The Fed's tentative steps towards a rate rise

The Federal Reserve moved one step closer to ending its asset purchasing program but it will be a ‘considerable time’ before it starts to raise rates. It will almost certainly be next year -- a view consistent with Fed forecasts -- but we’re still no clearer on when exactly it will happen.

At its September meeting, the Federal Reserve decided to cut its asset purchasing program by a further $US10 billion. The Fed will now add to its holdings of mortgage-backed securities by US$5bn per month (from $US10bn) and also purchase $US10bn of longer-term Treasury securities (from $US15bn).

The Fed has once again reiterated that “asset purchases are not on a preset course”, but it has been a long time since anyone believed that. October has long been regarded as the meeting when the program ends and, at this point, it would take a meltdown for the Fed to change course.

But the Fed remains cagey on when it will begin to raise rates, going no further than to say that the federal funds rate will remain at its currently level for a ‘considerable time’ after it ends its asset purchases.

Nevertheless, the Fed took the opportunity to outline an extensive plan to normalise interest rates. When economic conditions and the outlook warrant it, the Fed will obviously begin to raise the federal funds rate, which will be achieved primarily by “adjusting the interest rate it pays on excessive reserve balances”.

The Fed also expects to “cease or commence phasing out reinvestments” after it begins to raise the federal funds rate. Currently the Fed reinvests principal payments from its asset purchases. At the moment the Fed “does not anticipate selling agency mortgage-backed securities as part of the normalisation process”.

The timing will largely depend on whether the US economy continues to grow at a solid pace once the asset purchases end next month. The main concern for Fed chair Janet Yellen is a mixture of labour market underutilisation and poor wage growth.

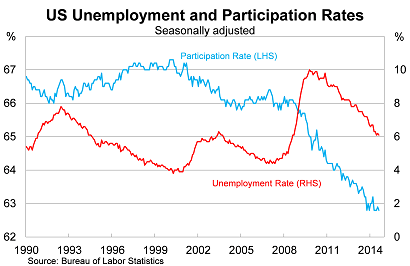

Yellen remains dovish but her concerns are legitimate. There remains considerable slack in the labour market despite recent improvements.

Non-farm payrolls rose by a more modest 142,000 in August following six months of strong growth, and the unemployment rate has dropped to 6.1 per cent (Putting the weak US payrolls result into perspective, September 8). But wage growth remains subdued, which continues to weigh on household spending (Cautious consumers aren’t helping the US recovery, September 1).

For wages, the ongoing weakness appears to be more structural than cyclical -- a view which Yellen discusses in detail here. The economy is producing more lower-paid positions and those positions have absorbed a great deal of the spare capacity across the US economy.

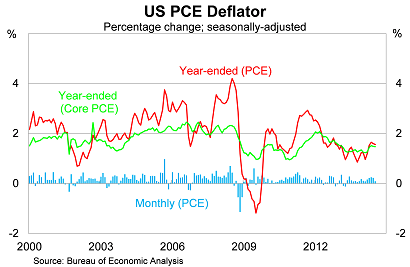

If that is correct, then a structural shift in the labour market -- which puts downward pressure on national wages -- has helped to keep inflation in check. The core personal consumption expenditure deflator (the Fed’s preferred measure of inflation) rose by just 1.5 per cent over the year to July.

Alternatively, there is a view that the remaining slack in the labour market largely reflects the long-term unemployed, a group often ignored by employers when they are making hiring decisions. If this view proves correct, then wages could break out even at a reasonably high unemployment rate.

At the September meeting, the Fed also published new forecasts from its board members and presidents. It has downgraded its growth forecasts for both 2014 and 2015, though in doing so it has also upgraded its forecasts slightly for the unemployment rate.

That could simply be a quirk of the forecasts since they are based on only a small number of individual forecasts, though it could also reflect an ongoing shift in views about the long-term participation rate and the ongoing relationship between growth and unemployment.

Most members expect rates to begin rising in 2015, although two members are more pessimistic and see the Fed waiting until 2016. In the long-term, the Fed sees interest rates rising to around 3.75 per cent but that will take some time to eventuate.

The meeting overnight was just one more step towards raising rates next year. The asset purchases are almost finished and, by formalising the normalisation process, it is clear where the Fed’s priorities lie. The US economy is well-placed to end the year on a high and, if that eventuates, then I expect the Fed to make a move in the first quarter of 2015.