The hybrids supervision challenge

| Summary: Retail investors have been the main subscribers to hybrids issues, but the issuance marketplace is not structured to protect them. As well as greater supervision, hybrids should be subject to greater regulation. |

| Key take-out: With superannuation assets now exceeding the market capitalisation of our sharemarket, there is a growing market imbalance that gives an unfair advantage to issuers over investors. |

| Key beneficiaries: General investors. Category: Income. |

I have often been critical of the quality and structure of many of the recent hybrid issues, so I welcome the announcement of the Australian Securities and Investments Commission last week that it was intending to introduce a form of supervision for the market and investor disclosures concerning hybrid issues.

However, I doubt the regulator’s efforts will have much impact unless it fully understands the evolution of the hybrid market in Australia.

Further, and at the outset, it needs to acknowledge that the advisers and the promoters of these issues are paid by the issuing company and that there is no real negotiation concerning the appropriate terms in many of the transactions. Simply stated, there is no entity that negotiates appropriate terms on behalf of investors. Clearly that should not be ASIC, but just as clearly the marketplace at present is not working.

In the main, the subscribers to the recent hybrid securities issues are not the large superannuation or institutional funds but rather retail investors. This means that the historic protective mechanisms that were in place in the Australian capital market framework some 20 years ago have fallen away.

The demise of strong mutual entities with a long-term investment focus has resulted in a marketplace where a proper negotiation of terms simply does not exist. This is because in the 1980s and early 1990s major institutions negotiated and demanded appropriate terms for convertible, yielding and convertible securities.

These institutions both underwrote and subscribed for these securities. The advisers to the issuers had to sound out and negotiate with the major investors before the retail market was involved. This meant that many of the terms that are common in today’s hybrid securities were never seen in securities issued in that bygone era. Mutuals are now regarded as extinct dinosaurs, but in their own way they had a vital function in the integrity of capital markets that has now been swamped by the activities of investment banks.

Thus, the marketplace is not structured to protect the small investor and I am afraid that education by ASIC will not suffice. Rather, a form of legislature that governs the minimum required terms of hybrid securities, akin to the Tax Act regarding interest deductibility of debt securities, is required.

I can already hear the clamour of advisers whom will protest that markets do not need more regulation and that the marketplace should be left to its own mechanisms to negotiate securities. However, I would suggest that many of these same advisers were at the epicentre of subprime debt and therefore have no credibility in terms of a debate that concerns fairness or integrity.

Finally, and most importantly, I would suggest that the hybrid market certainly needs a higher level of regulation and supervision because of the historic announcement last week that Australia's superannuation assets grew in 2012-13 to a level that approximates our GDP.

Further, our superannuation assets now exceed the market capitalisation of our sharemarket. This suggests a growing imbalance in the marketplace that will give an unfair advantage to issuers over investors. Too much capital that must be invested in a low yield and growth environment will cause the terms of issuance to deteriorate.

That is how an unregulated market operates, and the consequences will be felt well into the future. Indeed, on sober reflection, that is exactly what happened in the subprime era and resulted in the GFC.

The job of regulators should be to avoid another market meltdown, and that is why a heightened level of regulation is required.

Commonwealth Bank of Australia (ASX:CBA)

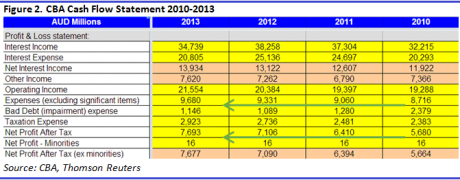

Commonwealth Bank of Australia, which sits in my income portfolio, recently announced its net profit after tax had increased 8.3% to a record $7,693 for 2012-13. In reviewing the result I have made the following assessments of the key performance metrics:

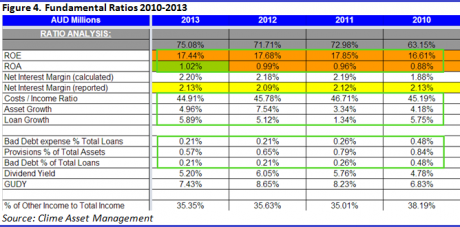

Return on Assets: Improved 3 basis points (bps) over the year to 1.02%. POSITIVE

Cost to income: Reduced to 44.91% from 45.78% in 2012, driven by slow cost growth driven by productivity. Positive improvements flowing from a large technology spend. POSITIVE

Net interest margin: Increased 4bps to 2.13%. POSITIVE

Loan growth: Increased 5.89%; home loan market share increased 20bps and business loan market share decreased 20bps. POSITIVE

Bad Debts: Flat at 0.21% of loans, a continuing theme of declining provisions was observable with provisions falling to 0.57% of loans from 0.65% in 2012 & 0.84% in 2010. NEUTRAL

CBA announced Tier 1 capital of 10.20%, an increase of 19bps over the year and a $2 franked dividend for the full year. Reflecting the strong result, CBA has been able to increase the payout ratio and increase the capital ratio whilst growing the loan book at a moderate rate.

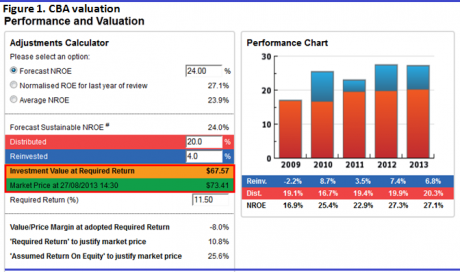

Therefore it was clearly a strong result from a strong bank in a challenging period for asset growth. These attractive qualities are reflected in the current price of about $72.50 (ex dividend), which is screening through StocksInValue as somewhat expensive (refer to Figure 1).

Source: StocksInValue.com.au

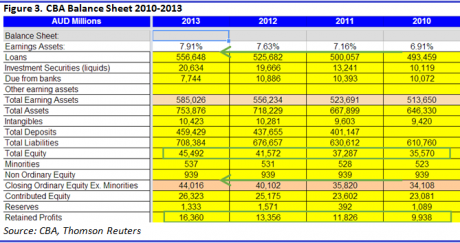

In the following tables (Figure 2, 3 and 4) I have highlighted the key financial ratios that show how strong the CBA performance has been over the last five years.

At the current price of CBA I am challenged to hold this security in the income portfolio. The quality is undeniable but the share price has moved to 3 times book value and this makes CBA one of the most expensive banks in the world.

At this point I am holding my position, but I am actively looking for a switching opportunity out of CBA shares into a higher-yielding security. However, the broader market is presenting me with limited opportunity.

John Abernethy is the Chief investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Clime Income Portfolio Statistics

Return since June 30, 2013: 5.19%

Returns since Inception (April 24, 2012): 32.15%

Average Yield: 7.32%

Start Value: $150,754.88

Current Value: $158,577.77

Dividends accrued since June 30, 2013: $1,541.73

Clime Income Portfolio - Prices as at close on 27th August 2013 | ||||

| Hybrids/Pseudo Debt Securities | ||||

| Company | Current Price | Margin over BBSW | Running Yield | Franking |

| MXUPA | $82.30 | 3.90% | 7.90% | 0.00% |

| AAZPB | $94.88 | 4.80% | 7.80% | 0.00% |

| MBLHB | $74.25 | 1.70% | 5.79% | 0.00% |

| NABHA | $71.65 | 1.25% | 5.37% | 0.00% |

| SVWPA | $86.69 | 4.75% | 8.47% | 100.00% |

| WOWHC | $104.65 | 3.25% | 5.59% | 0.00% |

| RHCPA | $105.60 | 4.85% | 7.05% | 100.00% |

| High Yielding Equities | ||||

| Company | Current Price | Dividend | GUDY | Franking |

| TLS | $4.88 | $0.29 | 8.49% | 100.00% |

| AAD | $1.85 | $0.13 | 7.03% | 0.00% |

| CBA | $73.47 | $3.79 | 7.37% | 100.00% |

| WBC | $31.61 | $1.82 | 8.23% | 100.00% |

| NAB | $32.66 | $2.01 | 8.79% | 100.00% |