The jobs picture is starting to look ugly

According to ANZ research, up to 75,000 resource-related jobs could be lost over the next couple of years. But with growth expected to remain below trend for some time, the economy will struggle to absorb these losses and, even if it does, those jobs will be at much lower pay.

The resource sector has shifted from the investment and construction stage of the mining boom towards the less labour-intensive production stage. In the process, thousands of Australians will be shown the door.

Mining giant BHP Billiton is understood to be considering job cuts of around 3,000 from its iron ore division (almost 20 per cent of employment in that division). Iron ore prices have declined sharply throughout 2014, placing increased pressure on margins and prompting mining companies to bring forward some of their job cuts.

The ANZ research, discussed in detail here, is broadly consistent with earlier research from NAB, which pointed to as many as 100,000 jobs being lost over a similar timeframe. Regardless of which estimate you take, the effect is significant and could push annual employment growth well below its current level.

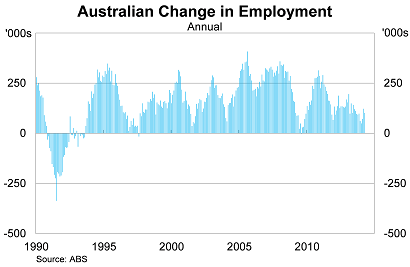

Employment growth has shifted down significantly over the past few years, with employment rising by just 101,000 over the year to May 2014. With the retail sector slowing significantly and the manufacturing sector continuing to deteriorate -- in addition to losses in the mining sector -- the outlook for employment is far from pretty.

ANZ senior economist Justin Fabo noted that it was not clear how many of the workers losing their resource sector jobs would end up being unemployed. Some foreign workers could return home, while others could be absorbed by other parts of the economy.

Unfortunately the broader economy is poorly placed to absorb these losses. Furthermore, a high level of job losses within a single sector may give rise to greater structural unemployment.

The RBA noted in the minutes to its March board meeting that around 400,000 to 450,000 people leave employment each month and a similar number of people take up new employment. In that light, 75,000 people losing their jobs over a couple of years doesn’t seem that bad.

But it can become problematic when a high level of job turnover is concentrated within a specific sector or among employees with a similar skill set. Those skills may not be easily substitutable or compatible with the new jobs being created.

The reality is that a high number of people with similar skills will be competing for a small number of jobs that take advantage of those skills and experience. And since there will be oversupply of those skills, their bargaining power will be diminished. Other employees may simply decide to take jobs in other sectors, inevitably earning a reduced rate of pay.

The eventual job cuts to the automotive sector could have a similar (albeit lesser) effect. Workers in that sector will find it difficult to find new employment, as they compete against their former colleagues for a limited range of opportunities.

The end result of all of this is softer income growth and subdued household spending; our falling terms-of-trade will weigh on both of these factors as well.

It is important to remember that the collapse in mining investment will have spillover effects across the economy, in the same way that the boom did on the upside. That in turn could result in even greater job losses in sectors unrelated to mining.

The ANZ research provides a timely reminder of the challenges facing the Australian economy over the next couple of years. Mining investment is set to fall sharply -- an optimistic estimate is around 4 percentage points of real GDP -- and although the economy is showing signs of rebalancing, that remains a work in progress.

The jobs market will take a hit and based on the current outlook, it is poorly placed to absorb that hit. Rising structural unemployment is an unfortunate reality of this transition and many people will struggle to find timely or decent employment once their mining contracts are up.