The market stillness before the storm

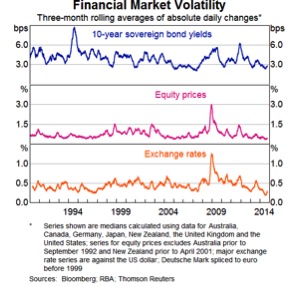

“Financial markets have been quiet, maybe too quiet,” according to Reserve Bank of Australia assistant governor Guy Debelle. Nevertheless, volatility has picked up somewhat more recently and the VIX, a common measure of implied volatility in financial markets, has increased to its highest level since February.

But the market remains remarkably calm given the combination of “heightened tensions in the Middle East and Eastern Europe, uncertainty about … US monetary policy, a succession of strong US job numbers, uncertainty about … policy in Europe and Japan, as well as increased concern about the strength of the Chinese economy”.

As Debelle says, volatility has been mild in the “face of a number of events which individually would normally be associated with high volatility”. Not being a markets person, I'd found this somewhat surprising and attributed it to a combination of central bank forward guidance and excess market liquidity.

Debelle fleshes out some of these arguments, though he doesn't find any of the reasons that compelling. He notes that “while there is more forward guidance from central banks in place than in the past, investors don't have to believe it.”

It's an excellent but underappreciated point.

Forward guidance has been hit-and-miss. The Federal Reserve and the Bank of England had to change their forward guidance so frequently that it probably added to market volatility. The RBA has had more success, but it's probably easier to be credible when you declare that you have no intention of doing anything.

Debelle finds it somewhat surprising that “the market is willing to accept the central banks at their word and not think so much for themselves”. Given the recent forecasting performance of central banks, which have typically been biased on the upside, the market remains incredibly naïve.

In Australia, every market economist holds the same belief that the RBA will lift rates next year, despite the range of headwinds and challenges facing the Australian economy. Unfortunately it's better to be collectively wrong than prove a different point-of-view for investors and market participants.

The important point on interest rates is that it remains data-dependent. The RBA might have a central view of how the economy will develop and what might prompt a rate rise, but that narrative can easily change. As the RBA and Debelle have noted in the past, the RBA is dreadful at economic forecasting.

It remains unclear when volatility will return to the market, except to say that it certainly will at some point. In a sobering assessment of financial markets, Debelle says that there are “reasons to suspect that the sell-off, particularly in fixed income, could be relatively violent when it comes”.

Debelle believes that “there are a number of investors buying assets on the presumption of a level of liquidity, which is not there”. When investors rush for the exits, they will find that the market lacks the liquidity to get the deals done.

At the same time, some investors are playing a risky game by assuming that they can exit the market ahead of any sell-off. History says that is often a path to failure.

Debelle also warns about the role of mechanical rules or mandates, which could result in volatility breeding greater volatility. We shouldn't assume that the sell-off will be any more rational than the current period of extremely low volatility.

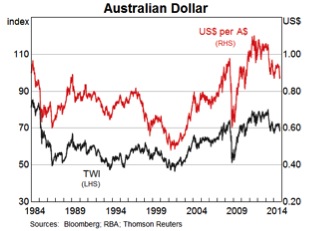

On the exchange rate front, the story remains fairly simple: the Australian dollar remains too high. The dollar has depreciated significantly against the US dollar recently but the trade-weighted-index has simply returned to levels from earlier this year. Importantly for the Australian TWI, the Chinese renminbi has also appreciated, moving in line with the US dollar.

But the Australian dollar remains somewhat higher than its fundamentals. In particular, it remains much stronger than our terms of trade. From an economic standpoint, we need a lower dollar to support Australian exports and reduce the demand for imports, thereby shifting demand towards Australian-made products. As it stands, the Australian dollar isn't providing the level of economic support that the RBA had hoped for when they began cutting rates back in 2011.

Debelle's speech should give investors and market participants plenty to think about. Low volatility might sound good, but in the presence of so many economic and financial shocks it feels like a harbinger of more difficult times: the calm before the storm. Finally, if recent developments persist, then it may be time to declare that those difficult times have already arrived.