The Great Sharemarket Return: Finding value in Fleetwood

With the market cracking the all-important 5,000 barrier on the ASX earlier this week, the hunt is on for good value stocks that pass the test of a value investor. In the coming weeks, as part of our Great Sharemarket Return series, we will select and present an outstanding stock to you each Friday.

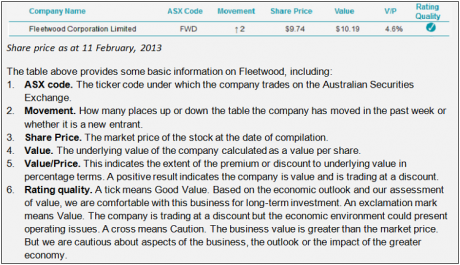

In conjunction with Clime Asset Management, Eureka Report will select from among the market’s best stocks based on a selection of key value indicators. Crucially, these indicators include a price-to-value ratio that examines the current range price of the stock in relation to its premium or discount to intrinsic value. In other words, we’re using professional analytics to underpin reports on selected stocks that are currently displaying value (remember stock prices can move dramatically, even in a short period of time).

Discovering a selected stock is signalling value does not mean the stock is perfect, but it does provide a comfort for investors who are cautiously rebalancing portfolios and re-investing cash in the stockmarket.

Today we begin the series with Fleetwood Corporation, a stock that has rarely been out of favour with serious investors and is currently selling at value levels. Along with written articles within this series each week, we’ll also present a video interview. In our first interview, we kick off with Adam Carr explaining why he believes the forces underpinning ‘The Great Sharemarket Return’ are only just beginning. Click here to view the video, or go to EurekaTV.

(Managing Editor, James Kirby)

| Summary: The past year has been troubling for Fleetwood Corporation, but the company is working to get on the recovery road with a number of key projects. But analysts have mixed views on the group’s medium-term prospects. |

| Key take-out: In the days since Fleetwood’s earnings downgrade, it has enjoyed strong investor support. |

| Key beneficiaries: General investors. Category: Growth. |

Fleetwood Corporation is an outfit that has embraced the three “R”s. No, not those ones. It instead concentrates on recreation, retirement and resources.

Next time you are out on the road and see a ute fly past with a fibreglass Flexinet canopy over the back, that’s a Fleetwood product. And if you ever find yourself stuck in a row of cars out on the highway, cursing that caravan ahead, there’s a good chance it too was made by Fleetwood.

In recent years though, the company, now led by former Wesfarmers executive Stephen Price, has expanded that traditional business to incorporate modular housing and transportable homes that have been extensively used in caravan parks and more recently for housing on major resource projects.

Until this year, the company – where senior management hold about 18% of the stock – had an outstanding long-term record delivering serious returns on equity of close to 40% and solid dividends. But the past year has been a troubling one for the group and this week it confirmed that earnings this would be well below the previous corresponding period.

First-half earnings last year came in at $41 million before interest and tax. This year it is likely to be as low as $13 million and that doesn’t include a $5 million restructuring cost to its caravan division.

In a statement to the ASX, it forecast improved conditions in the second half and backed up that conviction by declaring that it would maintain a fully-franked interim 30c dividend.

As a result, its share price dipped just 4% on the day as investors opted to overlook the current problems and look ahead to 2014. The market verdict is that this appears to be a temporary earnings trough.

With two caravan brands – Coromal and Windsor – and production centres in Victoria and WA, it was sensible to consolidate that to the Perth base.

Caravans, however, last year contributed just 10% of earnings. So the real problems in the group during the past six months emanated from manufactured housing.

The sudden plunge in commodity prices late last year had a significant impact on earnings as mining expansion projects were put on ice and manufacturing activity in the resources sector ground to a halt. That impacted Fleetwood because it has expanded into building, owning and operating accommodation facilities for resource projects.

Its Searipple Village near Karratha, in the north of Western Australia, which has been a terrific moneyspinner for many years, experienced much lower than expected occupancy rates, in the order of 40 to 50%.

It since has embarked on an upgrade of the village and, in December, signed a contract with Rio Tinto to accommodate 660 people for a year, with options to extend for another two years. On top of that, it is building a 293 dwelling facility, called Osprey, at Port Hedland that essentially is underwritten by the WA Government.

Meanwhile, on the other side of the continent, it is building accommodation at Gladstone to house up to 1,000 workers employed on the three new LNG export facilities currently under construction. This will be built in stages to match supply with demand, which will help underwrite continued high returns.

These new projects along with the rationalisation of its caravan division are expected to return the company to its earnings trajectory.

In the days since Fleetwood’s earnings downgrade, it has enjoyed strong investor support, recovering its lost ground and sitting right on Clime Asset Management’s revised 2013 valuation of $9.90. At that price, Clime reckons it is a hold. But any dip back toward $9 makes the company extremely attractive.

Source: MyClime

“On a cum dividend basis, Fleetwood is likely to produce between 90c and 95c per share of fully franked dividends over the coming 13 months,” says Clime analyst Adrian Ezquerro.

“This is quite attractive for income focussed investors and at a potential entry price of $9, investors are effectively ‘paid to wait’ for the above catalysts to materialise.”

Macquarie analysts, while rating the stock as neutral, agreed that the earnings warning should not overshadow the longer-term prospects for the company.

UBS analysts, on the other hand, were somewhat harsher, cutting earnings forecasts for full-year 2014 and 2015 by 11% and 7%, although they added that the dividend payment was expected to provide short-term share price support.

JP Morgan analysts rate the stock as an underperform, however, arguing that the earnings cut indicated weakness across all the company’s main divisions. They also dropped their price target on the company to $9.20.