The lucky country loses its shine

Short-term arrivals are set to receive a boost on the back of a weaker Australian dollar but immigration continues to soften. Weakness in the Australian economy -- and improving prospects aboard -- are weighing on net immigration and presents a considerable challenge for the retail sector in the years ahead.

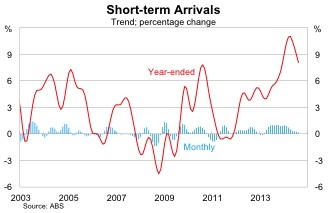

The number of short-term arrivals to Australia -- trips lasting less than one year -- has begun to slow following particularly strong growth earlier this year. Short-term arrivals rose by 1.6 per cent in August according to the volatile seasonally-adjusted measure but the trend has clearly turned south.

The recent moderation could reflect a number of factors -- including simple volatility -- but it is likely that the relatively high Australian dollar is having some effect. The effect of the dollar can be distinctively observed within the data.

After Australia’s trade-weighted-index peaked in mid-April 2013, it fell by around 16 per cent by late January 2014. That was a great period for visitors but it was also short-lived, with the dollar quickly rebounding by 7.0 per cent through to the end of August.

But the tourism industry can breathe a sigh of relief. With the dollar declining significantly in September -- in line with the deterioration in the iron ore sector -- the tourism industry is set to be the big winner. Expect short-term arrivals to begin to pick up over the remainder of this year, although obviously a lot depends on whether the recent weakness in the dollar persists.

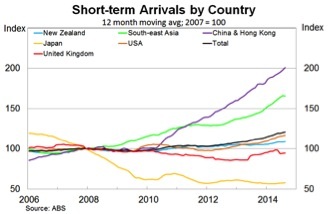

Backing away from the recent trend for a second, the growth over the past few years has reflected a strong increase in visitors from China and South East Asia. That won’t surprise a lot of people, but the graph below does help to visualise the phenomenon.

While short-term arrivals to Australia fell sharply from countries such as Japan and to a lesser extent the United Kingdom, the number of Asian visitors -- particularly from China -- soared. The high Australian dollar would certainly have scared many visitors away, as did the economic crisis in Europe and the United States.

The rising number of Asian travellers simply reflects their relatively strong economic performance and rising affluence. I expect to see this upward trend continue -- albeit at a more moderate pace -- in the years ahead. Chinese visitors only account for 13 per cent of total short-term visitors and clearly that can go a lot higher.

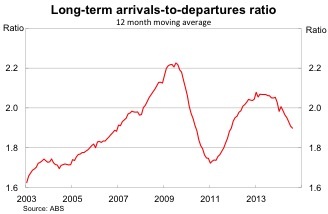

But while short-term visitors are set to boom, the same cannot be said of long-term migration. The graph below shows the ratio between long-term arrivals and departures -- effectively net migration -- and it has started to trend downwards.

This reflects three fundamental factors.

First, the global economy continues to improve. Second, expectations for growth in Australia have softened. Third, the Australian dollar is now weaker.

People generally move country for new or better opportunities. Over the past decade Australia has been a high-income, high-growth and high-exchange rate country; it was a perfect mix for high immigration.

Couple that with the mining boom -- which often allowed unskilled labourers to earn six figure incomes -- and it was hardly surprising that Australia’s population has boomed.

But the global economy is improving and at the same time the Australian economy has begun to moderate. Australia is no longer as appealing -- for both immigrants and Australians considering overseas opportunities -- and that is reflected in the graph above.

With the dollar set to decline further over the next couple of years and the Australian economy experiencing a negative terms-of-trade shock and the collapse in mining investment, I’d expect this trend to continue. Obviously net migration will continue to be positive but we might return to the relative levels that were normal prior to the mining boom.

This will be a positive or a negative depending on your persuasion. It may ease some infrastructure bottlenecks and the demand for housing but it will definitely be felt throughout the retail sector. One of the major effects will be felt by measures of real GDP, which increasingly reflect population rather than productivity growth.

Short-term arrivals have moderated recently but the outlook remains bright given recent developments for the Australian dollar. The same cannot be said of longer-term arrivals, with Australia’s period of high net immigration coming to an end.