The RBA must not let its rate cut go to waste

Following months of complacency, the Reserve Bank of Australia finally took steps to bolster Australia's fragile economic recovery. Now the real challenge begins: ensuring that the benefits of historically low rates don't simply accrue to the property sector and higher asset prices.

At today's meeting, the RBA lowered the cash rate by 25 basis points to 2.25 per cent -- the first move since August 2013. The cut caught market economists by surprise (though that's hardly unusual) while the market was pricing in a 56 per cent chance of a cut at the close of business yesterday.

Back in December the RBA flagged that a “period of stability” was in order, so what caused the turnaround? What has happened to the economy between now and December to justify an interest rate cut?

The RBA offers no such explanation. In fact the only major development since the December meeting is that the oil prices have fallen further.

One could argue that the cut was caused by headline inflation -- which rose by just 1.6 per cent over the year to the December quarter -- but that can't be it since the RBA expects that “inflation will remain consistent with the target over the next one to two years, even with a lower exchange rate”.

In the absence of a smoking gun, the only reasonable conclusion is that the RBA's decision this month amounts to an acknowledgement that it stuffed up by twiddling its thumbs last year and that the economic situation warranted a cut months ago.

The bank will receive no argument from me. I laid down the argument for a rate cut back in June and the major factors back then remain in play today (How the RBA got it wrong on rates, June 16). It has become abundantly clear since then the earlier cuts caused the Australian economy to peak too soon, which combined with a softer terms of trade left the economy poorly placed to offset the eventual decline in mining investment.

The bank does acknowledge that “output growth will probably remain a little below trend for somewhat longer, and the rate of unemployment peak a little higher, than earlier expected”. Though it remains unclear why its view on these variables has changed since December; perhaps it has suddenly realised that the lower terms of trade and associated income shock is actually happening.

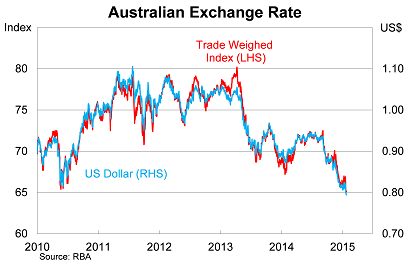

The Australian dollar has fallen sharply against other major currencies, down 8.5 per cent against the US dollar and 6.3 per cent against the trade-weighted index since December. But the RBA believes that “it remains above most estimates of its fundamental value, particularly given the significant declines in key commodity prices”.

Back in December, RBA governor Glenn Stevens flagged US75c as a likely target for the Australian dollar. The dollar could push through that level in the next few days later and move on to US70c and beyond.

More important, though, will be the progress made against the trade-weighted index -- particularly given quantitative easing programs introduced by both Europe and Japan. It remains less clear how much progress will be made on this front.

Finally, we arrive at the elephant in the room: the property market. The main reason to keep rates unchanged throughout last year was a concern that lower rates would inflation Australia's housing bubble even further.

The RBA shared that concern -- though it took them a long time to acknowledge it -- noting that in light of today's interest rate cut it is “working with other regulators to assess and contain economic risks that may arise from the housing market”.

That means the introduction of macroprudential policies. I'd assume policies that are stronger than those advocated by the Australian Prudential Regulation Authority in December. So far APRA has taken only minor steps to address investor activity, stating that “growth materially above a threshold of 10 per cent will be an important risk indicator for APRA supervisors in considering the need for further action”.

With investor activity already breaching that level, we can safely say that lower interest rates require the need for further action. What that involves remains uncertain, but a failure to act will all but ensure that today's rate cut was a wasted opportunity.

Part of the reason that lower interest rates have not provided sufficient bang for their buck can be understood by considering the financial sector's attitude to lending. The sector prefers mortgages (which have a lower perceived risk and therefore allow for a much higher degree of leverage) over business lending, thus creating a system that largely distorts the allocation of capital.

Business lending remains the key to the RBA's rebalancing story. It isn't the only way in which businesses can expand, but it is often the only way in which small businesses can survive and thrive. It also remains a significant source of funding for larger corporations. How exactly can the non-mining sector support the broader economy without access to reasonably priced credit?

The RBA made the correct decision to lower rates this month -- even if it failed to adequately communicate the idea -- but pulling the interest rate lever by itself won't be enough to boost the economy. Now it and ARPA must take steps to address imbalances in the Australian financial system. That can be achieved through the use of macroprudential policies and implementing the recommendations contained within the Murray report.