB's own economic forecasts assuming a continuation of the current QE program and various dovish comments from Draghi around the lack of upward inflation pressures indicate that an extension of the QE program beyond its March 2017 expiry at its December meeting is likely. The ECB also looks likely to announce a technical widening of the assets than can be purchased under the QE program in order to ensure that the ECB does not run into problems in implementing its program.

Having just cut rates last month, it was no surprise to see the Reserve Bank of Australia leave rates on hold at 1.5 per cent at its September meeting. We remain of the view that the RBA will cut rates again at its November meeting when it reviews its economic forecasts after the release of the September quarter inflation data in late October. The risks to inflation are on the downside thanks to underlying deflationary pressures globally and record low wages growth domestically and the Australian dollar is too high and at risk of breaking beyond the April high of $US0.78 given the Fed's endless delays in raising rates. However, with economic growth holding up very well another rate cut is a close call and is now critically dependent on seeing a lower than expected September quarter inflation result. A cut in the cash rate to 1 per cent or below and the adoption of quantitative easing looks very unlikely in Australia.

Major global economic events and implications

US economic data painted a mixed picture – not one supporting of an imminent Fed rate hike. Labour market indicators remain very strong with the rate of job openings, hirings and people quitting for new jobs all at high levels and jobless claims remaining ultra-low, but a slump in the non-manufacturing conditions ISM index on top of the fall in the manufacturing conditions ISM adds to worries that growth may have slowed. The Fed's Beige Book did nothing to clear the picture talking of modest growth (although there was a slight downgrade in conditions across states), a tight labour market but little sign of inflation. While the slump in the ISM indexes could just be noise the mixed readings on the US economy and continuing low inflation indicate that the Fed would be wise to hold off on raising rates in September. The market's probability of a September rate hike has dropped further to 28 per cent (from 32 per cent a week ago). Our base case remains for a December hike but this “will they or won't they” soap opera looks like dragging on a for a while yet.

Eurozone retail sales rose more than expected in July and are up 2.9 per cent year on year, but German industrial production and factory orders were weaker than expected.

Japanese data continued the more positive tone of the previous week with an upwards revision to June quarter GDP growth, stronger than expected wages growth, a rise in Japan's leading index, a rise in overall economic sentiment and Tokyo's office vacancy rate falling to just 3.9 per cent.

Chinese data for August showed a welcome improvement with exports and imports suggesting stronger global demand and stronger domestic demand respectively and a small rise in the Caixin services sector conditions PMI adding to confidence that Chinese growth has stabilised. What's more producer price deflation continued to fade in August which is invariably a pointer to stronger Chinese nominal growth. Meanwhile, China's State Council (or cabinet) indicated it would step up fiscal stimulus and investment in weak areas of the economy adding to confidence that Chinese growth is not about to fall out of bed any time soon.

Australian economic events and implications

A good week for the optimists on Australia. June quarter GDP data showed solid growth of 0.5 per cent quarter-on-quarter or 3.3 per cent year-on-year. To be sure the quarterly pace of 0.5 per cent was down on 1 per cent in the March quarter and were it not for a surge in lumpy public spending (notably in defence) growth would have been negative as the slump in mining investment continues to detract from growth. However, some slowing in the quarterly growth rate of 1 per cent, qoq, seen in the March quarter was inevitable, going forward net exports are likely to remain solid as new resource projects come on stream, underlying public investment is on the rise thanks to infrastructure projects in NSW and Victoria, mining investment is getting close to more normal levels so the huge growth detraction from its unwind over the last few years will start to abate next year, reasonable growth in consumer spending is likely to be underpinned by a still high household savings rate and the completion of new homes, a stabilisation in commodity prices and our terms of trade suggests that the big hit to national income is over and productivity growth is very strong at 2.9 per cent, yoy. What's more 3.3 per cent growth for the year to the June quarter is way above the US at 1.2 per cent, the eurozone at 1.6 per cent and Japan at just 0.6 per cent and the diversity of growth drivers of the Australian economy (from mining to housing to public capex, etc) in part highlights why the economy has now gone 25 consecutive years without a recession.

In other data, housing finance fell in July and AIG services and construction conditions PMIs followed the manufacturing PMI lower in August, but these series can be quite volatile. Meanwhile, ANZ job ads were strong in August (pointing to continued solid jobs growth) and the trade deficit improved sharply in July (although this was driven by volatile gold exports so is not quite as good as it looks), but the Melbourne Institute's Inflation Gauge showed that inflation remained weak in August.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Craig James, CommSec

Confidence and the job market

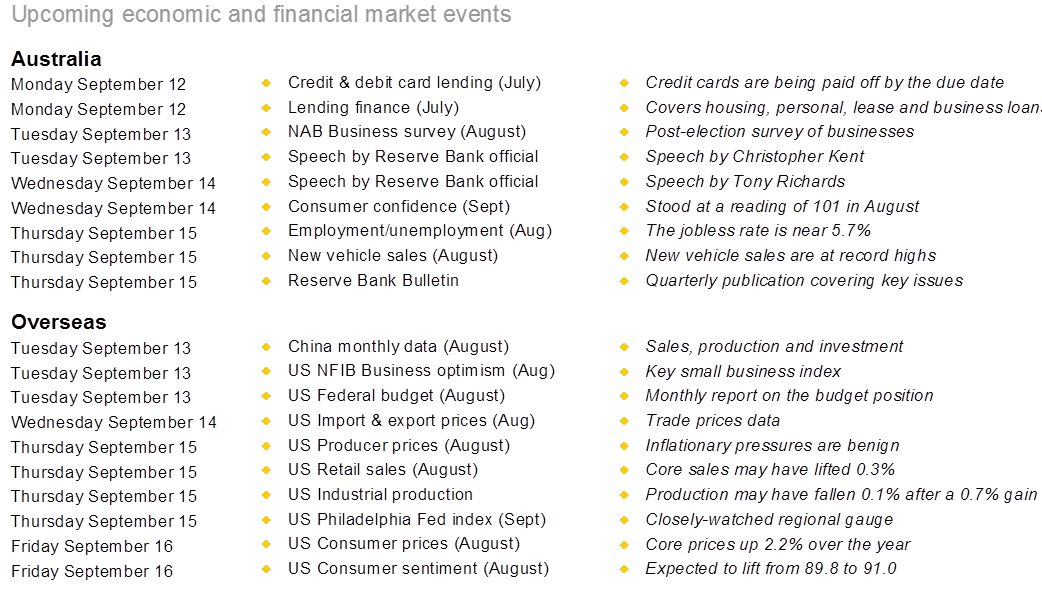

The economic data-fest continues. There are around eight economic events of note in Australia in the coming week. In China, the August activity data is released. And in the US there are close to a dozen indicators to analyse.

The week kicks off in Australia on Monday when the Reserve Bank releases the latest data on credit and debit card lending. Cards are being used more often. But savvy customers are choosing to pay off credit cards by the due date.

Also on Monday the ABS releases broader lending finance data, covering business, personal, housing and lease loans.

On Tuesday the weekly consumer confidence survey is issued by ANZ and Roy Morgan. Confidence has eased over the past fortnight but from near three-year highs.

Also on Tuesday, the National Australia Bank releases the August business survey. Both confidence and the business conditions index eased in July although the latter is well above the long-term average.

And the Reserve Bank also features on Tuesday. The Assistant Governor, Economic, Christopher Kent, delivers the Bloomberg Breakfast Address in Sydney.

On Wednesday, there is another speech from a Reserve Bank official. Tony Richards, head of payments in the Policy Department delivers a speech on the Gold Coast.

And it's like Groundhog Day on Wednesday as the Reserve Bank speech is accompanied by consumer confidence data. This time it's the monthly consumer confidence index from Westpac and the Melbourne Institute.

On Thursday, the (ABS) releases the August employment data. In recent months unemployment has been ticking very modestly lower. In fact the jobless rate hit a three-year low of 5.72 per cent in the month. We tip job growth of around 20,000 in the month and a steady jobless rate.

Also on Thursday, the ABS releases data on new vehicle sales. Motor vehicle sales are currently at record highs.

And the Reserve Bank also makes another contribution on Thursday with the release of the quarterly Bulletin which contains articles of topical interest.

Overseas: Yet more Chinese data to dominate attention

There are healthy helpings of ‘top shelf' economic data in both China and the US in the coming week. And while there are two speeches by US Federal Reserve presidents on Monday, data releases begin on Tuesday.

On Tuesday in China the August activity data is released – covering retail sales, production and investment. Retail sales probably continued to barrel on at a double-digit pace – annual growth of 10.3 per cent is tipped. Production may have been up 6.1 per cent on a year ago with investment up by 8 per cent.

In the US on Tuesday, the National Federation of Independent Business (NFIB) releases results of the small business survey. Monthly data on the Federal Budget is also issued together with the regular weekly data on chain store sales.

On Wednesday data on import and export prices is released together with regular weekly mortgage finance data.

On Thursday, a tsunami of key economic indicators is released. The highlight is probably retail sales data for August. Economists expect that sales (excluding autos) rose by 0.3 per cent in August after a 0.3 per cent fall in July. The data is hardly illustrative of an economy going gangbusters and in need of higher interest rates.

Also on Thursday, data on business inflation is released with industrial output, business inventories, import and export prices, the current account and the influential Philadelphia Federal Reserve survey and the New York Fed manufacturing index.

Economists expect that production fell by 0.1 per cent in August after a 0.7 per cent gain in July. And producer prices may have lifted by only 0.1 per cent in August.

Also on Thursday, the weekly data on claims for unemployment insurance (jobless claims) is issued – a key weekly gauge on the job market.

On Friday, the consumer price index (CPI) is issued. In other countries this is the main inflation measure. But in the US the Federal Reserve focuses on the core personal spending deflator (excludes food and energy). The core CPI is up by 2.2 per cent on a year ago, above the 1.6 per cent growth of the key Fed indicator.

Still, any surprise strength in the CPI will raise speculation about a September rate hike.

Sharemarket, interest rates, currencies & commodities

In the coming week dividend payouts start to lift. In the five days to September 16, $1.25 billion will be paid by companies to shareholders.

Over the three-week period from September 19, $16.3bn will be paid out as dividends by listed companies. The highlight will be the week to September 30 when over $7 billion will be paid.

Craig James is chief economist at CommSec.