The hedge funds with an edge

PORTFOLIO POINT: The best hedge funds make money even in flat or declining markets. Here’s our list of the top performers, including a dozen that have achieved five-year positive returns.

Like any good marathon runner will tell you, success is all about long-distance performance.

Being at the front of the pack for short periods is always good, but getting consistent results – whatever the prevailing conditions – is always far more difficult. In the same way that marathon races are a test of long-distance physical performance, the ability to achieve long-term success as a hedge fund manager during some of the worst global market conditions ever seen is a huge feat of both investment skill and stamina.

There are always claims regarding fund performances that try to suggest a fund is performing well, or has gained a recommended or highly recommended rating in spite of the fact that they have lost investors’ money.

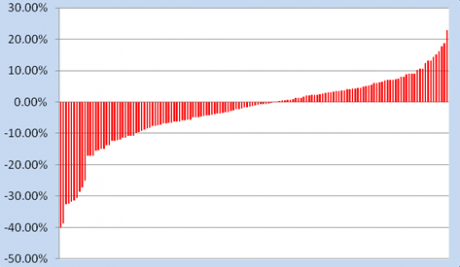

But, when it comes to managed funds, and hedge funds are no exception, performance is the only reality. Over the year to June 2012, 43% (65 out of 144) absolute return and hedge funds with 12-month returns provided a positive performance, as shown in the following chart.

Chart 1: Hedge fund returns for year to June 2012

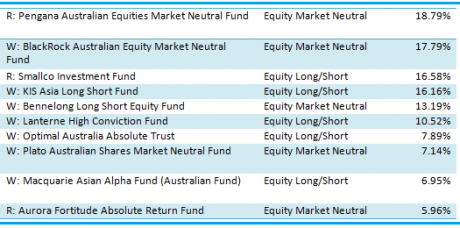

Although 80% of funds in our database outperformed the ASX 200, it still left 37% of funds outperforming the ASX but failing to provide their investors with a positive return. More impressive were those funds that provided a positive performance over the 12 months, including the following list of the top 10 equity long/short hedge funds over 12 months to June, 2012.

In a declining market, investors in the top six hedge funds achieved returns of well above 10%, including almost 19% for those invested in the Pengana Australian Equities Market Neutral Fund.

Funds listed with R are retail funds, while funds listed with W are wholesale investment funds only.This is an impressive list, and in these difficult times such performances were difficult to achieve to say the least. However, as readers would understand, 12 months is not long enough to really gauge a fund manager’s performance, and further examination reveals some telling trends.

In recent articles I have shown that various funds and strategies can produce significantly different performances in different market conditions. What is interesting about the performance of funds in the 12 months to June 2012 is that those with a positive performance over the last 12 months also showed a capacity to perform over the longer term.

It is also fair to say that the strategies that performed in the volatile conditions of the past 12 months tended to be risk averse with low net market exposure, rather than the high conviction, concentrated portfolios that had provided often spectacular performance in previous years, but often with high volatility.

This suggests that the past 12 months have been tough, an opinion which is unlikely to have many readers disagreeing with. But it also suggests that those funds able to navigate the tough markets of the past 12 months have the necessary skills and capacity to do so over the longer term.

Indeed, further investigation showed that performance over the past 12 months was as good a method as any of filtering risk averse managers and funds. Only four funds with a positive 12 month performance failed to provide a positive 24 months, and of the remaining, only four fell at the three year hurdle. Four years became a little harder, with six falling by the wayside, and over five years, a few more.

Finally 26 funds (across all strategies, investing in both equity and non equity type assets) with positive returns over one year also had positive annualised returns over the past two, three, four and five years.

That would appear to be enough to really sort the wheat from the chaff, but even within this group of 26 there were some performance measures which still required refining, most notably the intra year drawdowns in 2008 at the height of the GFC. With the market down over 50% from its peak in November 2007 I removed any fund with a drawdown of 20% or more, leaving just 17 funds remaining.

Finally I measured each fund’s risk adjusted performance as measured by the Sharpe Ratio, arrived at by taking actual returns less the “risk free” cash rate, divided by volatility. Ideally this should produce a number as close to one as possible, but I took the top 10 to produce our list of “best funds”.

No doubt there will be arguments from some that this methodology is imperfect, and I readily admit that there more ways than this to filter good funds from bad. For instance, some investors may not be so concerned about volatility, preferring to just take a fund’s long term annualised return as the true measure of performance, and of course what suits one investor’s risk and return appetite may not suit another’s.

The list below also excludes some newer managers who don’t have a five-year track record, but somewhere along the way a line has to be drawn. If good enough they’ll no doubt appear in these columns next year, or the year after.

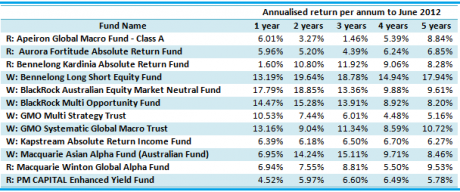

So stripping away the words and promises of the promoters, here are 12 funds which have provided positive returns over five years to June 2012, while having a drawdown of no more than 15% during that time. Performances over 24 to 60 months are annualised.

The Bennelong Long Short Equity Fund is the only fund to have achieved double-digit returns over each of the last five years, while the BlackRock Australian Equity Market Neutral Fund, BlackRock Multi Opportunity Fund and GMO Systematic Global Macro Trust achieved double-digit returns in three out of five years, and solid returns in the remainder. Here are the top performers, sorted alphabetically.

Table 2: The best hedge fund five-year annualised returns

By any standard this is an impressive performance from each of the above funds, but to have provided investors with positive returns each year over five years during some of the most difficult and turbulent market conditions is a significant achievement.

The fact that they are all “hedge funds” should dispel the myth that they are risky and speculative, and in fact reinforces one of the common factors amongst all the funds on the list: First and foremost they consider the risk of loss of capital as more important, or at least equally important as providing a positive return.

Remember, only performance is reality.

Chris Gosselin is chief executive officer of Australian Fund Monitors Pty Ltd. www.fundmonitors.com