The hidden strains on economic growth

Summary: There are a number of developments currently taking place which would have a significant impact on the Australian economy going forward – in particular attempts by the Australian Transport Remuneration Tribunal to establish minimum pay for owner-operator truck drivers, which I believe will have the effect of attacking owner-operators in the long haul industry and will drive prices at our big supermarkets up. |

Key take-out: Increasing transportation costs could have the effect of sending inflation higher, which would lead to interest rate rises and a higher Australian dollar. I believe the trucking proposal is a very dangerous one for Australia in coming decades. |

Key beneficiaries: General investors. Category: Shares. |

As Alan Kohler has illustrated so often, sometimes it takes a graph to make sense of what is happening. (You can see the Kohler Graph on Eureka Report website every day, click here: Kohler's Graphs).

And right now amazing developments are taking place, including the sharp rise in the Australian dollar, the trashing of bank and resource shares and the difficulty federal and state governments are having raising the money to carry out what they want to do...

Accordingly, they are reverting to massive borrowing.

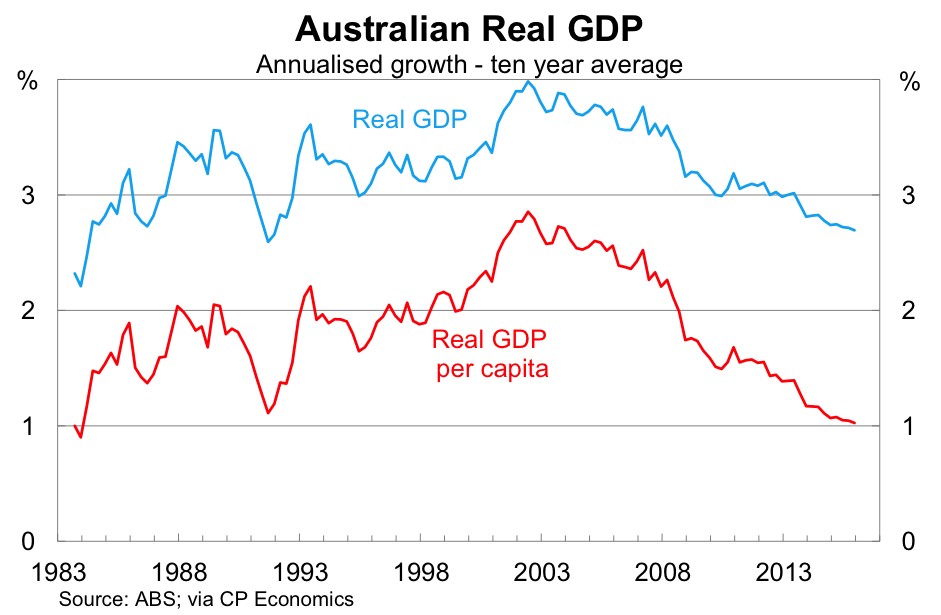

This week I came across a graph prepared by economist Callam Pickering's CP Economics website (read more here: CP Economics), which crystallises why this is happening. It tells us a lot about the problems in our share market and helps explain why the tax intake has deteriorated and why it is unlikely to return to the highs experienced during the height of the mining boom.

The graph plots growth in real GDP and real GDP per capita over a rolling 10-year window.

Australia's GDP per capita is down to an incredibly low one per cent which helps explain why growth in our living standards has slowed so much over the past decade.

The difference between the lines reflects growth in the population and, as we can see population growth is accounting for an increasingly large share of economic growth - and that population growth is now starting to decline.

For decades Australia grew strongly because productivity was strong and an increasing share of the population was entering the workforce.

But bit-by-bit an ageing population has undermined our economic performance, and the effect has been amplified by bad productivity performances and, of course, the global financial crisis.

Given we are now seeing population growth rates decline, there is now a real challenge for our companies. But this is but one of the events taking place that chief executives have not had to encounter before: There has also been lots of publicity about how the new digital technologies such as blockchain will attack banks, particularly Australian banks, and other enterprises.

But there are also a series of other developments that until now have been under the radar and which will be just as challenging. None of these is more important than the unfair contracts legislation and the attempt by the Australian Transport Remuneration Tribunal to send to the wall a large chunk of Australia's owner-drivers in the long haul industry.

In Australia, companies undertake most of their activities via employees but a significant proportion is performed by independent contractors and, as we have seen in in the UK, this is how jobs will be created in the decades ahead. Currently large companies (and government organisations) go to their lawyers and prepare contracts that give them almost unfettered rights to change the rules.

Those contracting with the large enterprises usually have no equivalent rights. Those public companies that use such standard contracts (and I think most of them do) will find their contracts will be void next November. That means that all their confidential information, which is currently the subject of restraints, can be sent to anybody. What the companies will need to do by November is to negotiate with their contractors or establish contracts that are fair to both sides.

Now I must confess that through Business Spectator, I played a big role in convincing the legislators, including the Coalition, the ALP, the Greens and the cross benchers to introduce meaningful unfair contracts legislation.

In the longer term it will result in much better relationships between companies and their contractors and lead to improved productivity. But it requires a different style of management. The current crop of chief executives are only now beginning to wake up to the fact they have to change their style of management or face some nasty consequences.

The Business Council of Australia tried to stop this legislation. They also tried to stop what is called the “effects test”.

The effects test proposal would replace the misuse of market power clause, currently standing in the Competition and Consumer Act,with a new clause – whereas previously it had to be proved that a company with substantial market power had taken advantage of that power to lessen competition, under the revision there would be no need to prove intent, merely that the actions of a company had lessened competition, whatever the motives.

The “effects test” legislation will depend on the outcome of the election. But if it is introduced it will mean that large corporations will have to be careful not to take actions like substantially reducing the price to drive the competitor out and then raising it again. If you do offer lower prices then you have to make sure you leave them low for a very long period of time.

I suspect this affects Coles and Woolworths more than other companies.

Certainly Coles' and Woolworths' costs are set to rise dramatically if the Transport Remuneration Tribunal has its way and escalates the cost of transport in Australia dramatically. Farmers will also be hit hard. The Tribunal plans to heavily fine owner drivers who charge freight rates below a fixed level that is substantially above current rates. But the tribunal plans to allow large transport groups employing Transport Workers Union members to charge whatever they like. They can undercut the small operators who have no flexibility.

My estimates are that transport costs in Australia will rise between 30 – 40 per cent and because our retailers are big users of transport, particularly with food products they will need to pass their costs on. In turn that will lift the Australian inflation rate, which has benefitted greatly from the efficiencies in our major supermarkets.

This proposed action is incredibly dangerous and, as you would expect, I am in the thick of the fight to stop it. But I discovered the tribunal's plan very late and because the price hikes are being done in the name of road safety the going may get tough.

Right now the Reserve Bank is looking to lower rates given the rising Australian dollar, although the continued strength in the Australian economy has deferred any action.

If our inflation rate starts to increase as a result of our higher transport charges, they may start to think about actually increasing interest rates, which will send the Australian dollar much higher. Frankly, what the tribunal is doing is the most dangerous move I have seen from a government body for many decades. And unfortunately the chaos in the Australian parliament makes it very difficult to change the direction.

The trucking situation is so bizarre you have to think that somebody will set to and fix it but if they don't then our nation has the real possibility of running into a recession. At this point of time I would think that somehow, someway, the Australian parliament will respond but the lift in the TWU membership is set to be so great that the ALP will not help. But watch carefully because if the parliament can't or does not fix this, we are in for a very dangerous time.