The five-year curse afflicting Europe

Deflation emerged as a distinct threat to Europe's tentative economic recovery earlier this year and since then conditions have deteriorated further. Europe stands on the precipice of a triple-dip recession and at this point it appears unlikely that rates will rise in the euro zone for at least another five years.

But why is deflation such a threat? And should households and businesses really be worried?

It's a fair question, and one that deserves to be fleshed out further. Surely declining prices are a good thing, right?

To some extent falling prices can be beneficial. Consider for example Australia's mining boom and its impact on household spending. A high Australian dollar -- and an elevated terms-of-trade -- not only boosted Australian incomes but also increased our purchasing power.

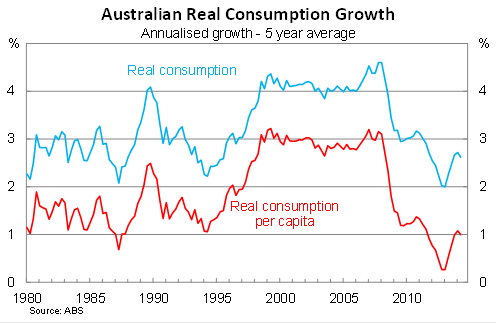

For the best part of a decade, real household consumption per capita rose by around 3 per cent each year. That's extraordinary growth by the standards normally expected of developed countries but it wasn't possible without that once-in-a-lifetime income shock and the rise in our purchasing power.

That should establish that not every source of deflation is an economic evil. As a result, I find it makes more sense if we distinguish between deflation that is imported compared with domestic factors such as wages and capacity utilisation. Alternatively, we can choose to ignore some of the more volatile factors that drive consumer prices.

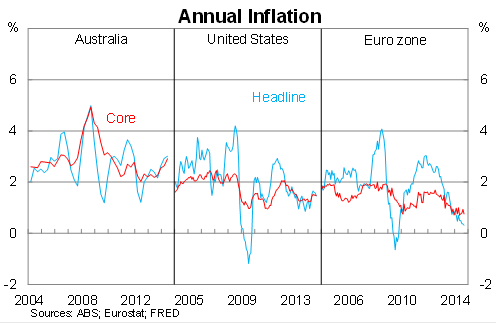

Luckily statistical agencies across the world do the job for us, publishing a range of headline and core measures of inflation. Headline inflation attempts to calculate the overall changes in consumer prices for a particular basket of goods; core measures attempt the same task except that they often exclude volatile items such as food and fuel prices.

Central banks tend to focus primarily on core measures of inflation. The Reserve Bank of Australia, for example, pays the most attention to two core measures: the trimmed mean and weighted median metrics. The Federal Reserve gives greater weight to the core personal consumption expenditure (PCE) deflator over the more widely publicised consumer inflation measure.

When assessing the data, the first thing that readers should know is that deflation is highly uncommon. Using annual growth and headline consumer prices, Australia hasn't suffered any form of deflation since 1997 and the United States has suffered one episode in over fifty years.

Deflation is less common still on a core basis and it is almost unheard of among developed countries (at least in developed countries that are not Japan). By this measure, the threat of deflation in Europe remains distant; core inflation in the euro zone is at 0.8 per cent over the year to September. Deflation isn't the inevitability that many analysts predict but low inflation can also prove debilitating.

At the very least, the persistence of the European crisis suggests that low inflation is here to stay and that high unemployment and austerity will be a feature of the region for years to come. That will give plenty of time for the real cause of deflation to rear its ugly head: an ongoing decline in real wages.

That's the crux of the issue. The exchange rate may create temporary deflation but persistent deflation always reflects falling wages.

When nominal wages either decline or there is a widespread pay freeze, it puts downward pressure on domestic prices and that feeds directly into core measures of inflation. Core inflation often captures this process perfectly because by ignoring volatile overseas prices, it reflects the underlying demand in an economy.

Insufficient demand remains a problem in Europe and as long as that is still the case the spectre of deflation will never be too far away.

More broadly, deflation, if it appears, will affect the euro zone economy in a range away. It's also worth remembering that low inflation is having a similar effect albeit to a lesser degree.

First, deflation feeds on itself by reducing the incentive to spend money today in favour of waiting until tomorrow, next week, next month etc. If such behaviour is widespread then it creates the ideal conditions for another recession.

Second, it increases the value of debt. The existing debt burden has already brought Europe to her knees; an ongoing period of deflation -- combined with a third recession -- would only exacerbate the crisis further.

Third, deflation increases the real interest rate. The real interest rate is measured as the nominal interest rate -- such as a cash rate or mortgage rate -- less the annual inflation rate. Remarkably, the real interest rate is higher in Europe than it is in Australia and much higher than either the United Kingdom or the United States. A higher real interest rate stifles investment, while simultaneously encouraging greater saving.

The threat of deflation for Europe isn't quite as imminent as many analysts believe but we don't need to wait for deflation to see the destabilising effects that low inflation is already having on the fragile euro zone recovery. Each of those three effects is currently in play.

As long as demand remains insufficient -- and unemployment elevated -- the threat of deflation will hang over Europe. The saddest part, of course, is that it didn't need to be like this; years of poor policy and insufficient action has left Europe poorly positioned both economically and financially. The result is a crisis and economic downturn that could very well persist until the end of this decade.