The Fed's labour booster shot

Despite unusually poor weather continuing to be a factor, the US labour market regained its momentum in February. As a result, the Federal Reserve is all but certain to continue tapering its asset purchasing program when it meets on March 18 and 19.

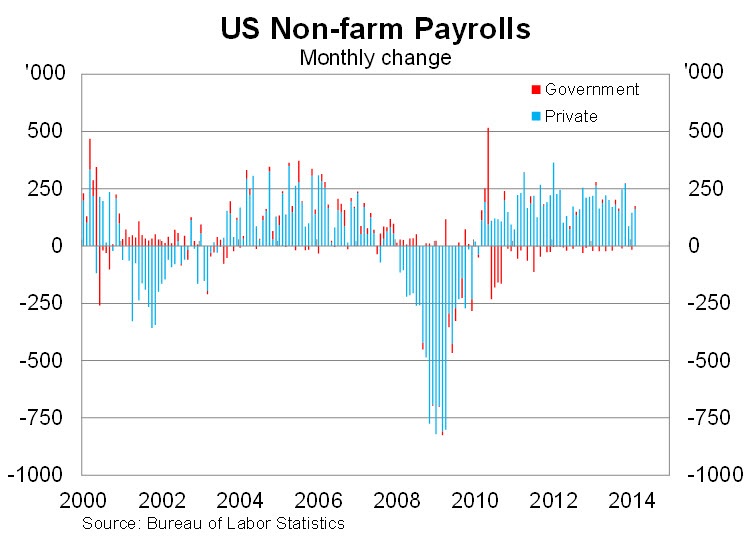

Non-farm payrolls rose by 175,000 in February, exceeding market expectations, following two consecutive months of below-trend growth that had been attributed to poor weather. Payrolls in December and February were revised up, with payrolls now expanding by an average of 129,000 per month from December to February.

That is considerably weaker than payroll growth during 2013 but I expect job creation to pick up in March and April as the bad weather begins to subside. Businesses that held off hiring are likely to play catch-up once weather conditions improve. In addition, employees who were unable to work during the reference week are more likely to attend work. Both factors point towards a strong March outcome.

Private non-farm payrolls rose by 162,000 while government payrolls expanded by 13,000. The federal government continued to contract, losing 93,000 jobs over the year to February. Both state and local governments have increased employment over the past year.

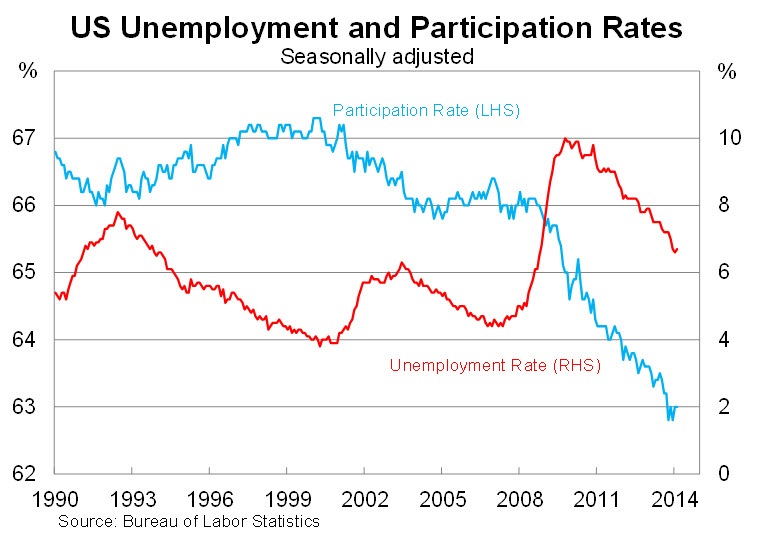

The unemployment rate -- determined using a different survey -- ticked up to 6.7 per cent in February, from 6.6 per cent. It has been effectively unchanged for the past three months after a rapid decline between October and December.

The participation rate was unchanged in February but continues to be at historically low levels. Over the past five years it has been driven lower by two factors: the ‘baby boomer’ generation beginning to retire and disgruntled former workers giving up after lengthy periods of unemployment. The latter will recover at some point -- though it will be a slow process -- but an ageing population is set to push participation to increasingly low levels.

The Federal Reserve is all but certain to reduce its asset purchasing program by a further $US10 billion when it meets on March 18 - 19. Stronger job figures didn’t necessarily change their minds -- in fact late last week William Dudley, President of the New York Fed, said they were on close to a preset course -- but it certainly makes it easier to publically justify the decision after a few months of poor data.

The comments of Dudley suggest that there is perhaps more concern about the Fed’s balance sheet than is commonly expressed by leaders at the Fed. Certainly it appears as though they are determined to wind down their asset purchases sooner rather than later and it will take a considerable change in economic conditions to stop them.

At this point we are still a long way from the Fed increasing its cash rate. Inflation continues to be benign and there is no sign of wage pressures. I expect wage growth to pick up in some industries during 2014 and this will eventually feed through to inflation. However, at the moment the Fed is unlikely to raise rates until well into 2015.

Payrolls data should ease concerns that the US economy fell in a hole in early 2014. The economy lost some momentum due to temporary weather factors and growth in the March quarter may be soft as a result. However, I expect the economy and jobs to rebound in the June quarter and continue to be quite solid throughout the remainder of 2014.