The next crisis will test the lucky country

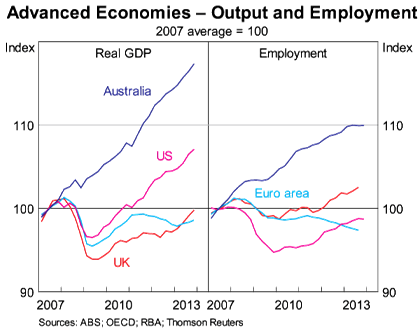

It’s been seven years since the onset of the global financial crisis and five and a half years since the collapse of Lehman Brothers brought the world’s financial markets to the brink of ruin. How exactly did Australia avoid a collapse that captured most of the developed world? It was likely a mixture of good luck and good management.

Reserve Bank of Australia Assistant Governor Malcolm Edey spoke yesterday at the CFO Summit on the Gold Coast, providing some reflections on the financial crisis. Views on the global financial crisis naturally differ -- a crisis of this magnitude will never have a singular underlying cause -- and multiple columns could (and inevitably will) be dedicated to discussing these issues.

But it is perhaps more interesting to discuss Edey’s view on why Australia avoided a recession. To his credit, he didn’t shy away from the fact that there was a lot of luck involved -- amid some good economic management.

First and foremost, we were incredibly lucky to be geographically well connected to the fastest growing region in the world economy at a time when the demand for our resources was expanding at a rapid rate. No amount of good economic management would have allowed us to avoid a recession if it wasn’t for demand from China.

Edey says that high interest rates in the lead up to the GFC helped to “limit some of the aggressive risk-taking seen elsewhere, and it allowed plenty of room to shift to a more expansionary stance when that was needed”.

That is certainly true but in part the high interest rates -- or at least the last few moves in 2007 and 2008 -- were evidence of the RBA failing to recognise the size and scope of the impending financial crisis prior to the collapse of Lehman Brothers.

At the time, it was too inward looking, focusing on domestic inflation and wage pressures, under the belief that our proximity to China had decoupled the Australian economy from the United States and Europe.

The RBA was certainly not alone in failing to recognise the severity of the crisis. But with so few staff remaining from Australia’s last recession, there was a clear lack of appreciation for what was happening.

That indecision left the Australian economy susceptible to a swift collapse in domestic demand. To the RBA’s credit, it cut rates swiftly after Lehman Brothers collapsed, but by that point it was simply hoping that the Australian economy could hold on long enough for low interest rates to work their magic and provide relief for households and businesses and help free up the financial system.

Our regulatory framework, which arguably has higher expectations for our domestic banks than some foreign frameworks, certainly helped us weather the storm. Australia’s financial system didn’t suffer to the same extent as the US or Europe, though we certainly had our dicey moments particularly with the near collapse of Bankwest.

Luckily for the RBA, the federal government acted swiftly via a stimulus package that was largely unprecedented, both in Australian history and by international standards. Unlike many other countries, Australia had both the finances and political will to push through a large stimulus package and maintain it for a long period of time.

There is naturally debate as to whether the Rudd Government got the stimulus right. Did they spend too much? Or not enough? Did they balance short-term handouts with long-term infrastructure projects? But at the time, facing considerable uncertainty, the most important characteristics of the stimulus was that it was large, decisive and it sent a clear message to financial markets.

In my view, a mixture of China, a solid regulatory framework and the federal government stimulus explains why we avoided a recession after Lehman Brothers collapsed. A mixture of China and low interest rates helped the economy maintain its momentum through difficult times.

Australia was certainly lucky when it came to the GFC. I wonder how we would have coped had it happened five years earlier, or five years later. Our resilience was perhaps a product of its time: the worst events happening at the best time for Australia.

And that luck is why Australia should heed the lessons learnt elsewhere. Australia is better than most, but our banks also need to have better risk management and stronger capital and liquidity buffers to reduce the systemic risks to the financial system and the broader economy. We might have been incredibly lucky last time but we cannot assume that we will be so lucky when the next crisis hits.