The misguided energy superpower narrative

Former Treasury secretary Ken Henry gave a speech on Tuesday outlining the danger that we have fallen under the spell of a narrative which says the route to economic prosperity is built on exports above all else.

Henry pointed out that a focus on improving the competitiveness of our exporters was a good thing, but this was part of achieving the final end-game – improving both present and future Australians’ overall quality of life. Henry noted that this focus on exporters was very useful in helping the general public to see the value in a range of economic reforms which unfolded over the 1980s. Yet these reforms were, in fact, great for the economy as a whole – not just exporters. However, he was worried this heavy emphasis on export competitiveness was now acting to distort public debate in ways which distracted us from the final end-game.

Unfortunately, this government is in real danger of falling for a sub-narrative related to this, one that has its roots in the 1970s but doesn’t make sense today.

A range of statements from this government seem to suggest it believes that Australia’s economic prosperity and competitive advantage rides upon the availability of cheap energy for domestic use.

Back in December last year when under pressure about what he’d do in response to the closure of the car industry, in particular, as well as other manufacturers, Tony Abbott responded that he was aiming to get power prices down and that Australia ought to be “an affordable energy superpower”. He has subsequently repeated this claim on a number of occasions, that a key element to Australia’s prosperity is as an affordable energy superpower.

Industry Minister Ian Macfarlane has echoed the rhetoric. In a speech to CEDA last week he said:

“…issues relating to energy and energy market reform are central to our economy, because access to affordable and reliable baseload power has long been one of Australia’s most potent competitive strengths. It will be equally as important in building the industries of the future.”

This theme also crept into the Warburton Review of the Renewable Energy Target, which argued:

...access to cheap and reliable power (historically, predominately provided by coal) helps to underpin Australia’s economic growth and Australia needs to balance its emissions reduction efforts with the need to maintain this source of competitive advantage.

Firstly, it’s worth pointing out that Australia’s energy may not actually be that cheap irrespective of what the government might or might not do. But putting this aside for one moment. let’s consider whether low-cost energy is particularly important to economic competitiveness anyway.

In evaluating this issue there’s no point including the use of petroleum-based fuels. These are traded across the globe with Australian prices reflective of international conditions, so no room for competitive advantage there.

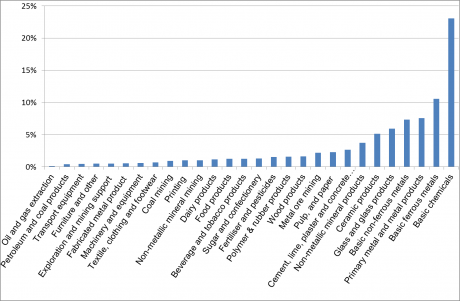

So excluding oil, the chart below details non-petroleum energy costs as a proportion of overall costs for Australia’s mining and manufacturing sectors. As is readily apparent, energy is actually incredibly unimportant to the competitiveness of most manufacturing and mining industries (it’s even less important to industries outside of manufacturing).

Figure 1: Energy as a proportion to total expenditure for Australian mining and manufacturing sectors

Source: Australian Bureau of Statistics (2010) 4660.0 - Energy, Water and Environment Management, 2008-09

There are basically a handful of industries where non-petroleum energy is an important factor to competitiveness:

– Steel furnaces (basic ferrous metals)

– Basic chemicals

– Building materials (Glass, cement etc.)

– Non-ferrous metals, primarily aluminium smelting and alumina refining

These industries together represent the grand sum of less than 3 per cent of Australia’s GDP.

Even when you look at these specific industries you find that Australia’s competitiveness has always been questionable, in spite of Australia apparently being predisposed to be a cheap energy superpower.

Let’s start with steel. If proximity to the raw materials was a major advantage then you’d expect Australia to dominate global steel production, given we supply half the global seaborne coking coal supply and have similar dominance in iron ore. But we’re an absolute steel production minnow – and always have been. On the other hand Japan and Korea, which have virtually no raw materials and really high energy costs, have traditionally been major steel producers. In the end, shipping the raw materials is cheap. Proximity to major customers – such as ship builders and car manufacturers –seems to be rather more important.

Again, with chemicals – apart from nitrogen-based fertilisers and explosives – Australia has never been much of a beacon for investment in chemical plants. Interestingly, where we happen to be OK – in nitrogen-based chemicals – we also happen to have two world-scale, large consumers of these products, in mining and agriculture. Now, we have traditionally also had access to the key input to these chemicals, in lots of cheap methane gas. Alas, that gas is no longer cheap because we can now liquefy and ship it to places like Japan and China. So unless we want to impose central planning on the gas industry, we can give up on gas as a means to become an affordable energy superpower.

Building materials? The problem here is this stuff, to a large extent, is heavy relative to its price or just generally not well suited to transport, such as glass. Australia’s producers of cement and glass have been entirely focused on the domestic market, so not sure how this is a great opportunity for growth of economic wealth.

This then leaves us with aluminium, alumina and other metals. Australia has actually been pretty good at alumina refining thanks to proximity to excellent bauxite deposits and low-cost energy. It’s the one area where Abbott and Macfarlane’s affordable energy superpower dream rings true. Pity there isn’t that much money in it. And there’s even less money in smelting it into aluminium metal. Aluminium smelters are to a large extent struggling to cover their costs, and they aren’t particularly big employers either.

So there you go. Even if Australia’s major competitive advantage is cheap energy and, particularly, cheap electricity for domestic use – it ain’t worth much. What does seem to be far more valuable is the exporting of energy to others.

If Abbott and Macfarlane think we’re going to get rich on the back of being an affordable energy superpower they’re fooling themselves. So time to abandon that narrative.