The RBA gears up for two-speed lending

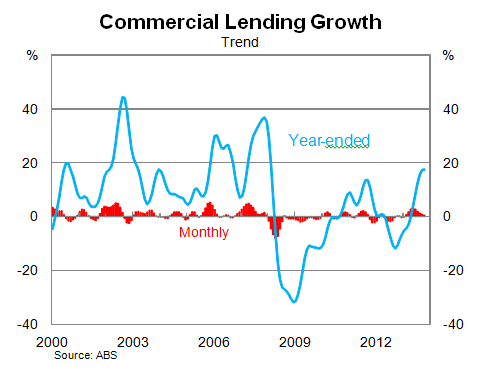

New lending activity has continued its upward march in January. But why hasn’t it translated into business credit growth?

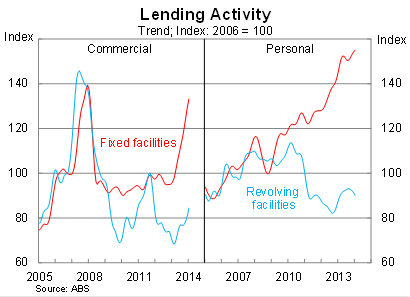

On a seasonally adjusted basis, commercial lending rose by 2.1 per cent in January, to be 40 per cent higher over the year. Low interest rates continue to boost lending activity for the business sector, but so far it has failed to cause a breakout in credit growth.

Annual growth for commercial lending has now trended upwards to its highest level since December 2007. In addition, the monthly data suggests that for now momentum has stabilised at a particularly strong level.

In January, commercial lending growth was broad based across fixed and revolving facilities. Revolving facilities are showing some sign of improvement over the past year, although obviously it is coming off and incredibly low base.

Personal lending declined by a further 1.2 per cent in January and is down 3.2 per cent since August. Revolving facilities -- including credit card usage -- remain particularly weak, as it has for a number of years.

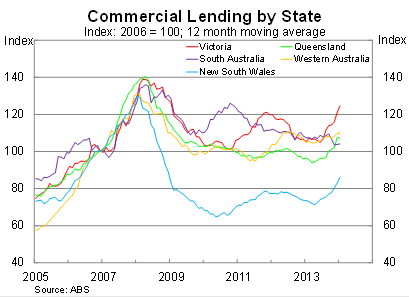

At the state level, lending conditions differ significant between states. We have states where lending growth is strong such as Victoria, Queensland and New South Wales, but we also have subdued conditions in Western Australia and South Australia.

For Western Australia, this is likely due to mining companies receiving foreign rather than domestic funding and some softness for the non-mining economy. However, for South Australia, it presumably reflects a lack of investment opportunities and optimism for the future.

New South Wales is quite interesting, given the divergence between lending demand for households and businesses. Business lending has obviously improved – albeit from a low base – but the improvement is nowhere near as prevalent as that achieved by household lending over 2013. Are households too optimistic or are businesses too pessimistic? I’m inclined to believe the former.

The lending data provides further evidence that low interest rates are helping to support the non-mining economy. However, this has yet to translate into a boost for business credit balances outstanding. This suggest that many businesses are taking advantage of low interest rates by refinancing existing loan commitments or winding down their loan balances. Rather than seek out new purchases or investment opportunities, they are instead happy to simply improve the quality of their balance sheets.

Until business credit begins to gather momentum, it is reasonable to conclude that many businesses remain cautious about their prospects. Normally, interest rates this low would lead to a sharp rise in credit, but so far it has simply created a two-speed lending environment.

The risk for the Reserve Bank is that they might find themselves in an uncomfortable position, facing high house prices and strong retail spending but also weak business credit and an impending business investment collapse. Balancing the needs of the household and business sectors is likely to prove difficult, but for now the RBA will simply be content that low interest rates are spurring lending activity for some businesses.