The major retailer that's now thrashing Myer and DJs

How times have changed in Australia’s retail sector. We all know that overseas online retailers have burst onto the local scene with a bang, leaving many players on the back foot.

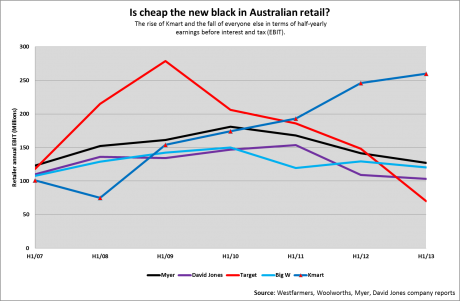

But behind this trend another revelation has emerged. Kmart is now also, as far as earnings go, leaps and bounds ahead of the big end of town.

(Click to enlarge)

Kmart, which was once the laggard, earning less $80 million in 2008, now leads the sector. Meanwhile, Target, which once led the sector with a peak half-year earnings before interest and tax (EBIT) of $279 million in 2009, now earns the least of all the big retailers. The figures also reveal just how closely aligned Myer and David Jones’ results actually are. Though, Myer has always outperformed David Jones in terms of earnings.

Perhaps the most interesting point on this graph is Kmart’s rise to lead the sector. The retailer’s titanic shift over the years has been largely attributed to the work of its current chief executive Guy Russo, appointed to the role back in 2008. Tellingly, in a recent interview Russo, an ex-McDonald’s chief, didn’t attribute the turnaround to Kmart’s online efforts. In fact, there’s no mention of Kmart’s online strategy in its latest annual report.

Instead, he said the work is largely a result of limiting the company’s product range, eliminating the need for middlemen and setting up its own supply offices in China, India, Bangladesh and Hong Kong. Its strategy is to turn a profit through selling a huge volume of units at low prices. The company is also attempting to reposition its brand away from ‘everything is cheap’ to ‘you’ll be surprised how cheap this quality product actually is’.

So what can the other retailers learn from this? Not much, some may argue. Particularly given that David Jones and Myer play in the higher end of Australia’s retail market, well away from Kmart’s products and prices. That makes Myer and DJs more susceptible to online disruption than Kmart.

But if this graph shows us one thing, it’s the difference a clear, targeted strategy can have on a retail business.

Given all this, it will be interesting to see what strategy and target market a joint Myer and David Jones may end up pursuing, if they do to decide to merge.

If Kmart can turn itself around with the right strategy, then what’s to say the department stores can’t?

Got a question? Ask the reporter @HarrisonPolites on Twitter or leave a comment below.