The RBA homes in on foreign investment

Should we be concerned about foreign investment into Australian real estate? New research by the Reserve Bank of Australia suggests those fears are misplaced. It may be right, but unfortunately poor data collection and monitoring make it difficult to pinpoint how prevalent foreign investment really is.

Based on current law, foreign investors cannot buy established dwellings as investment properties. Instead they can only purchase newly constructed properties.

Temporary residents -- with visas allowing for 12 months of continuous stay -- can apply to purchase one established dwelling to live in while in Australia. Temporary residents are required to sell that home when they leave Australia but it does not appear to be strongly enforced.

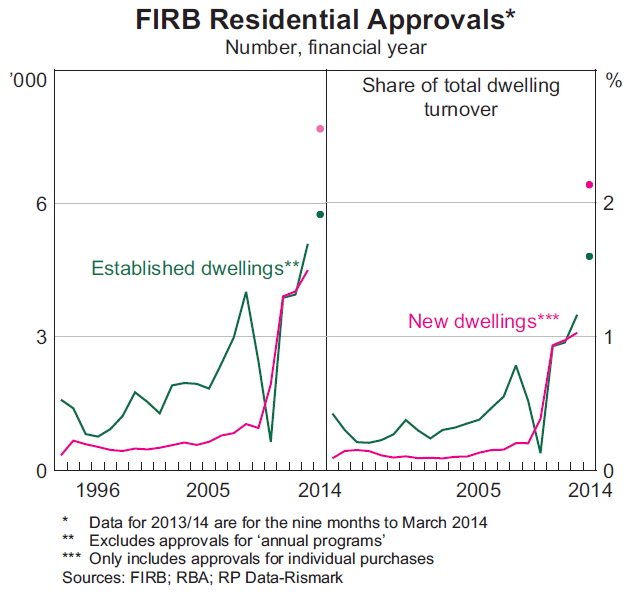

According to the Foreign Investment Review Board, foreign investment accounts for a relatively small share of real estate purchases. The value of foreign investment to residential property has increased from $6 billion annually in the 1990s to more than $17bn in 2012-13.

As a share of total residential approvals, foreign investment accounted for just 1 per cent of both new and established dwellings in 2012-13. However, as the dots in the graph below show, that is set to rise significantly during 2013-14.

The RBA notes that these estimates overstate the true level of foreign investment. For example, “while approval can be sought to sell up to 100 per cent of completed dwellings in a new residential project, a recent FIRB report noted that typically only around 35 per cent of the dwellings in such projects are actually sold to foreign citizens and temporary residents”.

On the other hand, it remains absurdly easy for foreign investors to get around the FIRB’s rules, such that the actual level of foreign investment is unknown. My best guess is that it may in fact be higher than the FIRB estimates but certainly lower than much of the anecdotal evidence supplied by real estate agents.

The more important issue is whether the benefits of foreign investment are sufficient to cover the costs.

The RBA notes that an increase in the demand for new or established dwellings is likely to increase housing supply. But the responsiveness of Australia’s housing supply to changes in demand is notoriously slow, “reflecting the lack of suitable brownfield and greenfield land for development, difficulties in planning coordination, and resistance by local residents to new housing projects”.

It then asks an important question: do foreign investors actually represent an increase in overall demand for housing in Australia?

The RBA argues that if a property is purchased to house an international student or temporary resident who otherwise would have rented, then demand for property is effectively unchanged.

By comparison, if a new property is left vacant after purchase, then this does constitute an increase in housing demand since we now need more housing to home our existing population.

I understand the logic of this argument but it assumes that buying and renting are perfectly substitutable. I wonder how many current renters would agree with that.

If we treat buying and renting as imperfect substitutes (or as different markets), with buying preferred to renting, then the argument begins to fall apart. In this situation, foreign investors will increase the demand for buying a home even if there are sufficient rental properties available.

As anyone who has been to an auction will confirm, property prices are often determined by a single buyer. A single buyer, by igniting competition, can have a significant effect on the successful price.

Foreign investors are capable of having a direct effect on prices through their purchases but they can also have an indirect effect because those receiving a higher sales price often go on to buy a new property. In that regard, foreign investment in established properties can have a similar effect to the first home owner grant.

The primary benefit of foreign investment is that it has helped support our local residential construction industry, which accounts for around 9 per cent of total employment. The RBA notes that “foreign residential demand has been especially helpful in boosting construction activity in the current state of the economic cycle”. However, the extent to which this has benefited employment is unknown.

In my opinion the biggest cost associated with foreign investment isn’t so much to do with house prices, but greater vulnerability to economic shocks. Widespread foreign investment leads to a more volatile housing market: greater gains during upswings but also greater losses during downturns (Counting the cost of foreign investment in Australia, March 24).

This new research paper by the RBA provides a solid overview of many of the issues surrounding foreign investment, although the FIRB does a fairly poor job of monitoring and enforcing its legal requirements. We shouldn’t overreact to foreign investment -- it probably isn’t a large share of activity -- but we cannot ignore the potential effects it may have on dwelling prices or the extent to which it leaves us vulnerable to overseas downturns.