The inherent risks of index investing

Summary: Many index funds, exchange-traded funds and actively managed funds have inbuilt concentration risks and are insufficiently diversified. But there are ways to offset the risks by building smarter portfolios. |

Key take-out: When building portfolios, index investors need to employ alternative investment styles to offset the risks over exposure to one sector. |

Key beneficiaries: General investors. Category: Indexing/ETFs. |

Many investors choose index investments seeking a secure return without appreciating the concentration risks they are taking on.

In Australia's highly concentrated sharemarket and the local and overseas dysfunctional bond market, billions invested in unlisted funds and ETFs are insufficiently diversified.

Investors need to make additional investments to dilute these risks or choose another way of investing. As many active style funds don't stray far from the index either, you need to be careful considering them as alternatives.

I have always been a big fan of low-cost, low-turnover, index-style investing. While I believe markets are inefficient, I think most of the time for most people they are efficient enough to make stock picking and market timing inefficient after fees, transaction costs and taxes. Index investing will win most of the time, but maybe a market size based benchmark shouldn't be the benchmark? Certainly it shouldn't be the default way to build a portfolio.

Australian equity index investing sector ... and size concentration risk

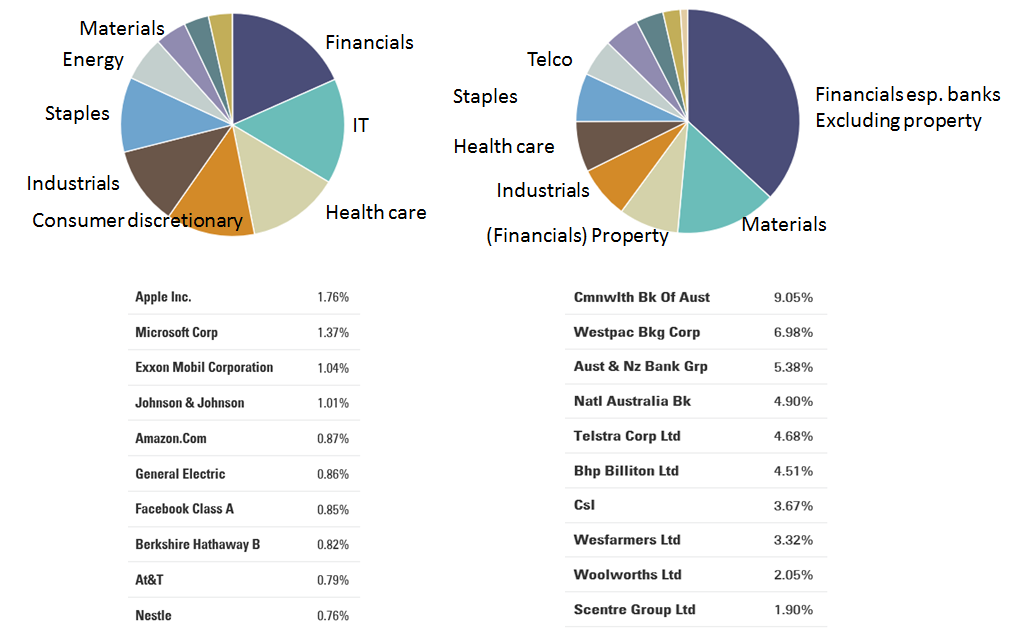

Globally the sharemarket is highly diverse, and so investing passively makes intuitive sense. In Figure 1 below, the pie chart and table on the left side shows the global sharemarket offers investors a balanced diet of companies and sectors.

The right side of Figure 1, however, shows in Australia that our market is currently 37 per cent fat with financial company shares and an obese 46 per cent if you also count property trusts (which also earn profits from property funds and so are often also counted as financials). Regardless, investing in a local equity index fund means half your investment dollar is invested in just 10 companies versus only 10 per cent used up when investing ex-Australia.

Figure 1: World ex-Australia (left) and Australian sharemarket (right) industry sector mix and top 10 holdings at August 1.

Source: State Street SPDR ETF WXOZ and STW holdings.

Our local market's concentration risk changes dynamically. Only a couple years ago a third of local equities indexed were in price-taking resource companies. It's not now. Not because of clever redesign of the index, but simply because those companies are worth half of what they were.

Indexing methodology doesn't correct for or care about industry mix. By local equity indexing, investors loaded up in a once-in-decades mining boom –which busted. It now has them propping up one of the world's most expensive property markets. As the only way of investing in shares, I don't consider that safe.

Another design feature of indexing is its reliance on market value to dictate portfolio weighting. This means index investors are overweight expensive stocks and underweight cheap stocks. For instance, when you invest in an index you hold 20 per cent more Commonwealth Bank than ANZ, justified by its bigger profit. "Which bank" has a price-to-earnings ratio of 14 instead of 12?

Professor Eugene Fama recently earned a Nobel Prize showing that cheap stocks and small companies, also poorly represented in a size-based index, beat expensive and big stocks over the long term. On this basis index investing can also underperform.

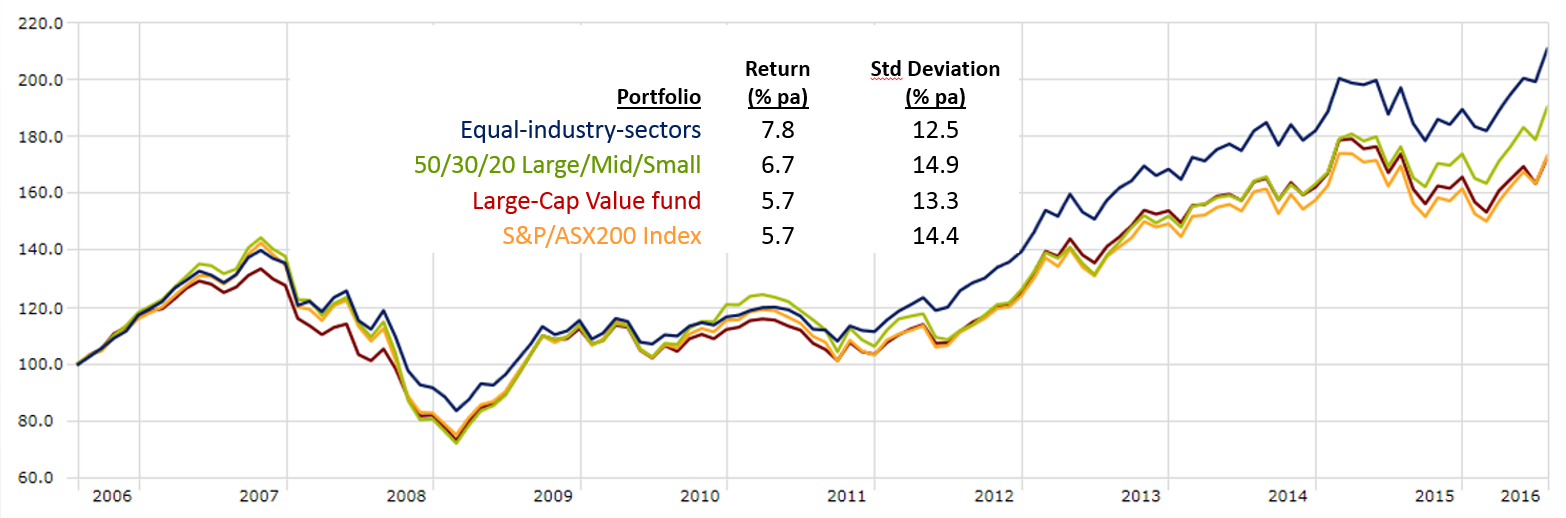

Figure 2 compares the returns and volatility of a benchmark ASX200 portfolio of stocks over the last 10 years to...

- A portfolio made from an equal representation of Australian industry sectors (a perfect balanced pie chart version of Figure 1). This portfolio I made up beat the index by 2% annually and offered the lowest volatility. For some related portfolio ideas see: Goodbye to the 'All Ordinaries', June 2012.

- A portfolio with more midsize and small companies built from a 50/30/20% mix of the returns from the top 50, next 50 Midcap and next 200 Small companies. The latter based on the returns on the median performing small cap manager, as it is widely recognised that the Small Ordinaries index is also flawed with 90 per cent plus managers regularly beating it. This portfolio beat the index by 1 per cent annually but with higher volatility.

- A portfolio with a low price company/value tilt, here the returns from the median performing Australian actively managed value fund. Over this time period “Quality” not “Value” companies have been in favour, so no performance advantage is observed, but volatility is less.

Figure 2: Growth of $100 and annualised return and volatility of alternative Australian equity index portfolios over 10 years to 30 June 2016:

Source: PW Analysis

So what can you do?

- Given the small size of our market you could assemble your own industry sector balanced portfolio, however this won't provide much in the way of size diversification.

- You could invest in ETF “MVW”, which allocates your money equally amongst about 60 companies. However you are still left with an overweight to financials and resource companies.

- To reduce your reliance on expensive stocks, you could also invest in value ETF “RDV” or if having a whopping 78 per cent in financials and property trusts seems counterproductive you could invest more broadly in value tilted ETF “QOZ” or the unlisted Realindex fund.

- To increase your exposure to middle size and small size companies, you would need to also invest in a mid cap fund (including new ETF “MVE”) and an active small companies fund.

- Choose an active fund manager that genuinely is “index unaware” – easier said than done as most aren't and it's hard to gleam that from fund marketing speak.

- While I consider it the wrong answer (including for loss of franking credits), you could invest more of your money offshore to dilute Australia's current bank overweight.

- Lastly, you can join my plea that the major index fund managers stop surrendering portfolio construction to index suppliers and create more innovative designs.

Bond index investing

Broad-based bond index funds allocate your money in proportion to debt outstanding and so lend more and more to the most indebted.

In the current environment this means lending more money to governments issuing more and more debt and with self-serving longer and longer maturities. Compounding this, central bank money printing is especially driving these bond prices to frothy levels.

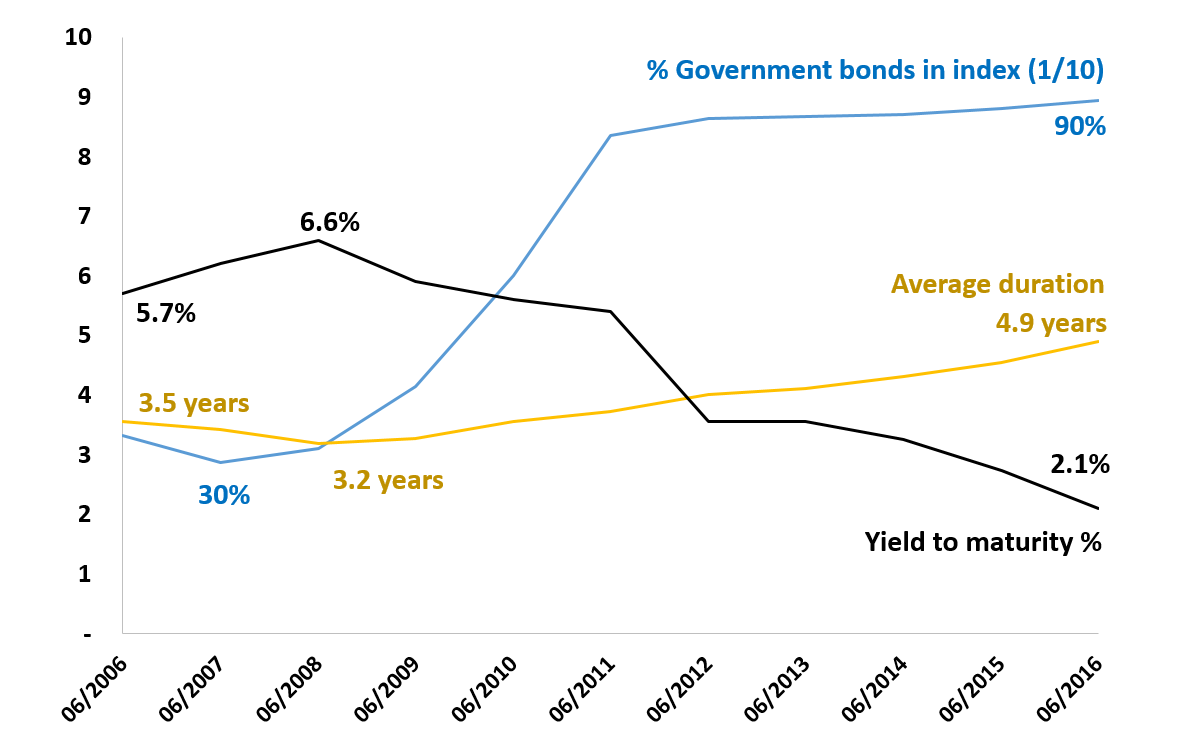

The composition of the Australian investment grade bond market has changed markedly, as shown in Figure 3. Prior to the GFC we had a fiscally responsible government and so the make-up of the Australian bond market was about 70 per cent dominated by company debt. After continuing deficits and bond issuance the local investment grade bond universe is now 90 per cent government or government related.

The average maturity of these bonds has increased about 50 per cent from 3.5 to five years. Yields have also collapsed from around 6 per cent to 2 per cent. Buying a once-diversified index mix of Australian investment grade bonds leads you to now lend 90 per cent of your money to the government and affiliates at a measly 2 per cent fixed for five years.

Figure 3: Australian investment grade Bond Index composition

Source: Vanguard

Investing in the Bond Index has been a great strategy, generating 9.8 per cent and 6.4 per cent annual returns over the last five and 10 years as bond yields have fallen. However, going forward, you need bond yields to fall further to make more than just 2 per cent annually for the next five years.

What to do?

- At the Australian Investors Association conference last week I pointed out I could count only four of about 100 investment grade wholesale bonds currently on offer that beat a three-year, 3.2 per cent term deposit return. All of these were the lowest investment grade rating (BBB-), a short step away being downgraded to non-investment (“junk”) grade. Central bank intervention has made bond yields unusually low and intervention by regulator APRA has made term deposits unusually high, relatively speaking. Stick to term deposits.

- You can now invest in a newer bond index funds/ETFs that only invest in Australian investment grade companies like VACF and RCB. However these are yielding only a little higher at 2.8 per cent for an average maturity of four years. The two-thirds lending exposure to banks and financial companies worries me.

- You could lend offshore, where lower yields on offer (0.6 per cent for Treasury ETF VIF and 1.8 per cent for Corporate ETF VCF before fund fees) are topped up with hedging income. However as the cash rate has fallen in Australia, this top-up has fallen to about 1.5 per cent. The duration of these bonds has also drifted out, so you are locking into these low rates for eight and six years respectively!

- With rates so low and perhaps the Australia dollar relatively high, it might make sense to lend offshore without currency hedging or buy a non-Australian dollar ETF to protect your overseas purchasing power in case of a fall in the Australian dollar. There are a few ETFs to help with this too.

REIT index investing

For many years institutional investors worried about the concentration risk that Westfield represented in both the property trust index and the overall market pre the GFC REIT price collapse.

Westfield and its split company Scentre Group are still together 40 per cent of this index. Regardless, if you think they are or aren't separately governed, their presence contributes to an overweight 55 per cent mix of retail/shopping centres in the local AREIT index.

What to do?

- Make up your own more balanced portfolio of local REITs, which is doable as the top five and 10 REITs make up two-thirds and 90 per cent of the index.

- Diversify by buying international REITs, where retail properties only make up 30 per cent of the index and other asset types not in Australia are on offer like residential homes, hotels, storage and prisons.

- Add global infrastructure into your portfolio, which may provide a complementary portfolio effect. In my opinion the new index ETF INFRA offers better diversification than Vanguard's fund as do the many successful active funds (Mid-caps in the sweet spot, June 17, 2015) in this sector.

Multi-asset investing

It's probably no surprise that if you build a multi-asset portfolio based on index funds your portfolio's foundations are built on the same cracks.

I've been a fan of Vanguard's range of multi-asset funds especially for beginner investors and those with small balances. These funds have performed especially well over recent years. However the reasons they have done so well (i.e. concentrations) create risks for the future.

As an example, investing in Vanguard's 50-50 equity-bond balanced fund means allocating two-thirds of your defensive-bond exposure to long-duration, low-yielding government bonds (yielding under 2 per cent). I wonder if a safer investment would be holding half your money in term deposits and half in Vanguard's High Growth fund?

Final word

While I remain a fan of index investing, I don't think most investors understand the assumptions built into indices and therefore the risks assumed investing in them.

As more and more specialist ETFs and index funds are introduced, investors have the opportunity to dilute these risks and assemble smarter portfolios. It is very important that index and ETF investors research the holdings of funds and understand exactly what exposures they are getting. Don't hand over your portfolio allocation to the index.

Dr Douglas Turek is principal advisor with family wealth advisory and money management firm Professional Wealth.

Please note financial products referred to here are for educational purposes and do not constitute an investment recommendation. Do your own research or contact a licensed financial advisor before investing.