The pros and cons of reverse mortgages

Summary: If it is alleviating financial stress, reverse mortgages are an attractive option for the 'asset rich and cash poor' retiree. |

Key take-out: A modest additional income from a reverse mortgage might have a significantly positive impact on quality of life, and still allow enough value in the home to support beneficiaries or access nursing care. |

Key beneficiaries: Retirees. Category: Strategy. |

Reverse mortgages, a financial product that allows people in retirement to take money to fund their cost of living while building a loan against the value of their home, often sit opposite to some key financial goals of people.

From my experience most people like the idea of owning their home outright, and being able to leave a significant pool of assets when they pass away. A reverse mortgage, which effectively builds an ongoing and increasing loan against the value of a person's property in exchange for some immediate cash flow, sits opposed to those financial goals.

That said, reverse mortgages have become a better regulated financial product and, with the harsher age pension test coming from January next year, they are a personal finance option that people should be aware of.

We often hear about the plight of the "asset rich and cash poor" retiree. The reduced number of people able to access some part age-pension from next year will only exacerbate this problem, and reverse mortgages are certainly a financial product that deals with this – allowing people to access some of the value of their home as cash.

The key regulatory improvement came in 2012, with protections against ‘negative equity' in reverse mortgage loans, meaning that what you ended up owing the lender could never be higher than the value of the house. This provides certainty that the only asset effectively used to secure a reverse mortgage is the property itself.

Two key risks – interest rates and future cash access

A key input into any loan is the interest rate charged. A quick scan of interest rates available show that reverse mortgages have higher interest rates than standard loans – something around 6.0 to 6.5 per cent per annum appears to be standard at the moment. This, of course, is one of the key challenges around using a reverse mortgage; interest rates are significantly higher than a standard loan, and may rise in the future.

Another risk to be aware of is that if you have to sell your home in the future, perhaps to access nursing care, the loan has to be repaid at this point in time. This will reduce the amount of money that you have available at that point in time.

ASIC's MoneySmart website further discusses issues to be aware of in considering a reverse mortgage.

Supplementing your income

Those negatives aside, I think there are situations where the benefits of immediate income might mean someone is prepared to use a reverse mortgage. A modest additional income from a reverse mortgage of $100 a week might have a significantly positive impact on someone's quality of life, without building up too significant a debt.

To look at how this scenario might work, let's consider a person who is 70 years of age. They own their home worth $600,000 outright. Let's assume that they have $800,000 of assets which excludes them (from next year as a home-owning single person) from receiving any part age-pension. They are very conservative investors, holding most of that $800,000 in cash – currently returning them around $24,000 in interest per year.

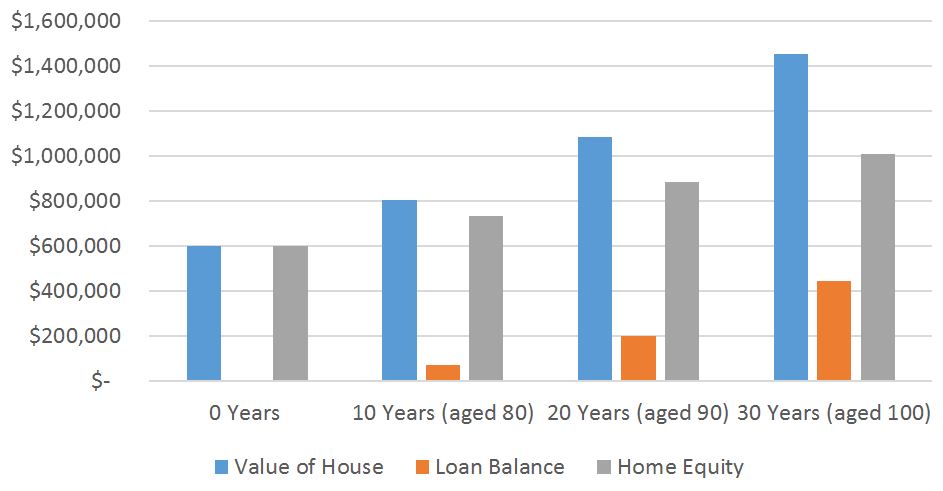

Let us look at the situation if they were prepared to use a reverse mortgage loan, assuming an interest rate of 6.25 per cent (and using the calculator on the MoneySmart website). They want to access another $100 per week, which they suggest will significantly improve their quality of life. The calculations also assume that they currently have a home worth $600,000, and that home increases in value by 3 per cent per year. The summary of the situation follows:

Chart 1: 30-year reverse mortgage at 6.25 per cent.

Source: Moneysmart.gov.au

It is interesting to note that a withdrawal at the rate of $100 a week, even over a 30-year period, will still see ‘home equity' in the overall situation continue to grow.

One challenge with this calculation is that it does not take into account inflation. If we were to assume that inflation was around 2.5 per cent over the 30-year period, we would expect the value of goods and services to roughly double, or the value of money to halve over that period. That would make the home equity value of $1.012 million in 30 years time equivalent to around $506,000 in today's dollars. In real (after inflation) terms, there has been a reduction in the value of home equity. This would have to be weighed against the benefits of receiving $100 a week over a 30-year period.

Conclusion

Choosing to take out a reverse mortgage is not an easy decision – going into retirement while managing an increasing loan is hardly ideal. However, there are many people who struggle along through retirement with such a low level of income that it creates financial stress.

Using a reverse mortgage to access some additional spending money in a modest way might still allow people to keep enough value in their home to allow for supporting beneficiaries on their death, or accessing nursing care, while providing an immediate and ongoing improvement in their quality of life.

With reducing age pension access, an extended period of below-average sharemarket returns and historically low interest rates on cash investments, it might be a ‘backstop' personal finance strategy worth keeping in mind.

Frequently Asked Questions about this Article…

A reverse mortgage is a financial product that allows retirees to access the equity in their home to fund their living expenses. It involves taking out a loan against the value of the home, providing immediate cash flow while the loan amount increases over time.

Reverse mortgages are particularly beneficial for 'asset rich and cash poor' retirees who need additional income to improve their quality of life without selling their home.

The main risks include higher interest rates compared to standard loans and the requirement to repay the loan if the home is sold, which could reduce available funds for future needs like nursing care.

Since 2012, regulations have included protections against 'negative equity,' ensuring that the amount owed cannot exceed the value of the home, providing more security for borrowers.

While a reverse mortgage provides immediate income, it can reduce home equity over time due to accumulating interest. However, if the home's value appreciates, equity may still grow, albeit at a slower rate.

Yes, a reverse mortgage can impact age pension eligibility, especially with stricter pension tests. It allows retirees to access cash without affecting their pension status, which is crucial as fewer people qualify for the age pension.

Interest rates for reverse mortgages are typically higher than standard loans, ranging from 6.0% to 6.5% per annum, which can increase the overall cost of borrowing.

For some retirees, a reverse mortgage can be a viable strategy to supplement income, providing modest additional funds that can significantly enhance their quality of life while preserving enough home value for future needs.