The real danger in Hockey's cuts

With the federal budget just two weeks away, it is time to come to terms with the implications: the Australian economy is going to take a hit.

The budget cuts are unlikely to be as severe as recent reports indicate; the message of doom and gloom leading up to a budget is standard political fare. Lowering expectations is the name of the game -- it is hardly rational to promise the world and then under-deliver.

Nevertheless, spending will be cut and that will have firm implications for the rest of the economy. Absent a rate cut, budget cuts are unlikely to be offset by greater growth elsewhere and it is also unclear how the Coalition plans to square away its austerity measures with its growth pledge as leader of the G20.

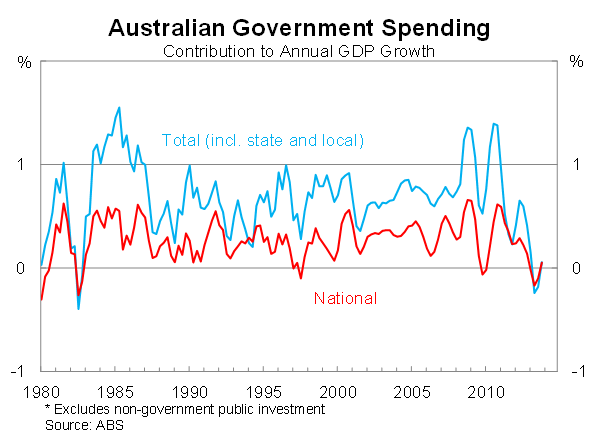

Over the past couple of years we have already seen some austerity across the three levels of governments. At the end of 2010, federal government spending contributed 0.6 percentage points to real GDP growth.

By 2013 the worm had turned and government spending was on the decline, subtracting 0.2 percentage points from real GDP growth in the year to June 2013. The contraction during 2013 was actually the largest in 30 years.

Based on the hype surrounding Treasurer Joe Hockey’s first budget it is reasonable to assume that the cuts will be more severe than those from the 2012-13 federal budget -- particularly given recent efforts to make government spending in 2013-14 as high as possible. If that eventuates, then government spending will subtract significantly from real GDP growth -- potentially over a number of years.

Understandably this poses a significant challenge for the Australian economy. The economy, at the present time, is tentatively poised. Low interest rates have boosted household spending and housing investment; however, the labour market remains subdued and mining investment is set to decline sharply over the next few years.

The collapse in mining investment could conceivably create a hole in real GDP of around 3 to 4 percentage points. The Reserve Bank of Australia hopes that housing investment and exports can fill the gap but with the dollar remaining stubbornly high and the non-mining sector subdued that is proving too optimistic.

The task becomes more difficult if government spending is off the table and instead creates a greater hole that needs to be filled. We could conceivably be looking at a 3.5 to 4.5 percentage point hole in the economy. Real GDP rose by 2.8 per cent over the year to December 2013.

Supporters of austerity are likely to argue that by reducing government spending they are freeing up resources that can be used better elsewhere. But that is a fallacy.

The common justification for austerity -- from a growth standpoint -- is that a high level of government spending raises interest rates and crowds out private investment. But that is not the case in Australia.

First, government spending in 2012-13 wasn’t high by historical standards; second, interest rates are not elevated; and third, new lending activity by businesses and households is through the roof.

There is evidently plenty of credit to go around and anyone that wants credit and can service that loan is able to borrow. The biggest problem is not a scarcity of credit but a lack of optimism from the business sector. By reducing demand, government spending cuts will only justify that lack of optimism. Instead of freeing up resources they may in fact leave resources unused.

There is widespread consensus that significant budget reform is necessary and I have certainly argued for extensive budget and tax reform in the past. But getting the timing right is essential.

Sharp cuts to government spending leading into a collapse in mining investment is the nightmare scenario but unfortunately a plausible one if the Coalition cuts spending significantly in the 2014-15 and 2015-16 financial years.

The Coalition’s budget cuts are unlikely to be as severe as recent speculation suggests. Nevertheless if they are greater than the Gillard government’s cuts during 2012-13 then they could lead to the sharpest contraction in government spending in at least 50 years.

If this eventuates then the economy will take a hit and it isn’t clear what will fill the void. The big challenge for the government is getting the timing right; reforming the budget is necessary but not yet urgent enough to warrant compromising the broader economy.