The great unit divide

| Summary: It’s a classic case of supply and demand, but when it comes to residential units to divide between Melbourne and Sydney is greater than ever. On the one hand, Melbourne is eclipsing Sydney in terms of the number of units available for sale. But the figures show that Sydney unit sales are much higher than in Melbourne. |

| Key take-out: One could argue that there has been too many new unit approvals in Melbourne given they are only accounting for 30% of all sales. |

| Key beneficiaries: General investors. Category: Residential property. |

One of the major concerns of many is the significant supply of units already in existence, and the number set to enter the Melbourne inner-city market over the coming years.

The concern is so great that the Reserve Bank went so far as to highlight the potential risks in this particular market earlier this year in a release. If I look at supply and demand, and compare it to Sydney, you can see that there clearly appears to be excess unit supply across the Melbourne housing market currently.

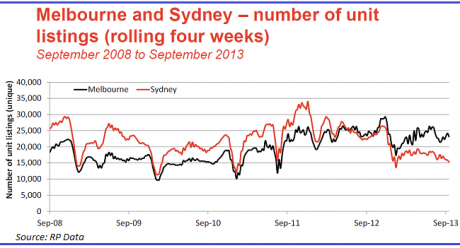

Based on the unique number of units currently listed for sale across Sydney (15,252) and Melbourne (23,097), there are 51% more units currently available for sale across Melbourne. Between the beginning of 2007 and the middle of 2012, Sydney had consistently recorded a greater number of units listed for sale than Melbourne. Since that time, there have been a greater number of units available for sale in Melbourne compared to Sydney, and more recently the gap between current listings in both cities has been widening.

If this information is paired with recent sales transaction data, you can further see the disconnect between the supply of units in Melbourne based on current demand. Over the June 2013 quarter, there were 10,687 unit sales across Sydney compared to 7,146 across Melbourne. Given this, based on June quarter sales, there were 50% more unit sales in Sydney than in Melbourne. However, there are currently 51% more units available for sale in Melbourne compared to Sydney. In terms of total sales, units accounted for 40% of all sales in Sydney compared to 30% in Melbourne. This would indicate that, based on sales, demand for units should be higher in Sydney than in Melbourne and therefore supply should also be greater.

When you look at total dwelling approvals across New South Wales and Victoria over the past 10 years, you can see a much greater level of approvals in Victoria than in New South Wales. Obviously the state-wide results are a good proxy for the capital city. Over the past 10 years, there has been an average of 2,970 dwellings approved for construction each month in NSW compared to 3,879 approvals in Victoria. This would suggest that new housing supply in NSW (and Sydney) has been much less sufficient than that in Victoria (and Melbourne).

Although approvals have been much greater, Victoria’s population has also been growing at a much faster pace, particularly in terms of net overseas migration. Over the 10 years to December 2012, Victoria has seen total net migration of 508,221 persons, which is 42% higher than the 356,926 in NSW. With higher levels of migration there will undoubtedly be a higher demand for housing and, as a result, you would expect a higher level of dwelling approvals. However, one could argue that there has perhaps been too many new unit approvals when you consider they are only accounting for 30% of all sales currently.

Finally, units tend to appeal much more to investors than owner-occupiers. Based on 2011 Census data, 52% of units and townhouses in Sydney and 53% in Melbourne are rented compared to 18% of detached houses in both Sydney and Melbourne. From an investment perspective, units in Melbourne are offering the lowest gross rental yields across the capital cities at 4.3% compared to 4.9% in Sydney. When you factor in 4.4% annual capital growth in Sydney compared to 2.8% in Melbourne, the total return is much more attractive in Sydney than it is in Melbourne.

Cameron Kusher is a researcher at RP Data.