The high savings rate is an illusion

Financial stability could become an overwhelming concern in light of the fact Australia’s savings rate actually isn’t as high as headline numbers flung around by the Reserve Bank of Australia and Australian Bureau of Statistics suggest.

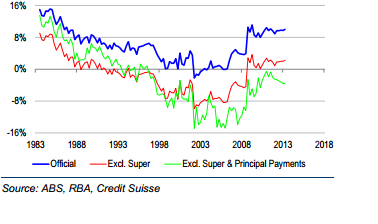

In the RBA’s November statement on monetary policy, the central bank explains the savings ratio is around 10 per cent of income, hovering near decade highs.

But this measure includes mandatory superannuation contributions, clouding the amount individuals are actual saving that is available for consumption and principal mortgage repayments.

Once superannuation contributions and extra payments on mortgages are excluded, the actual savings rate comes in at minus 3.6 per cent, according to Credit Suisse. The key takeaway from this is consumers actually don’t have any savings to spend – the notion of a historically high savings rate is merely a fantasy.

Policy makers and retail executives claim consumers have been much more conservative with their cash, but interpreting the savings rate minus superannuation contributions and extra mortgage repayments proposes an entirely different story. It would be fair to conclude some households would be living beyond their means, funded by credit.

To get to the point of potential financial instability it is a long and windy road, ending in highly leveraged household balance sheets.

Firstly, the housing market needs to strengthen further from current levels, with the corresponding outcome of consumers perceiving they are in fact wealthier. This in turn should inspire more robust consumption growth as consumers save less, leading to an increase in in household leverage. For now, housing credit remains moderate but will be a key measure to monitor.

It is evident the current environment is conducive for household consumption to improve. House prices are rising and equity markets continue to find higher ground in conjunction with an apparent improvement in consumer confidence.

Despite improving data points, consumers are still battling slower income growth and slower employment growth. In fact, the October labour force data confirmed how dire the employment growth situation really is, with no new jobs being added since February.

If we subscribe to economic theory, the fear of slowing income growth should make consumers hesitant to draw down on savings, sparking a vicious cycle. To break this trend, consumers will need to actually feel wealthier as a result of surging house and asset prices.

The economic reality of the current climate is that domestic consumers will not be leading the economy into a new era where investment from the mining sector is no longer the dominant force. Consequently, there will be sufficient reasons for the RBA to leave interest rates at current levels, with scope for rate cuts.