The high dollar trap

| Summary: A sustained higher $A will stifle economic growth and trigger more job cuts. While the sharemarket is currently ambivalent to the effects of the high $A, if it continues to hold above the $US, or rallies higher, there will be detrimental consequences on multiple levels. |

| Key take-out: The general increase in market share prices is not reflective of earnings growth or a solid outlook. Expect market growth to taper off, with returns over the next few months likely to be flat. |

| Key beneficiaries: General investors. Category: Growth |

In my view the big call for investors in 2013 is the ultimate direction of the $A against the $US. It is my strong view that a rising $A from current levels could well seriously depress the Australian economy. Talk of the $A rocketing up through US$1.20 is to my mind both fanciful and delusional. Such a move, if it is not supported by a significant improvement in both our trade account and our labour productivity, would pre-empt a disaster for our economic base. A rally to $1.20 would therefore be very short lived.

Indeed, to draw a proper conclusion on the direction of the $A, we must develop strong views on the outlook for both the US and Chinese economies. Further, we must be cognisant that the current value of the $A has little to do with the inherent strength of our economy. The bulk of the developed world’s economies are failing at present, and so the rerating of the $A represents a relative assessment against a poor peer group. I will develop my $A view a little later in this report.

The growth portfolio

Readers will remember that both the growth and income portfolios were rebalanced on 31 December. The rebalance for the Growth Portfolio involved:

- Replacing OrotonGroup Limited with Flight Centre Limited; and

- Reinvesting accrued and received dividends in the December half-year back into each company on an equal basis as at 31 December 2012.

Having done that, and as we have now entered a new calendar year, it is worth reviewing the challenges that await us as “value” investors in 2013.

The first challenge involves the recognition that a return of over 20% in just six months from the growth portfolio will be hard to replicate in the next 12 months. While I am fairly confident of achieving my goal of a 10% return over the next 12 months, it could well be that returns in the next few months will be fairly pedestrian.

Further, the market needs to take a breather because the recent and general expansion of market share prices is not reflective of earnings growth or a solid outlook. Rather, it is the result of massive monetary policy interference in offshore markets. The effect of quantitative easing (QE) is to create the excessive liquidity that is flowing into investment markets. Much of this liquidity is designed to stabilise bond markets, but it is creating speculative demand for shares and the Australian sharemarket is being positively affected.

Another issue is the likelihood that the Reserve Bank will need to cut rates further in an attempt to hold down the $A. It is truly concerning that the significant decline in Australia’s trade account, represented by a $5 billion deficit over October/November 2012, has not resulted in a devaluation of our dollar. This is another perverse effect of international QE, and the response of our RBA will need to be aggressive. From a political cycle perspective, the RBA will need to move well before the writs are issued for the next federal election. There may well be a 0.5% cut of interest rates in the next few months.

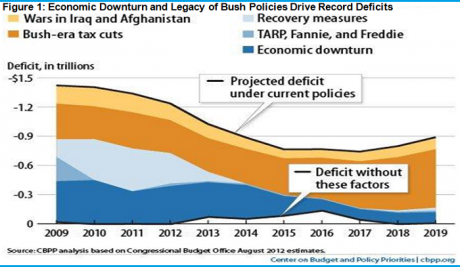

As noted above the big issue or call for 2013 will be the ultimate direction of the $A. My belief is that it will eventually head lower as the US emerges from its economic slumber and moves through its current inane economic debate over its budget settings. It is truly remarkable that the Republicans of America are in complete denial that it was their President that oversaw the pre-GFC years and it was his policies that blew the US budget.

The US does not have an expenditure problem, except for the legacies of its war efforts and the natural budget stabilisers that remain functioning due to the economic downturn. Rather, the US needs to lift its tax collection from those that can afford to pay more, or tax non-essential expenditure. It is really that simple. As a side comment, a way to partly balance the budget would be to impose significant registration taxes on the 280 million firearms that are known to exist in the community. A $1000 per fire arm on average would raise $280 billion and wipe out 30% of the deficit.

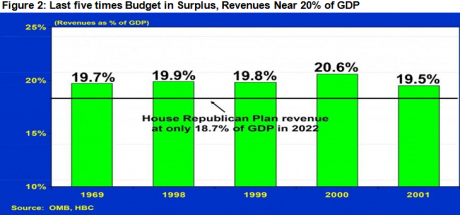

In any case the current tax revenues of the US federal budget are just 16% of GDP, and this is not enough as 20% is what is required.

My belief is that the combination of a fiscal agreement, the effects of a depreciated currency and low interest rates, plus a recovery in the US trade account (emergence of an energy sector) will be the catalysts for a revaluation of the $US. The pegging of the Chinese currency to the $US suggests that we will devalue against the Chinese currency as well.

The ultimate direction of the $US/$A is very significant for my portfolio in a number of respects. A sustained higher $A (towards $1.10) will throttle our economy and lift up unemployment. The market is currently ambivalent to the effects of a sustained higher $A, but I can assure you that the consequences will not be good for our economy. Investors, and indeed all commentators, need to be vigilant to not create an air of ambivalence that I liken to the proverbial “frog in slowly boiling water”.

I believe that the $A will devalue against both the $US and the Chinese yuan by this time next year, and this will be the stimulant required to generate economic growth in our economy. It is particularly important for our major resource companies (BHP, RIO and MIN) and it is important for all the companies in my portfolio. So I am holding my positions as currently presented.

John Abernethy is the chief investment officer at Clime Investment Management.

Need help establishing an SMSF or just want to make sure you are doing everything right?

Clime are holding SMSF Information Seminars across Australia. Click here to register or view our event schedule.

Clime Growth Model Portfolio

Return since June 30, 2012: 25.17%

Returns since Inception (April 19, 2012): 16.39%

Average Yield: 5.81%

Start Value: $111,580.24

Current Value: $139,663.79

| Company | Code | Purchase Price^ | Market Price* | FY13 (f) GU Yield | FY13 Value | Safety Margin |

| BHP Billiton | BHP | $31.65 | $36.34 | 4.60% | $42.21 | 16.15% |

| Commonwealth Bank | CBA | $53.38 | $62.46 | 7.94% | $64.91 | 3.92% |

| Westpac | WBC | $21.29 | $26.62 | 9.34% | $29.43 | 10.56% |

| Blackmores | BKL | $26.48 | $34.98 | 5.43% | $32.62 | -6.75% |

| Woolworths | WOW | $26.88 | $30.70 | 6.24% | $31.21 | 1.66% |

| Iress | IRE | $6.60 | $8.32 | 5.48% | $7.62 | -8.41% |

| The Reject Shop | TRS | $9.33 | $15.40 | 3.90% | $15.52 | 0.78% |

| Brickworks | BKW | $10.15 | $12.13 | 4.83% | $12.27 | 1.15% |

| McMillan Shakespeare | MMS | $11.88 | $13.49 | 5.40% | $14.23 | 5.49% |

| Mineral Resources | MIN | $8.98 | $10.20 | 6.72% | $12.63 | 23.82% |

| Rio Tinto | RIO | $56.86 | $64.60 | 3.76% | $63.76 | -1.30% |

| Flight Centre | FLT | $27.00 | $28.15 | 6.14% | $28.20 | 0.18% |

| * Market prices as at close January 17, 2013. ^ Purchase price as of close June 29, 2012 plus reinvestment 31 December 2012. | ||||||