The Fed's head-scratching data bag

Measures of core inflation in the US remain contained, while retail spending exceeds expectations but is still fairly subdued. The data overnight gives the Federal Reserve plenty to ponder but it is unlikely to make any change to policy in December.

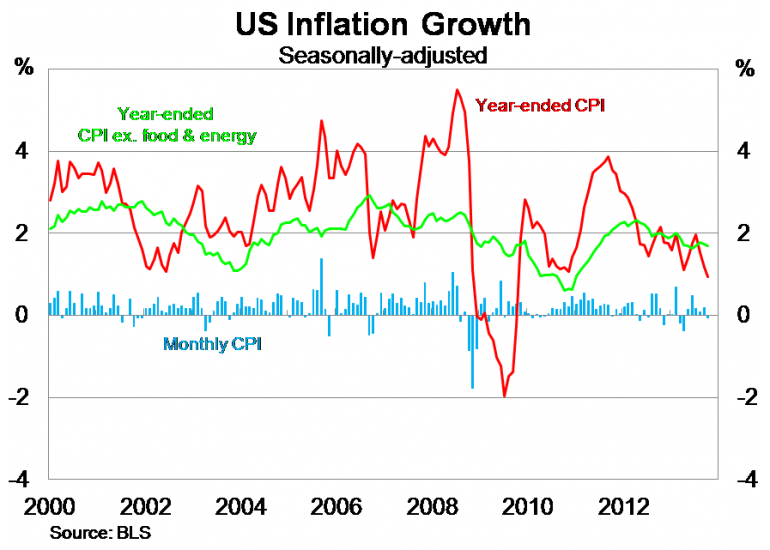

Inflation fell slightly in October, to be 0.9 per cent higher over the year on a seasonally-adjusted basis. Volatile energy costs continue to weigh on prices, with energy costs down 1.7 per cent in October and almost 5 per cent lower over the year. Gasoline costs were down 2.9 per cent in October. Excluding food and energy, US inflation rose by 0.1 per cent to be 1.7 per cent higher over the year.

Inflation has certainly dropped away in the last few months but the core measures of inflation suggest that prices will pick-up once energy costs stabilise. Inflation should head back towards the top of the Federal Reserves’ 2 per cent inflation target once this occurs.

With energy costs falling there may be some optimism for consumer spending, though spending remained fairly weak in October.

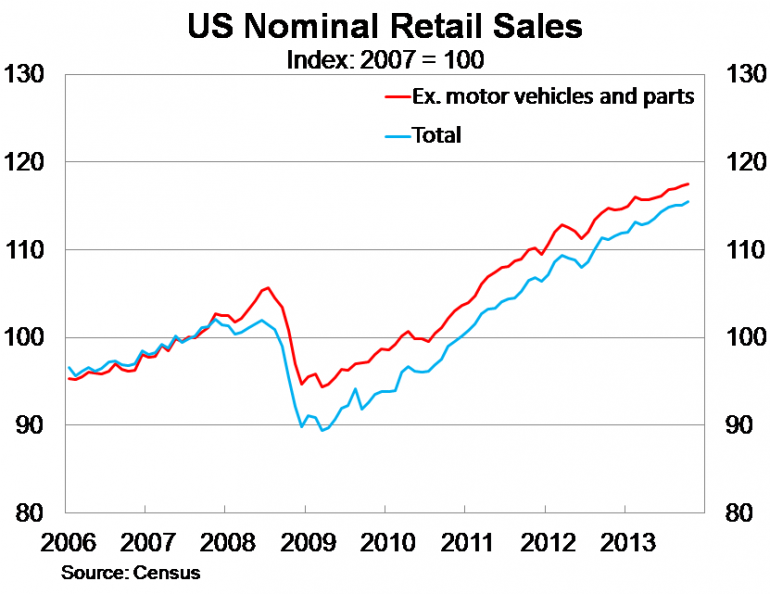

Retail sales were up by 0.4 per cent in October, beating market expectations, to be 3.9 per cent higher over the year. But growth was driven by the sales of motor vehicles, which continue to track quite strongly over the past twelve months. Retail sales excluding motor vehicles rose by 0.2 per cent in the month. Based on the inflation data for October, real retail sales were probably up by around 0.5 per cent.

Though beating expectations, household spending growth remains fairly weak ahead of what is expected to be a disappointing holiday season. Consumption had been a key growth driver for the US over the last year but began to falter a bit during the September quarter. October retail sales were around 0.5 per cent higher than the September quarter average.

To add a little bit of perspective, for retail spending in the December quarter to match growth in the September quarter – which resulted in the slowest pace of consumption growth in two years – growth in retail sales will have to be around 0.6 per cent in both November and December. Not impossible by any stretch but a fair pick-up from what we have seen over the past four months. On that basis, the outlook for consumption growth in the December quarter would have to be fairly modest, which points to slow real GDP growth for the quarter as well.

The Bureau of Labor Statistics (BLS) also reports that real average weekly earnings rose by 1.5 per cent over the year. The data highlights why consumption growth remains fairly modest. The increase over the year mostly reflects higher average hourly earnings but also a 0.3 per cent rise in the average work week.

The data overnight gives the Federal Reserve plenty to think about. The timing of the tapering is dependent on conditions in the labour market but they must also be convinced that the broader recovery is sustainable. Payrolls data was surprisingly strong in October but improvements in labour market conditions are also felt through both inflation and retail spending, and the Fed would be hoping to see a bit more activity in the retail sector in order to be confident about the recovery.

It is unclear to what extent the government shutdown affected consumer spending. Certainly spending picked up a little in October but the counterfactual – what would have occurred? – is always unknown. Consumer sentiment rebounded in November so it may be the case that retail spending is a little stronger than the October data indicates but like I said above it will need to be to ensure that consumption growth improves in the December quarter.

It is one month until the next Federal Reserve meeting and the likelihood of new data proving an impetus for change is fairly remote. The Federal Reserve is likely to remain cautious and I suspect that Ben Bernanke will be reluctant to rock the boat before Janet Yellen takes over.