The problems with annuities

|

Summary: There are definite advantages in having a guaranteed income stream in retirement, and more Australians are likely to invest in annuity products to achieve that objective. Changes in legislation are set the make deferred annuities more tax effective. |

|

Key take-out: Investors might be attracted to the simple, low risk structure of annuities, and the idea of removing market risk. However, the current low interest rate environment could make annuities less attractive, and they don't offer the flexibility some investors crave. |

When I started working in financial markets at the start of this century, some of the best positioned retirees I was working with had taken out annuities during the high interest rate period of the early 1990s.

They had positioned themselves beautifully for retirement – a risk-free income stream with an earning rate of more than 10 per cent (annuity returns are influenced by the cash rate of return at the time they are purchased). There was an additional bonus where, at the time, annuities had Centrelink benefits allowing additional access to the Age Pension. In the period since those annuities were taken out, inflation has also remained under control (compared, say, to the high inflation in the 1970s) which is important in keeping the purchasing power of the income stream strong.

The basics of annuities

The basic structure of an annuity is relatively straightforward. As an investor, you ‘purchase' an annuity with a set amount of money in exchange for regular payments over a set period of time. The payments include both some income and the return of your capital, so that at the end of the stipulated period, there is no remaining value in your annuity.

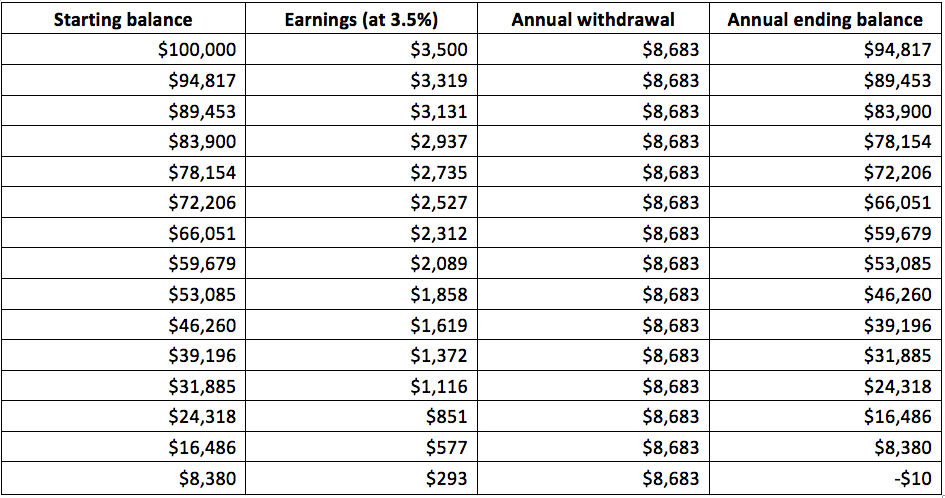

For example, a quote from a current annuity provider in Australia shows that for a 15-year term, say someone from age 60 to 75, a $100,000 annuity would pay $8,683 per annum over that period. That effectively puts a total of $130,245 into a retiree's hands for their $100,000 investment.

While annuities were tremendous value in the early 1990s when cash rates of return were high, the current low interest rate environment make them less attractive – although that is true of all cash-related investments.

This example is based on the simplest of annuities available. Two key risks of annuities have been addressed by annuity providers. The first is that if you purchase an annuity for a set term, there is the risk that you will outlive your income stream. There are now annuities that pay an income stream for your lifetime. Another risk is a period of high inflation eating into the purchasing power of your annuity payments (the $8,683 per year in income from the annuity example will buy significantly less goods and services in 15 years if there is a period of above average inflation). There are now annuities that provide ongoing payments that are against inflation.

Comparing the numbers

As an exercise, let's model what sort of return you would need if you were to start with $100,000 and take $8,683 in annual withdrawals over 15 years. The answer is 3.5 per cent – slightly above what you can get on the best online cash accounts right now.

However, this is still a rate of return that is achievable for an investor prepared to take just a little bit of risk beyond simple cash investments. While it would introduce a little capital volatility risk, minimal exposure to high yield shares and listed property trusts could achieve a similar outcome.

Looking at the following table, I suspect some investors will say that they like the idea of the simplicity and low risk of handing their money over to an annuity provider in exchange for the regular income, while others will look at the figures and think that they should be able to do a little better themselves:

Deferred lifetime annuities

A change in the legislative environment looks to encourage a different type of annuity, although I am not aware of any annuity providers planning to offer it in Australia just yet.

A ‘deferred lifetime annuity' will allow people to purchase an annuity now, and receive the income stream from it in the future. For example, you might retire at the age of 60, and want to be sure of an income stream later in your retirement, say from age 75.

The legislative change that is proposed to support this will allow the earnings of the assets held by the annuity provider to be tax-free over this period, in the same way the earnings of a superannuation fund are tax-free. This tax benefit will increase the effective earning rate of the assets, and the amount of income available to be paid by the annuity.

Removing market risk

There is a financial planning quote that I particularly like: “Cash lets you sleep, shares let you eat”.

Annuities are a cash-style investment, that effectively take the ‘market risk' out of investments by providing a known stream of future income payments. On that basis, they are likely to be the ‘let you sleep' investment option of choice for some retirees for all or part of the cash holdings in their portfolio.

Market volatility sends investors looking for low risk personal finance strategies. The use of annuities, with their set income streams, seems like a simple, attractive option.

A word to hands-on investors

It is less certain whether annuities will be the investment choice for more ‘hands-on' investors, as trading off a lump sum of cash for a series of income payments reduces the flexibility available from the cash part of the portfolio.

The benefits of managing cash as a cash holding rather than investing in an annuity for a more hands-on investor include:

- Maintaining the ability to rebalance your portfolio. A cash holding when markets fell during the GFC would have provided you with the flexibility to rebalance your portfolio and buy extra shares when they had fallen sharply in price, and were paying very attractive dividends. Buying an annuity with your cash does not provide you this flexibility.

- Using lump sum withdrawals from your cash holding. Whether it be for a great value cruise holiday or a compelling investment opportunity, a cash holding provides you with the ability to withdraw lump sums where an annuity does not.

- Reducing the overall volatility of a portfolio. There are two key roles for cash in a portfolio beyond just returns: To dampen volatility and to provide liquidity. Having a significant holding of cash in a portfolio reduces the fall in the overall value of a portfolio, thereby dampening volatility. That said, an annuity does provide the peace of mind of reliable income payments.

- Maintaining the ability to benefit from increased cash rates (keeping in mind, you would also be hurt by falling interest rates). Given that we would seem to be in a low interest rate environment at present, an annuity will not allow you to benefit from future interest rate increases as payments are set. A cash holding will allow you to pick up these benefits.

- Passing on the full value of your remaining cash to the beneficiaries of your estate. While some annuities do allow some minimum payment terms on your death, you need to be aware of the conditions attached to any annuity that you own. If you have a cash investment, it is dealt with by your estate.

Annuities certainly have their place, and will suit the needs of some investors. However, a more hands-on investor might prefer the flexibility of managing their own cash investments, particularly in the current low interest rate environment which is reflected in lower annuity income payments.

Frequently Asked Questions about this Article…

Annuities provide a guaranteed income stream in retirement, which can be appealing for those looking to remove market risk from their investments. They offer a simple, low-risk structure and can provide peace of mind with regular income payments.

The current low interest rate environment makes annuities less attractive compared to when interest rates were higher. This is because annuity returns are influenced by the cash rate at the time of purchase, leading to lower income payments in a low-rate environment.

A deferred lifetime annuity allows you to purchase an annuity now and receive income payments in the future, such as starting at age 75. Proposed legislative changes will make these annuities more tax-effective by allowing the earnings to be tax-free, similar to superannuation funds.

Annuities may not be ideal for hands-on investors who prefer flexibility. Trading a lump sum for regular payments reduces the ability to rebalance portfolios, make lump sum withdrawals, and benefit from rising interest rates.

While annuities offer a stable income stream, other cash investments like high-yield shares or listed property trusts might provide better returns with some risk. Annuities lack the flexibility to adjust to market changes or interest rate increases.

Key risks include outliving the income stream and inflation eroding purchasing power. However, some annuities now offer lifetime payments and inflation-adjusted income to mitigate these risks.

While some annuities offer minimum payment terms upon death, they generally do not allow the full value to be passed on to beneficiaries like cash investments, which are handled by your estate.

Retirees seeking a low-risk, predictable income might prefer annuities as they remove market risk and provide a known stream of future income, making them a 'let you sleep' investment option.