The RBA waits out Australia's credit conundrum

Normally the monthly credit numbers are a fairly uneventful affair -- certainly important and painstaking to put together, but generally quite dull. But recent comments by the Reserve Bank of Australia and RBA Governor Glenn Stevens suggest that the credit aggregates will receive a lot more attention in upcoming months.

In the Financial Stability Review, the RBA paints a pretty rosy picture for the household sector over the past six months, characterised by rising net wealth and fairly stable debt ratios. But following strong growth in lending activity by households and investors, debt ratios are set to rise towards record high levels during 2014.

The RBA believes that, on balance, “the pick-up in investor activity in the housing market does not appear to pose near-term risks to financial stability”, but it acknowledges that it will continue to monitor the market closely for signs of excessive speculation and riskier lending practices (Investors test the RBA’s homing instinct, March 26).

Stevens echoed similar sentiments in recent speeches and noted that it would be undesirable for annual housing credit growth to climb much higher.

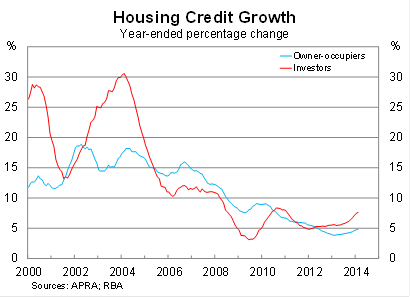

Housing credit rose by 0.5 per cent in February, to be 5.8 per cent higher over the year. Growth continues to be led by investor activity, with investor credit rising by 0.6 per cent in February. But monthly investor credit growth was actually at its slowest pace since September, though still growing quite strongly.

New investor lending activity continues to be elevated and I anticipate that investor credit growth will push back towards its pre-crisis level of around 10 per cent over 2014. Owner-occupier credit growth will not be as strong, but is also set to rise to levels that Stevens might find uncomfortable.

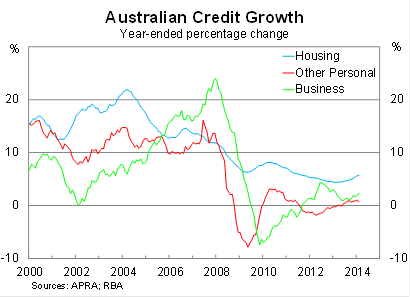

Housing credit is set to cause problems because it is too strong. However, business credit is set to cause its own problems -- it continues to be fairly weak. Business credit rose by 0.4 per cent in February but is just 2.4 per cent higher over the year.

Many businesses are utilising low interest rates to expand their operations but for many other firms, low lending rates have been used to pay down existing loan balances and refinance their loans.

Business investment activity is set to improve for the non-mining sector over the next couple of years, although investment from manufacturing firms is set to fall sharply. On balance, we should see annual business credit improve but at this point it seems unlikely that credit growth will return to its pre-crisis level.

In contrast to housing credit, personal credit fell by 0.2 per cent in February to be just 0.7 per cent higher over the year. It is difficult to square this away with the rapid rise in house prices, but households are showing a cautious attitude to other credit purchases such as motor vehicles and durable goods.

The contrast between housing, business and personal credit has created a difficult balancing act for the RBA. The housing market has arguably become too strong but low rates are necessary to generate greater momentum in business investment and facilitate the rebalancing of the Australian economy.

I’ve suggested that macroprudential policies would directly slow the housing market while allowing the business sector to benefit from low rates. This approach was followed by the Reserve Bank of New Zealand last year and has had considerable success so far.

It seems patently obvious that housing credit will continue to rise, quickly reaching levels that will leave Stevens feeling uncomfortable. The RBA has the tools available to address the issue but unfortunately seems more than happy to sit on its hands and wait it out for now.