The good, the bad and the ugly of the Murray inquiry

A government report is always a Parson’s Egg, and I’ll start with the parts of this one that were excellent. These were its wariness about and observations on superannuation, financial advice and household debt.

The raison d’etre for superannuation in the first place was that it enforced “saving for the future” by individuals, and one doesn’t save money by going into debt. That was the reason that borrowing by superannuation funds was banned in the first place when the system was designed. The decision by the Howard government in late 2007 to remove this ban was one of the worst decisions made by any government in the last 20 years. The committee sensibly suggests reverting to the original prohibition on borrowing by superannuation funds.

The Financial System Inquiry committee observes in its interim report that “general lack of leverage in the superannuation system is a major strength of the financial system”, but that recently there has been a substantial growth in the use of leverage by superannuation funds which, “if allowed to continue … may create vulnerabilities for the superannuation and financial systems” and “over time, erode this strength and create new risks to the financial system”. The committee therefore suggests that the government should “restore the general prohibition on direct leverage in superannuation on a prospective basis”.

This would be an excellent move on many fronts. The current rush of self-managed superannuation funds into leveraged speculation on house prices is not merely fuelling a house price bubble; it is also setting these funds up for long term losses unless the rate of price increase continues to exceed the carrying costs of these properties. The current bubble -- defining it simply as house prices rising faster than incomes -- could well go on for years, but not for decades. That’s what is required for SMSFs to come out ahead on this gamble.

If this decades-long gamble doesn’t pay off, there will be lots of would-be self-funded retirees who instead end up on the public pension, which is not what they wanted and certainly not what the government wants out of superannuation.

The best guarantee against this outcome is to abolish leverage for superannuation funds now. Those that have already gone ahead and done it can be left with the risks of their gamble, but we shouldn’t allow any more to plunge their retirement savings into debt.

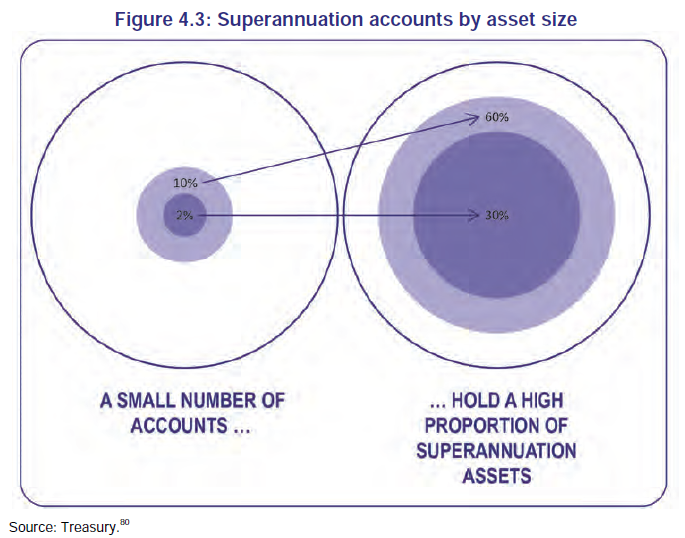

Another thing I wasn’t expecting the committee to do was to (politely) skewer the Abbott government’s bizarre desire to wind back consumer protection in financial advice. (I say bizarre because the demographic which has been and will in the future be most adversely affected by bad financial advice are Coalition voters.) This is made neatly evident by Figure 4.3 in the report, which shows that 10 per cent of superannuation accounts hold 60 per cent of superannuation assets, a pattern that is of course repeated in all financial sectors.

While the Abbott government laughably describes the winding back of Labor’s FoFA reforms as “reducing red tape”, the reality is that the winding back supports the banks at the expense of consumers. And since the committee is headed by someone who used to run one of those banks, I thought this Abbottism would be endorsed by the committee.

Not so. To its credit, the committee has come out in support of the FoFA reforms:

Recent reforms have sought to improve the quality of financial advice and increase trust and confidence in the financial advice industry by introducing a best interests duty and a requirement to put the interests of the client ahead of those of the adviser. These reforms have provided greater clarity over the expectations and requirements of financial advisers. Reforms on conflicted remuneration have also sought to better align the interests of financial advisers and consumers.The Inquiry considers the principle of consumers being able to access advice that helps them meet their financial needs is undermined by the existence of conflicted remuneration structures in financial advice.

Bravo! It’s about time Abbott abandoned this folly of rolling back FoFA, and hopefully responding to the committee’s report will give him an opportunity to do so with a minimum of egg on his face.

The third area where the committee distinguishes itself is its concern over the level and rate of growth of household debt, and in particular the extent to which easy short-term profits in lending to households squeeze out more socially useful lending to small business. Recent statistics show that over 90 per cent of the increase in lending since the GFC has gone to household debt, specifically mortgage debt. (Other forms of household leverage have in fact fallen.) Banks have virtually ignored small business, and the committee sees a direct link between these two:

One implication of higher household debt is the extent to which housing finance may crowd out finance for other activities.

In an environment of rising house prices, such constraints may see bank allocate funds towards housing and away from (unsecured) business loans. All else being equal, this would tend to increase the price and reduce the amount of business lending.

The committee also notes the systemic risk implications of mortgage debt crowding out other forms of lending:

Cross-country analysis on the effects of bank credit on economic growth suggests that credit provided to businesses has a larger positive effect on growth than credit provided to households. Housing is also a potential source of systemic risk for the financial system and the economy. Since the Wallis Inquiry, the increase in households’ mortgage indebtedness has been accompanied by banks allocating a greater proportion of their loan book to mortgages; the share of loans for housing has increased from 47 per cent in 1997 to its current share of 66 per cent. A large enough disruption to the housing market could have significant implications for household balance sheets, financial stability, economic growth, and the speed of recovery in household spending and broader economic activity following a shock.

So those are the good bits. And I have to admit there were more of them than I expected.

The poor bit is a continuation of the theme that defined its predecessor, the Wallis committee: the first year economics textbook belief that any economic problem could be solved by a good dose of competition. That bias is still present in this report, though it’s tempered slightly by the unfortunate fact that reality didn’t bear out the textbook fantasy.

The report notes the higher level of economic naivety (though that’s not how it was described) in the Wallis committee report:

The Wallis Inquiry’s approach to regulatory philosophy broadly considered unfettered financial markets would generally lead to resources being allocated efficiently. In the Wallis Inquiry’s view, the role of Government was only to intervene where market imperfections inhibited efficiency.

So much for that -- not only with the GFC but also with the failure of many competition-oriented reforms to have their expected beneficial effect. There is even a box item headed “Why hasn’t competition [in superannuation] delivered optimal outcomes already?”, which considers seven reasons why the real world has stubbornly refused to replicate the economics mantra that more competition is always and everywhere a good thing, and that all economic ills can be traced to its lack.

The reality is that many ills are systemic due to the relationship between economic sectors and feedback effects, rather than due to monopoly or other market structures.

Here’s where the bad bit of this egg turns up: the continued belief that more competition is good leads it to make a systemically dangerous proposal.

Since small lenders rely more on the 'originate and distribute' model -- otherwise known as residential mortgage backed securities-- and helping them out increases competition, the committee states that:

“The government should support the RMBS market to reduce funding costs for smaller ADIs and non-bank lenders, and to promote competition” by “purchasing housing loans from small lenders and issuing RMBS, or establishing a joint public–private sector body to undertake this function, along the lines of the Canadian approach or Fannie Mae and Freddie Mac in the United States”.

What?! How on earth can anyone suggest emulating Fannie Mae and Freddie Mac after the subprime fiasco?

How? Because they’ve swallowed the mainstream economic Kool-Aid, which teaches that competition is the Holy Grail that will unlock the key to the market economy nirvana. This is one reason that I’m looking forward to creating a new curriculum at Kingston University. Only someone who has been soaked in the naïve textbook belief in competition as the Vitamin C of economics could combine some wisdom (which this report has) with such a boneheaded proposal in favour of government underwriting of RMBS.